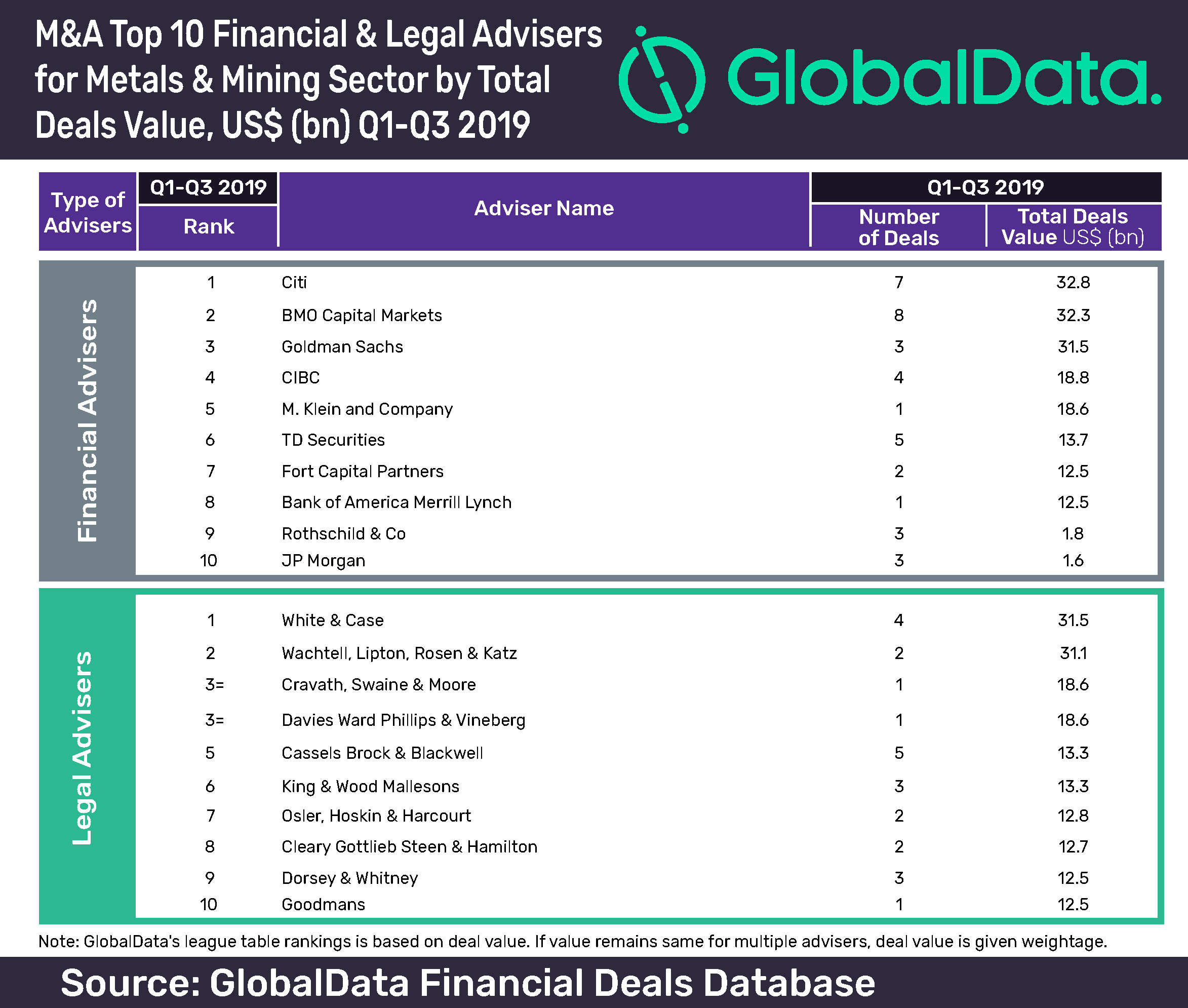

Citi was the leading financial adviser globally for mergers and acquisitions (M&A) in Q1-Q3 2019 in the metals & mining sector, according to GlobalData.

The American multinational investment bank led the table with seven deals worth $32.8bn, gaining a marginal edge over BMO Capital Markets, which advised on eight deals worth $32.3bn.

Goldman Sachs secured third position with three deals valued at $31.5bn.

GlobalData financial deals analyst Ravi Tokala said: “Newmont Mining’s deal to acquire Barrick Gold and Goldcorp were instrumental in deciding the rankings in this sector, even though the acquisition of Barrick Gold could not materialise. Top ten legal advisers and top eight financial advisers were involved in either one of these transactions.”

GlobalData has published a top ten league table of financial advisers ranked according to the value of announced M&A deals globally. If the value remains the same for multiple advisers, deal volume is given weightage.

Citi secured fourth position in the GlobalData’s Q1-Q3 2019 ranking of top 20 financial advisers for global mergers and acquisitions. The metals & mining league table’s second-ranked BMO Capital Markets did not find a place in the global rankings.

The metals & mining sector saw a decline in deal value in Q1-Q3 2019 when compared with the corresponding quarter of the previous year. The overall deal value fell by 51.07% from $84.96bn in Q1-Q3 2018 to $41.57bn in Q1-Q3 2019. Deal volume also decreased by 0.87% from 1,035 to 1,026.

White & Case secured the first spot in the table of the top ten legal advisers by value with four deals worth $31.5bn. Wachtell, Lipton, Rosen & Katz secured second position with two deals worth US$31.1bn. White & Case secured 14th position in the global league table of top 20 legal advisers for Q1-Q3 2019.

GlobalData’s league tables are based on the real-time tracking of thousands of company websites, advisory firm websites and other reliable sources available on the secondary domain. A dedicated team of analysts monitors all these sources to gather in-depth details for each deal, including adviser names.

To ensure further robustness to the data, the company also seeks submissions from leading advisers, through adviser submission forms on GlobalData’s website.