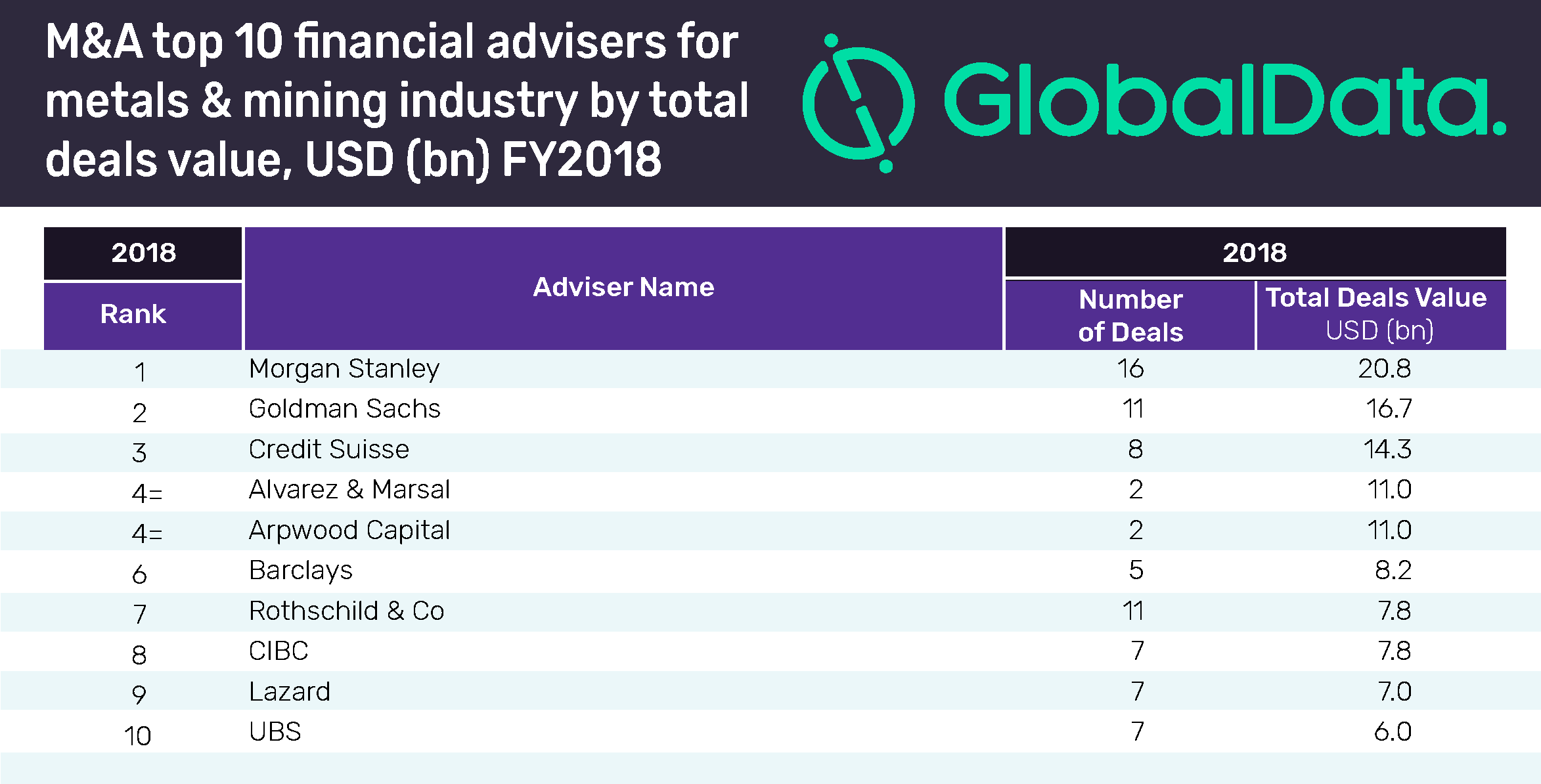

Morgan Stanley has topped the latest M&A league table of the top ten financial advisers for the metals & mining industry based on deal value in 2018, compiled by GlobalData.

The US-based financial services group led the table with 16 deals worth $20.8bn, including the industry’s highest value deal – Barrick Gold’s merger with Randgold Resources for $6bn.

Discover B2B Marketing That Performs

Combine business intelligence and editorial excellence to reach engaged professionals across 36 leading media platforms.

Goldman Sachs stood in second position with 11 transactions worth $16.7bn, followed by Credit Suisse with eight deals valued at $14.3bn.

Tokala Ravi, Financial Deals Analyst at GlobalData, said: “In the financial adviser category, Morgan Stanley was a clear leader, both in terms of value and volume. However, among the legal advisers, there was tough competition between Borden Ladner Gervais and Freshfields Bruckhaus Deringer for the top spot, with the former taking lead by a mere ~$0.3bn.”

The metals & mining sector saw high-value deals during 2018 when compared to the previous year. The overall value grew by 43.85% to $87.5bn in 2018 from $60.8bn in 2017. Deal volumes decreased by 2.76% from 1,341 in 2017 to 1,304 in 2018.

Canada-based Borden Ladner Gervais led the list of the top 10 legal advisers by value with five deals worth $9.7bn. The sixth-ranked Linklaters emerged as the top adviser in terms of volumes with 14 deals valued at $7.2bn.

US Tariffs are shifting - will you react or anticipate?

Don’t let policy changes catch you off guard. Stay proactive with real-time data and expert analysis.

By GlobalData

GlobalData’s league tables are based on the real-time tracking of thousands of company websites, advisory firm websites and other reliable sources available on the secondary domain. A dedicated team of analysts monitors all these sources to gather in-depth details for each deal, including adviser names.

The company also seeks submissions through adviser submission forms on GlobalData, which allow both legal and financial advisers to submit their deal details.