GlobalData, a leading data and analytics company, has revealed its league tables for the top ten financial and legal advisers by value and volume in metals and mining sector for H1 2022.

A total of 660 merger and acquisition (M&A) deals worth $30.1bn were announced in the sector during H1 2022.

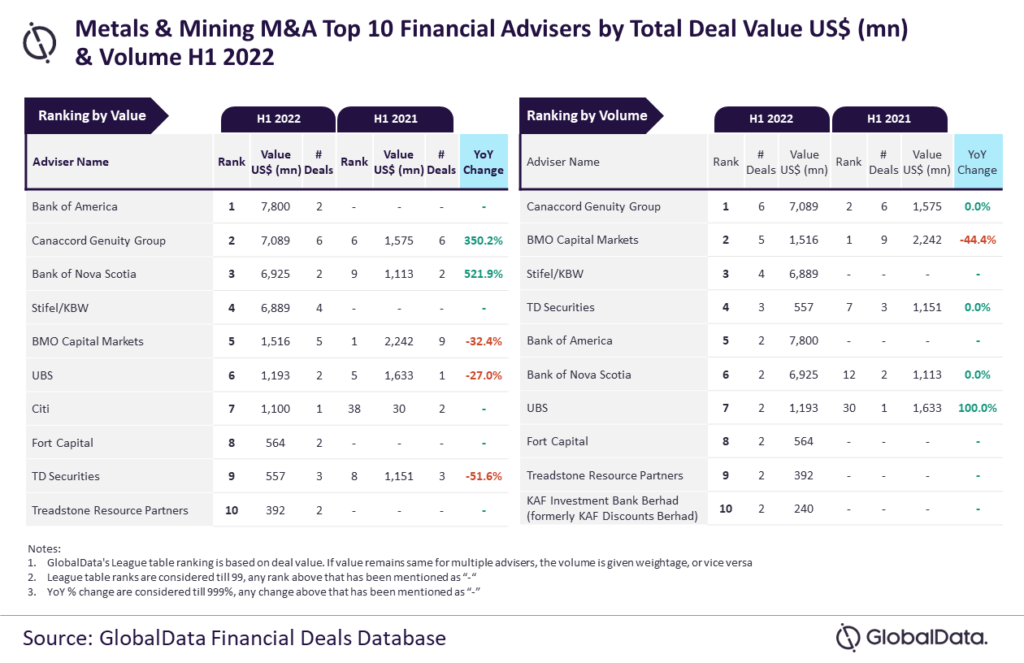

Top financial advisers by value and volume

According to GlobalData’s ‘Global and Metals & Mining M&A Report Financial Adviser League Tables H1 2022’, Bank of America and Canaccord Genuity Group emerged as the top M&A financial advisers in the sector for H1 2022 by value and volume, respectively.

Bank of America advised on $7.8bn worth of deals while Canaccord Genuity Group advised on a total of six deals.

GlobalData lead analyst Aurojyoti Bose said: “Besides leading the pack by deal volume, Canaccord Genuity Group also occupied second position by deal value, by advising on deals worth $7.1bn. Meanwhile, Canaccord Genuity Group and Bank of America were the only two firms to have total deal value of more than $7bn.”

According to the financial deals database of GlobalData, the other high rankers by value included Bank of Nova Scotia that took the third spot by advising on $6.9bn worth of deals; followed by Stifel/KBW with $6.9bn; and BMO Capital Markets with $1.5bn.

By volume, BMO Capital Markets secured the second position with five deals; followed by Stifel/KBW, with four deals; TD Securities, with three deals; and Bank of America, with two deals.

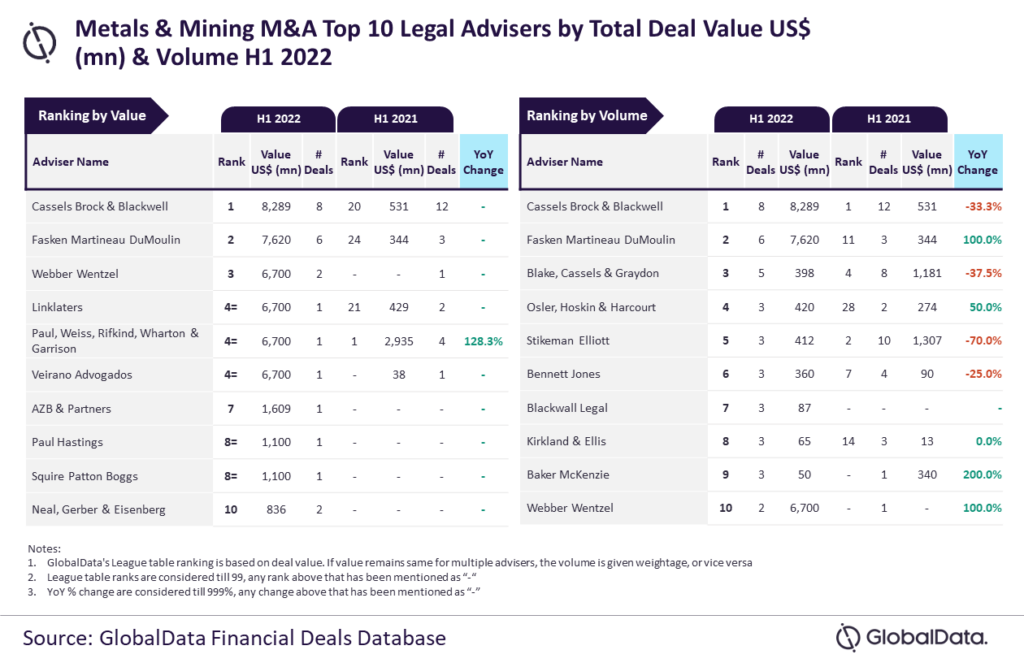

Top legal advisers by value and volume

Cassels Brock & Blackwell emerged as the top M&A legal adviser in the metals & mining sector for H1 2022 by both value and volume.

The firm advised on eight deals worth $8.3bn, according to GlobalData’s report, ‘Global and Metals & Mining M&A Report Legal Adviser League Tables H1 2022’.

Bose said: “None of the advisers we tracked, including Cassels Brock & Blackwell, reached double-digit deal volume in H1 2022. In fact, Cassels Brock & Blackwell advised on fewer deals in H1 2022 compared to H1 2021, but they were generally of higher value. The firm’s involvement in the $6.7bn Gold Fields–Yamana Gold deal played a pivotal role for Cassels Brock & Blackwell in securing the top position by value.”

The other high rankers by value include Fasken Martineau DuMoulin that took second spot by advising on $7.6bn worth of deals; followed by Webber Wentzel, with $6.7bn. Linklaters, Paul, Weiss, Rifkind, Wharton & Garrison and Veirano Advogados also advised on deals worth $6.7bn.

In terms of volume, Fasken Martineau DuMoulin secured second place with six deals; followed by Blake Cassels & Graydon, with five deals; Osler Hoskin & Harcourt, with three deals; and Stikeman Elliott, with three deals.

GlobalData’s league tables are based on the real-time tracking of thousands of company websites, advisory firm websites and other reliable sources available on the secondary domain. A dedicated team of analysts monitors all these sources to gather in-depth details for each deal, including adviser names.

To ensure further robustness to the data, the company also seeks submissions from leading advisers, through adviser submission forms on GlobalData’s website.