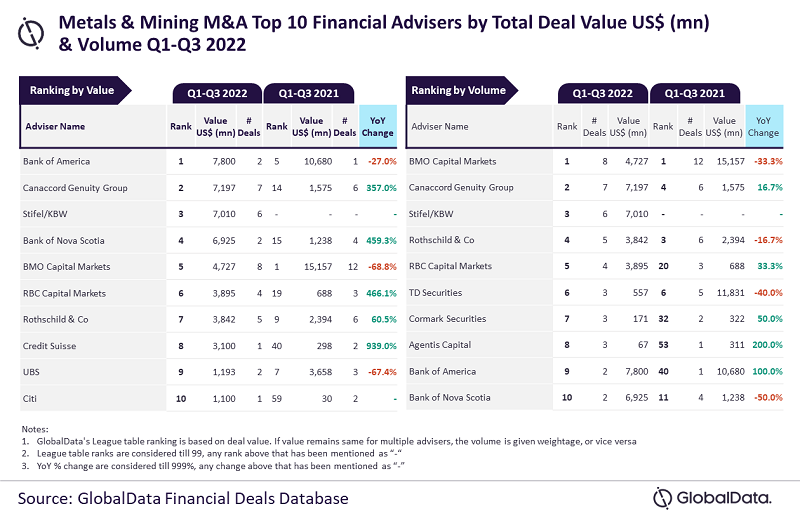

GlobalData, a leading data and analytics company, has revealed its league tables for the top ten financial advisers by value and volume in metals and mining sector for Q1-Q3 2022.

A total of 975 merger and acquisition (M&A) deals worth $45.8bn were announced in the sector during Q1-Q3 2022.

Top advisers by value and volume

According to GlobalData’s ‘Global and Metals & Mining M&A Report Financial Adviser League Tables Q1-Q3 2022’, Bank of America and BMO Capital Markets emerged as the top M&A financial advisers in the metals & mining sector for Q1-Q3 2022 by value and volume, respectively.

Bank of America advised on $7.8bn worth of deals while BMO Capital Markets advised on a total of eight deals.

GlobalData lead analyst Aurojyoti Bose said: “BMO Capital Markets has suffered a huge setback compared to Q1-Q3 2021 when it occupied the top spot by both volume and value. The company may have still clung to first place by deal volume, despite having registered a 33.3% decline, but it had to settle for fifth place by value. Meanwhile, Bank of America’s position in terms of value has jumped from fifth position in Q1-Q3 2021 to the top position in Q1-Q3 2022.”

According to the financial deals database of GlobalData, the other high rankers by value included Canaccord Genuity Group took the second position with $7.2bn worth of deals; followed by Stifel/KBW with $7bn; Bank of Nova Scotia with $6.9bn; and BMO Capital Markets with $4.7bn.

US Tariffs are shifting - will you react or anticipate?

Don’t let policy changes catch you off guard. Stay proactive with real-time data and expert analysis.

By GlobalDataIn terms of volume, Canaccord Genuity Group secured second place with seven deals; followed by Stifel/KBW with six deals; Rothschild & Co with five deals; and RBC Capital Markets with four deals.

GlobalData’s league tables are based on the real-time tracking of thousands of company websites, advisory firm websites and other reliable sources available on the secondary domain. A dedicated team of analysts monitors all these sources to gather in-depth details for each deal, including adviser names.

To ensure further robustness to the data, the company also seeks submissions from leading advisers, through adviser submission forms on GlobalData’s website.