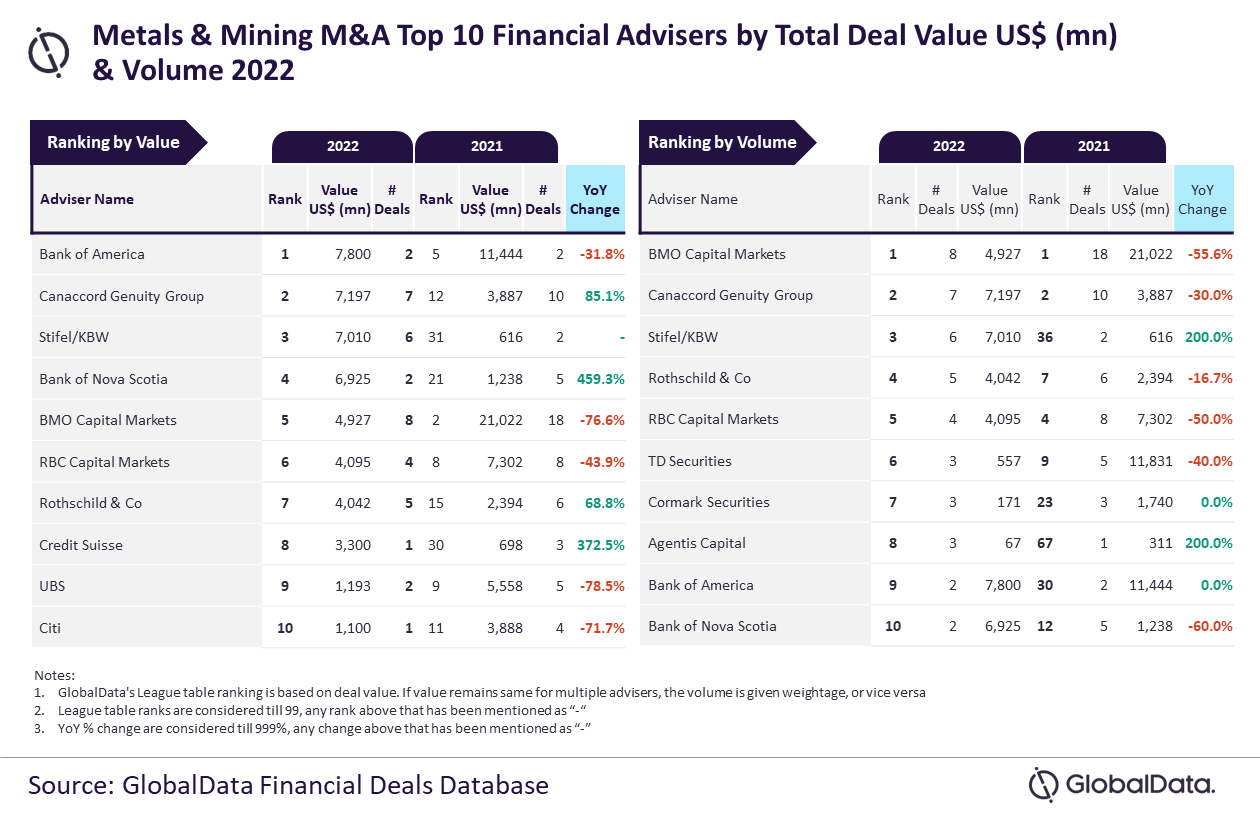

GlobalData, a leading data and analytics company, has revealed its league tables for the top ten financial advisers by value and volume in metals and mining sector for 2022.

Bank of America and BMO Capital Markets emerged as the top mergers and acquisitions (M&A) financial advisers in the metals & mining sector for 2022 by value and volume, respectively.

Bank of America advised on $7.8bn worth of deals while BMO Capital Markets advised on a total of eight deals.

GlobalData lead analyst Aurojyoti Bose said: “BMO Capital Markets registered a decline in the number of deals advised in 2022 compared to the previous year but still managed to retain its leadership position by volume. It also occupied the fifth position by value.

“Meanwhile, Bank of America, despite advising on relatively much lesser number of deals compared to BMO Capital Markets, occupied the top position by value. The average size of deals advised by Bank of America was $3.9bn, which is significantly high compared to BMO Capital Markets’ average deal size of $616m.”

According to the financial deals database of GlobalData, the other high rankers by value included Canaccord Genuity Group taking the second position with $7.2bn worth of deals; followed by Stifel/KBW with $7bn; Bank of Nova Scotia with $6.9bn; and BMO Capital Markets with $4.9bn.

US Tariffs are shifting - will you react or anticipate?

Don’t let policy changes catch you off guard. Stay proactive with real-time data and expert analysis.

By GlobalDataIn terms of volume, Canaccord Genuity Group secured second place with seven deals; followed by Stifel/KBW with six deals; Rothschild & Co with five deals; and RBC Capital Markets with four deals.

GlobalData’s league tables are based on the real-time tracking of thousands of company websites, advisory firm websites and other reliable sources available on the secondary domain. A dedicated team of analysts monitors all these sources to gather in-depth details for each deal, including adviser names.

To ensure further robustness to the data, the company also seeks submissions from leading advisers, through adviser submission forms on GlobalData’s website.