Saudi Arabian mining giant Maaden has raised $1.25bn from its inaugural Islamic bond (sukuk) sale, marking a milestone in its $12bn expansion investment programme through the end of the decade.

The company attracted more than $10bn in offers from investors, divided into two parts, including $750m maturing in 2030 and $500m maturing in 2035, reported Bloomberg.

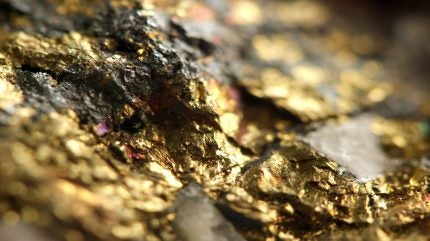

Maaden has been in discussions with banks to support the investment plan, which includes major expansions in gold, phosphate and aluminium operations, as well as intensified copper exploration within Saudi Arabia.

Maaden CEO Bob Wilt was quoted by Bloomberg as saying: “The market appetite for investing in Saudi Arabia, in mining, and in Maaden specifically, is strong, and a sign of the untapped potential seen in the kingdom.

“Around half of the demand came from US investors with the rest split between Europe, Asia and the Middle East.”

Maaden’s board will make a final investment decision regarding gold and phosphate production around mid-year, according to the company.

While Maaden does not anticipate returning to the bond market soon, future fundraising for growth projects has not been ruled out.

Maaden is majority-owned by the kingdom’s sovereign wealth fund and is a key player in Saudi Arabia’s vision to diversify its economy.

The company’s efforts align with Crown Prince Mohammed Bin Salman’s strategy to establish mining as a third economic pillar, alongside oil and petrochemicals.

In January, Maaden revealed plans to form a joint venture with state-controlled oil company Saudi Aramco, focusing on the exploration and mining of metals crucial for the energy transition.

At the Future Minerals Forum 2025, Maaden shared updates on its exploration activities, highlighting promising gold and copper intercepts at the Wadi Al Jaww and Jabal Shayban exploration areas in the Arabian Shield. These findings suggest the emergence of a new gold and copper district.

Furthermore, Maaden’s Mansourah – Massarah gold mine continues to yield “strong” gold mineralisation, with the latest drilling results revealing high-grade extensions at depth.