West African gold producer Orezone Gold has announced a bought deal offering with financial services company Canaccord Genuity, acting as the sole underwriter and bookrunner, to raise C$35m ($24.5m).

Under the agreement, Canaccord has committed to purchasing 42,683,000 common shares of Orezone for C$0.82 per share.

Orezone will also grant an option for 6,402,450 shares to Canaccord, which could raise additional proceeds of up to C$5.25m.

The proceeds will fund the development of the stage two hard rock expansion and the exploration of the Bomboré Gold Mine in Burkina Faso, West Africa. The funds will also support working capital and general corporate purposes.

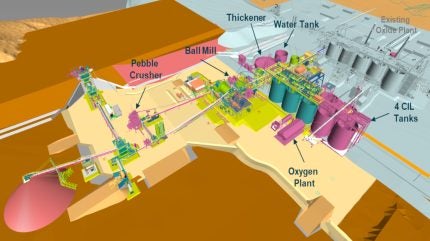

The Bomboré mine’s processing complex includes a six million tonnes per annum (mtpa) oxide plant.

The expansion of the hard rock plant at the mine will further boost gold production.

The company forecasts an optimised gold production profile of 220,000–250,000oz per year by late 2026, with preliminary cost estimates for stage two ranging between $90m and $95m.

The stage two expansion is scheduled to commence in the second half of 2025 and follows the ongoing stage one expansion that is scheduled to achieve first gold in the fourth quarter of 2025.

Stage two will enhance the hard rock plant’s throughput to 5mtpa, with the addition of new processing units within the stage one footprint.

The offering is expected to close around 13 March 2025, subject to regulatory approvals, including from the Toronto Stock Exchange (TSX).

The shares will be made available in Canada, certain offshore jurisdictions, and the US via private placement, adhering to the US Securities Act’s exemption requirements.

In addition to the offering, Orezone is planning a secondary listing on the Australian Securities Exchange (ASX) to attract more investors and enhance its capital markets profile.

This listing is targeted for mid-2025, contingent on market conditions and ASX listing requirements.

The ASX secondary listing will supplement the company’s primary listing on the TSX, aiming to enhance trading liquidity and attract a broader base of sophisticated investors including specialised mining-focused funds.

Orezone president and CEO Patrick Downey said: “Orezone is excited to be advancing these transformational initiatives during this period of record high gold prices. We believe that an acceleration of the Stage II hard rock expansion to an overall production profile of 220,000–250,000oz per year will serve to maximise free cash flow in the coming years, positioning Orezone with a cornerstone asset from which to diversify and grow its production base.

“This strategic goal will be complemented by our plans to list on the ASX, which is expected to enhance the company’s trading liquidity and promote better access to investment capital.”