Canadian firm Lundin Mining has agreed to acquire a 51% stake in SCM Minera Lumina Copper Chile, which operates the Caserones copper-molybdenum mine in Chile, for $950m.

The stake will be acquired from JX Nippon Mining & Metals and a number of its subsidiaries.

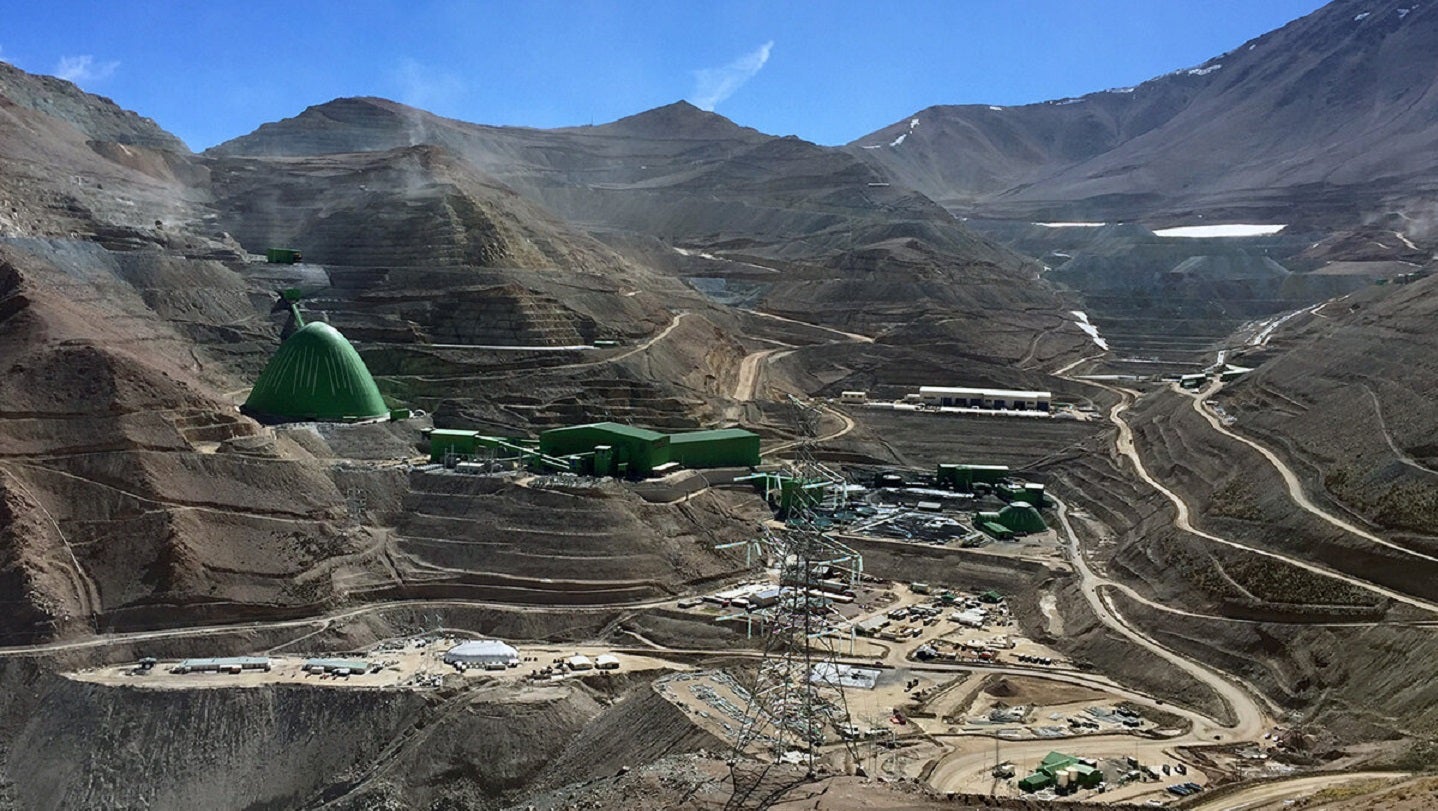

Located in the Atacama region of the northern Chilean Andean Cordillera, the Caserones project comprises a traditional open pit mine, a conventional sulphide flotation plant, and a dump leach, solvent extraction and electrowinning plant.

According to the deal, JX will receive $800m upfront cash consideration from Lundin Mining.

In addition, JX will also receive $150m deferred cash consideration from Lundin Mining, which is payable over a six-year period following the closing date.

Lundin Mining CEO Peter Rockandel said: “Upon closing of the acquisition of Caserones, we add another long-life copper mine of material size and with significant growth potential to our portfolio, in a region in which we have considerable knowledge and experience.”

How well do you really know your competitors?

Access the most comprehensive Company Profiles on the market, powered by GlobalData. Save hours of research. Gain competitive edge.

Thank you!

Your download email will arrive shortly

Not ready to buy yet? Download a free sample

We are confident about the unique quality of our Company Profiles. However, we want you to make the most beneficial decision for your business, so we offer a free sample that you can download by submitting the below form

By GlobalDataFurthermore, Lundin will have the right to acquire an additional stake of up to 19% in the Caserones mine for $350m over a period of five years. This would commence on the first anniversary of the closing date.

Rockandel added: “The initial controlling interest increases our exposure to what we believe is a growing top-tier copper mining district. We retain the option to further increase our ownership over the next few years at an attractive price.

“The acquisition further solidifies Lundin Mining’s position as a growing global producer of copper as the world shifts to a lower carbon future.”

The sale comes as part of JX Nippon’s review of its asset portfolio, which is aimed at driving its vision to move from an industry-type company to a technology-based entity.