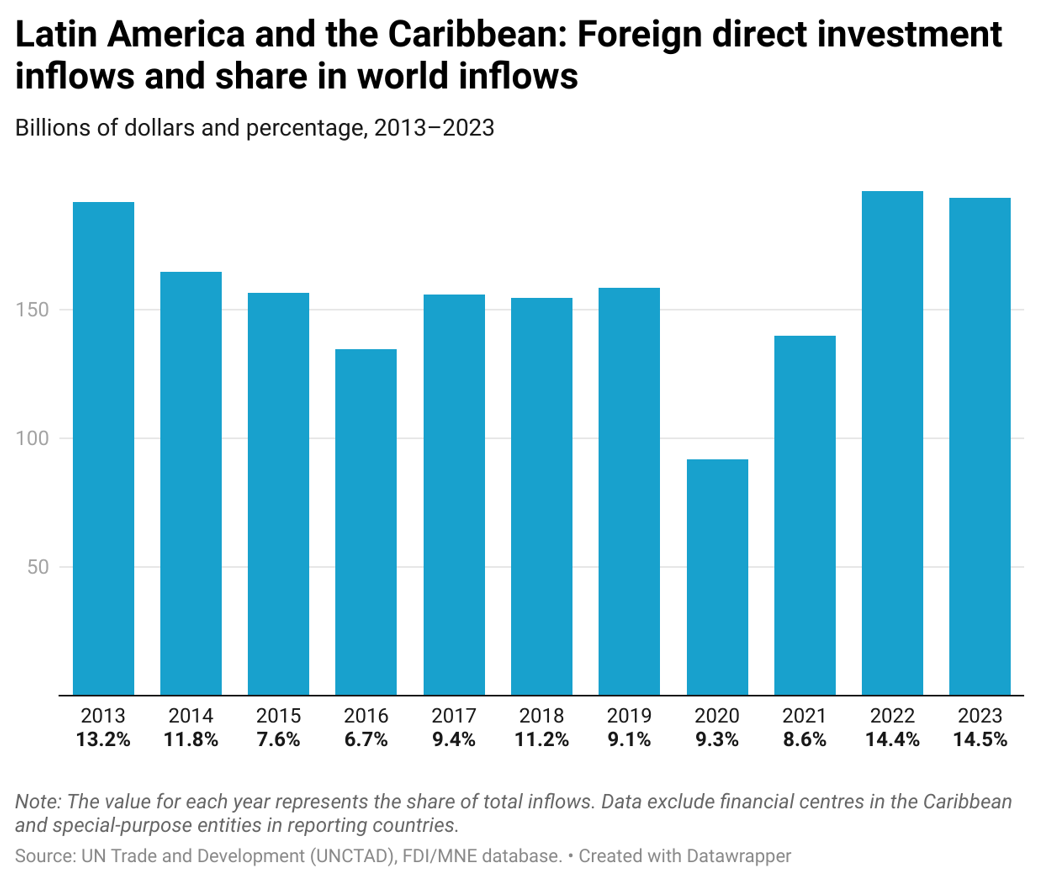

In 2023, foreign direct investment (FDI) in Latin America and the Caribbean was steady at $193bln, according to the World Investment Report 2024.

In 2023, there was a 44% surge in the total value of greenfield investment announcements and a 22% uptick in the quantity of such announcements for the region, indicating the establishment or expansion of companies’ operations abroad.

The rise in announcement values for greenfield FDI was driven by major projects in Brazil and Chile.

Over the previous two years, commodities and minerals accounted for 23% of the region’s greenfield project value. These critical minerals are essential for the production of clean energy technologies, which have seen increased demand worldwide. Comparing LATAM’s share of production with other developing regions, it is more than double.

Four of the top ten announced projects (by value) involved the production of green ammonia or green hydrogen, indicating that investments in renewable energy were also significant.

Foreign financing

In 2023, Latin America and the Caribbean saw a surge in megaprojects, with 19 of them valued at over $1bln each. Notably, 17 of these projects were executed by investors from outside the region. The significant foreign interest highlights the region’s competitiveness in attracting large-scale investments.

How well do you really know your competitors?

Access the most comprehensive Company Profiles on the market, powered by GlobalData. Save hours of research. Gain competitive edge.

Thank you!

Your download email will arrive shortly

Not ready to buy yet? Download a free sample

We are confident about the unique quality of our Company Profiles. However, we want you to make the most beneficial decision for your business, so we offer a free sample that you can download by submitting the below form

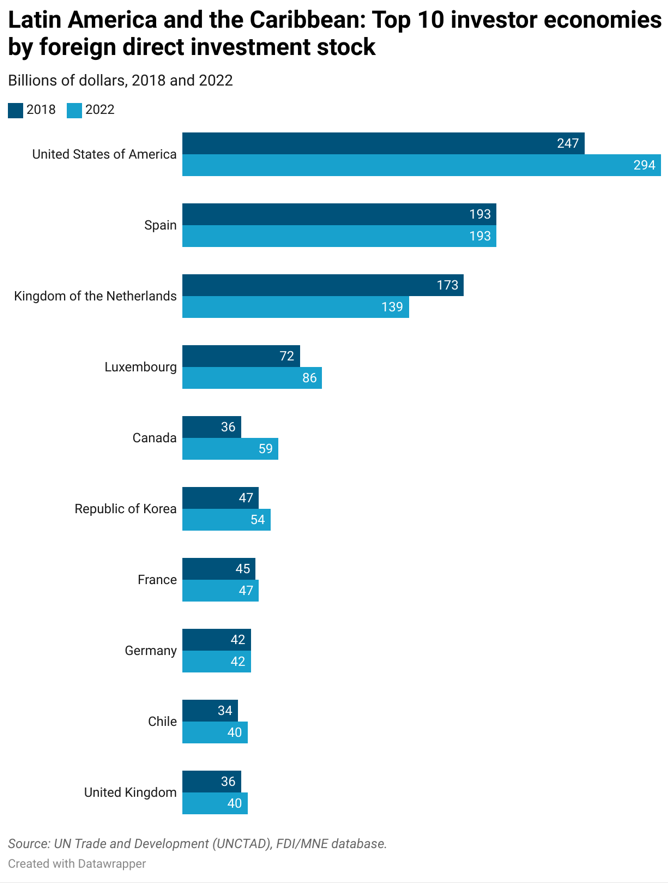

By GlobalDataThe United States, Spain, the Netherlands, and Luxembourg stand out as top investors in FDI stock. This indicates a strong international presence and confidence in the economic prospects of the region.

Trends by industry and sector

Similar to other regions, Latin America and the Caribbean saw a 30% and 23% fall, respectively, in the quantity and value of foreign project finance deals, which are essential for directing investment toward public services and infrastructure.

While many projects were announced in the renewable energy sector, this decline in foreign project finance deals hit the industry hard. It saw 40% fewer deals and a $16bln decline in value from 2022.

The overall value of cross-border mergers and acquisitions, which normally make up a lesser portion of FDI in the region, decreased by 26% to $11 billion. The industries with the biggest declines in transactions were information and communications technology and chemicals, but the market for basic metals and metal products rose.

Countries posted varying results

In South America, foreign investments experienced a slight decrease, falling by 2% to $143bln. While Brazil and Peru saw a decline in FDI values, accelerated flows to Argentina, Chile, and Guyana helped offset this trend. Brazil maintained its position as the largest FDI recipient in the sub-region despite these fluctuations.

In Central America, Mexico stood out as the main recipient of foreign investment. Despite lower project values, Mexico consistently attracted a significant portion of foreign capital, showcasing stable numbers.

In the Caribbean, excluding offshore financial centers, overall FDI saw a positive trend, increasing by 6%. This growth was largely observed across most countries in the region. Specifically, the Dominican Republic stood out with a notable 7% rise in FDI inflows compared to the previous year.

Over the past five years, foreign investments in the Caribbean have tripled compared to 2018. This surge in investment reflects the region’s growing economic significance, attracting capital from various international sources.