Global Energy Metals has signed a nonbinding letter of intent with NeoLithica to acquire a 19.9% interest and a 1% net smelter return (NSR) royalty in NeoLithica’s Peace River Lithium Project located in the Peace region of north-west Alberta, Canada.

The transaction is subject to TSX Venture Exchange approval and grants an 18-month option for the acquisition.

In exchange for the NSR and the option, Global Energy Metals will issue two million shares to NeoLithica at a deemed price of C$0.05 ($0.03) per share and pay C$10,000 in cash immediately.

To exercise the option, Global Energy Metals will pay NeoLithica C$1.5m in a combination of cash and shares within 18 months.

NeoLithica will continue to operate the project while Global Energy Metals plans to explore strategic partnerships to advance the project’s development.

Global Energy Metals CEO and director Mitchell Smith said: “Taking a nonoperating interest option and royalty on a highly prospective lithium brine asset offers excellent optionality against a realistic current background of depressed lithium pricing and global cost inflation.

“We see Peace River as an important Canadian project that has the potential to be a strategic source of lithium as the global supply chain rebalances over time, driven by the growing criticality of locally sourced, ethically produced lithium needed to support the energy transition.”

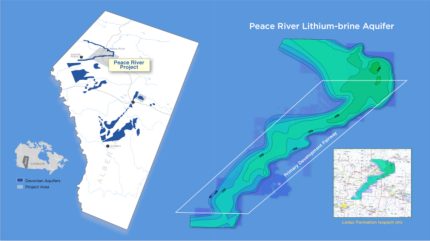

The Peace River Lithium project spans over 377,508 hectares and is estimated to contain an inferred mineral resource of ten million tonnes of lithium carbonate equivalent at an average grade of 70mg per litre.

NeoLithica has developed a two-stage pre-commercialisation plan for the project, with the first stage already completed in 2023.

The company plans to commission a preliminary economic assessment after conducting demonstration pilots in early 2025.

NeoLithica president Barry Caplan said: “Global Energy will be a valuable partner and help evaluate options for NeoLithica and work with us in securing a strategic operational partner to apply their technical and jurisdictional expertise to advance this North American lithium project when demand for lithium surges, driven primarily by the electric vehicle revolution and the growing need for renewable energy storage systems.”

The transaction is considered a ‘non-arms’ length’ transaction as Mitchell Smith serves as a director for both Global Energy Metals and NeoLithica. Smith has disclosed his conflict of interest to both boards and abstained from voting on the transaction.