Exploration company Antipa Minerals has regained full ownership and resumed management of the Wilki project in the Paterson Province of Western Australia (WA) after Newmont Corporation withdrew from a farm-in agreement.

In 2020, Antipa entered into an A$60m farm-in deal for the Wilki project with Newcrest Operations. Newmont acquired Newcrest in November 2023 and elected to withdraw from the agreement as part of its asset divestment programme.

Discover B2B Marketing That Performs

Combine business intelligence and editorial excellence to reach engaged professionals across 36 leading media platforms.

Antipa now holds a 100% interest in the 1,430km² Wilki project, expanding its wholly owned land package in Paterson Province to 2,540km².

The company is set to receive a cash payment of approximately A$590,000 from Newmont as per the farm-in agreement’s terms.

The Wilki Project has benefitted from A$12m in exploration investment since February 2020, entirely funded by Antipa’s partners.

With 103,500oz of gold mineral resources already identified, Antipa is poised for further exploration.

US Tariffs are shifting - will you react or anticipate?

Don’t let policy changes catch you off guard. Stay proactive with real-time data and expert analysis.

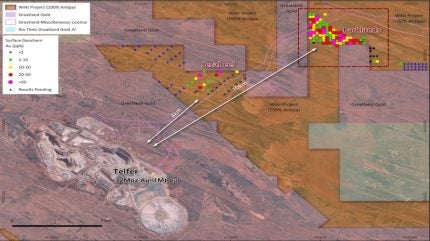

By GlobalDataAntipa will now focus on the high-potential Parklands and Jezabeel targets, with a comprehensive drilling programme planned for the first half of 2025.

Parklands, with a large gold anomaly and favourable geological features, is primed for drilling following the completion of a heritage survey.

Jezabeel, a newly identified target, also shows promise, with “significant” gold anomalies and proximity to Telfer operation.

Antipa’s cash reserves of approximately A$36.5m, as of 31 December 2024, support the company’s ability to fund exploration programmes in 2025.

The upcoming drilling programme at Wilki includes up to 16,000m of drilling, with a primary focus on the Parklands target.

Antipa Minerals managing director Roger Mason said: “We are very pleased to retain full, unencumbered ownership of the Wilki Project. Wilki contains a number of highly prospective gold targets, and we are particularly excited to drill-test Parklands, a stand-out surface geochemical gold target, with no existing drill-holes, that we have been eager to further explore.

“With Newmont’s withdrawal, we are well-positioned to confidently move forward with our calendar year 2025 exploration programme. Importantly, our strong balance sheet enables us to fully fund Wilki’s budgeted exploration activities, ensuring that any future success directly benefits, and fully flows through, to our shareholders.”

In September 2024, Antipa announced plans to sell its 32% Citadel joint venture stake to Rio Tinto for A$17m in cash.