Adventus Mining has set up a joint venture (JV) with Ecuador-based exploration company Salazar Resources to develop the Curipamba copper-gold project in Ecuador.

In 2017, Adventus Mining agreed to earn a majority interest in the project from Salazar Resources by funding $25m in exploration and development work over five years.

Furthermore, Adventus has to finance 100% of the capital costs to production for the project following the completion of the feasibility study.

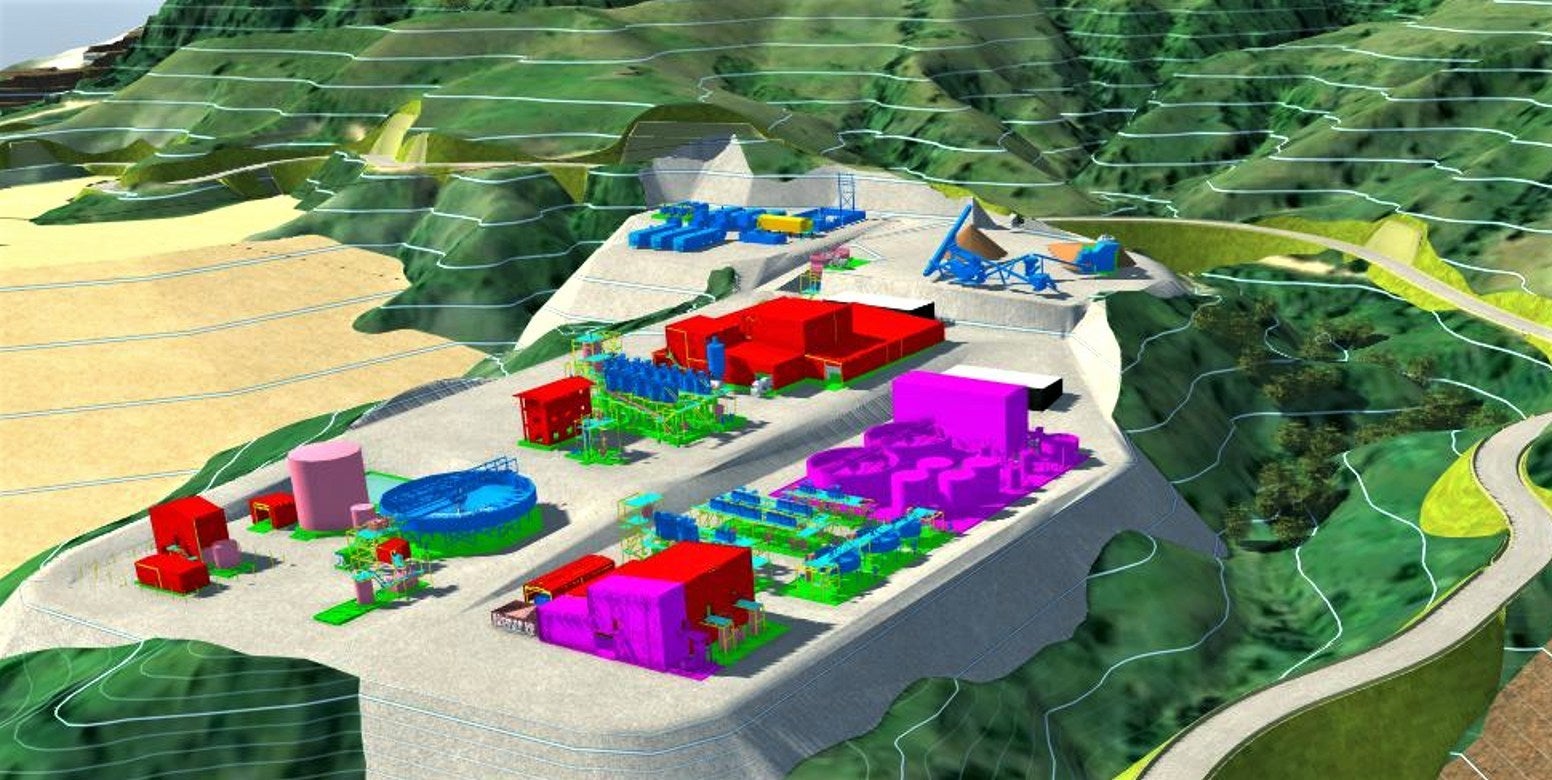

Completed last year, the study focused on the development of the high-grade copper-gold El Domo volcanic massive sulphide (VMS) deposit located within the Curipamba project concessions.

Adventus now owns a 75% stake in the Curipamba project.

The firm will receive 95% of future net cash flows from operations from Ecuadorian Curipamba holding company Curimining. This would continue until all of Adventus’ earn-in option expenditures and capital costs have been reimbursed.

Up to 30 September 2021, Adventus made $44.1m in total earn-in expenditures on the Curipamba project.

In Q1 2022, Adventus plans to start detailed engineering and complete an investment agreement with the Ecuadorian Government.

With the signing of the shareholders’ agreement, Adventus and Salazar will manage their respective rights and obligations as shareholders of the incorporated JV, which owns and operates the Curipamba project.

Located in central Ecuador approximately 150km north-east of the major port city of Guayaquil, the Curipamba project includes seven concessions.