The success of a business is no longer being measured based on financial performance alone.

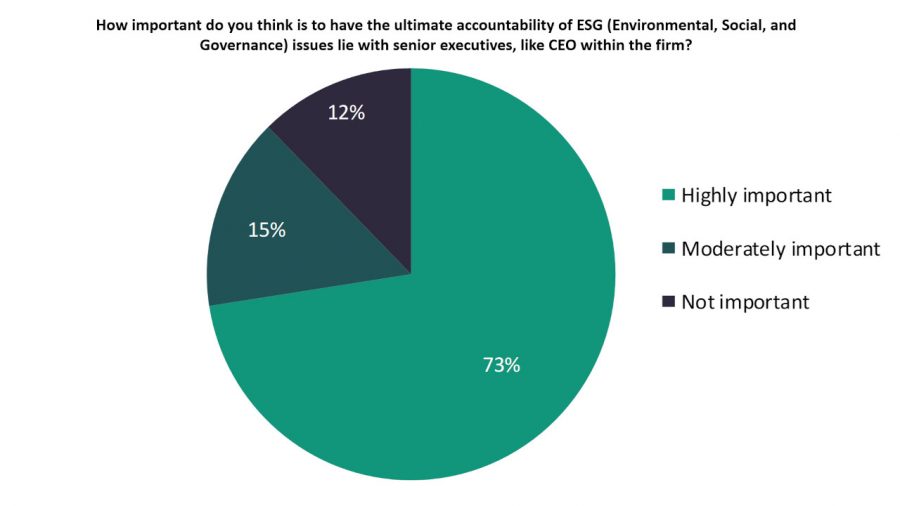

In a poll Verdict has conducted to assess how important it is for the ultimate accountability of ESG issues to lie with senior executives such as CEOs, a majority 73% of the respondents believed that it is highly important, while 12% opined otherwise.

Additionally, 15% of the respondents believed that it is moderately important.

The analysis is based on 284 responses received from the readers of Verdict, between 01 February and 01 March 2021.

Need for accountability of ESG issues

Businesses are increasingly being held accountable for addressing ESG issues and risks associated with climate change, inequality, employee health and safety, and human rights. Companies and businesses are also viewing ESG as an opportunity to innovate and differentiate themselves.

Investors and asset managers are calling for holding board members and senior executives accountable for the management of ESG issues. BlackRock, SSGA, and Vanguard are some of the asset managers who have highlighted the need for board accountability in ESG management.

Individual investors too are demanding more transparent ESG reporting, found a survey that financial reporting cloud vendor Workiva conducted recently. The survey found that businesses are failing to establish trust among individual investors in how they display ESG data.

ESG information was crucial for making investment decisions by 44% of the investors Workiva surveyed, and 70% of individual investors see displaying ESG data as a part of corporate social responsibility.

To ensure that ESG goals are met and prioritised, companies should ensure careful integration of ESG policies and practices into their corporate policies. The roles and responsibilities of achieving ESG goals should be part of a governance model and clearly communicated across board members and senior management.

One way to ensure accountability from senior executives is to link compensation with ESG metrics. Mastercard, for example, linked bonuses received by senior executives to ESG initiatives such as carbon usage and gender pay parity.