For the first time in decades, inflation is back as a political issue in the developed world – but should investors be worried?

Data suggests that inflation actually boosts foreign direct investment (FDI) inflows to emerging economies, but does dampen investor appetite elsewhere.

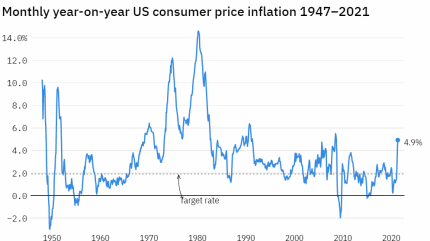

US consumer prices rose by 5% in the year to May 2021, a rate only seen once in the past 30 years, at the height of the 2008 financial crisis. The higher-than-expected increase in inflation has led the US Federal Reserve to bring forward its planned interest rate increase from 2024 to 2023, spooking commodity and equity markets.

Recent figures show that the UK's annual rate of inflation to May also exceeded economists' expectations, albeit rising to a relatively modest 2.1%, compared with the 1.8% inflation forecast.

Unlike the Federal Reserve, the Bank of England has so far shown no sign of stepping on the brakes to halt the rise in inflation.

Central bankers at both institutions have argued that the current price increases are at least partially a statistical artefact of artificially depressed prices during the height of lockdown in early 2020. Economists have also made the point that a temporary rise in inflation is necessary to offset the below-target levels of inflation seen since the 2008 financial crisis.

Does inflation reduce FDI?

In theory, high levels of inflation could be off-putting to foreign investors. Higher inflation risks reducing the value of assets pegged to the local currency, such as cash reserves and debts owed by local clients, relative to purchases in that currency, such as locally sourced inputs.

Inflation rates have generally been low across the OECD, and where they have been high investment decisions seem to have been broadly unaffected.

Inflation can also lead to currency depreciation, reducing the value of assets pegged to the local currency relative to foreign currencies – raising the cost of imports and reducing the ability of owners to repatriate their profits.

Rapid and unpredictable price increases can also add friction to the operation of businesses, such as the need to frequently update prices and wages.

On the other hand, moderate levels of inflation could also benefit foreign direct investors by helping to promote domestic growth, reducing the value of debts to suppliers and, via currency depreciation, increasing the competitiveness of exports.

In line with this theoretical ambiguity, inflation appears to have had little role to play in driving investment trends. Inflation rates have generally been low across the OECD, and where they have been high investment decisions seem to have been broadly unaffected.

Academic attempts to work out the effect of inflation on FDI have frequently produced mixed and contradictory results. A recent study by two Nigerian economists found that this may be because the effect of inflation on FDI varies with the nature of the host economy and its current level of inflation.

The researchers found that, in industrialised economies, increases in inflation of up to 1.35% had no significant impact on FDI flows, but increases over that threshold did dampen investment.

In non-industrialised economies, however, the relationship between inflation and FDI was reversed. For these countries, increases in inflation of up to 6.63% reduced FDI inflows, whereas increases above this threshold actually boosted foreign investment.

Rather than focusing on current rates of inflation, investors may be more attuned to factors affecting long-term trends, such as the country's institutional set-up. From the 1990s onwards, many governments have sought to cement low and stable rates of inflation through inflation-targeting policies.

In many developing countries in particular, this was intended to reassure investors that the value of their assets, including capital and revenues, in the local currency would not be depleted.

A 2018 study examined FDI inflows to 71 developing countries over almost three decades, finding that inflation targets had a significant impact on the cyclicality of investment.

Countries that adopted inflation targets did not see dramatic spikes in FDI inflows during economic upswings, but they also didn't see the dramatic cratering of inflows that other countries experienced during recessions.

After researchers adjusted for other factors relevant to investor decision-making, such as the size of a country's economy and its openness to trade, they found that countries with inflation targets received no more FDI than others during good times, but during bad times received a bonus equivalent to 1.1 percentage points of GDP each year.

Should investors be concerned?

If the current rise in inflation is not strictly temporary it may cause a moderate reduction in FDI to industrialised countries. However, this has to be weighed against the broader economic consequences of an anti-inflationary policy at the current moment.

A rollback of fiscal stimulus, such as US President Joe Biden's $1.9trn spending plan or a hike in interest rates, would risk undermining the economic recovery from Covid-19 and tipping economies into recession.

Moreover, it is not even clear that it is within the power of central banks to curb the current spike in inflation, as the Brazilian central bank is currently discovering. The bank's interest rate hikes have failed to curb the country's inflation, which is a result not of a surge in demand but issues with supply – most notably, a once-in-a-century drought that has slashed hydroelectricity production.

Much like Brazil, the rest of the world economy is currently in the midst of a number of overlapping supply shocks, from bottlenecks in global shipping to a worldwide shortage of semiconductors. To the extent that current levels of inflation are not just a statistical artefact of 2020's highly depressed prices, they are likely to be due in large part to these temporary supply-side constraints.

The real threat is not a return to the hyperinflation of the 1920s but to the depression of the 1930s.