Last year nickel was the worst performing metal on the London Stock Exchange, with prices remaining persistently depressed due to a surge in supply from Indonesia. It is a status quo that, in the near term at least, analysts do not expect to change much.

Despite this gloomy outlook for nickel – the silvery-white lustrous metal used in batteries and alloys — exploration and development company Alliance Nickel is making notable progress with its flagship greenfield initiative: the NiWest Nickel Cobalt Project in Western Australia (WA).

Discover B2B Marketing That Performs

Combine business intelligence and editorial excellence to reach engaged professionals across 36 leading media platforms.

The definitive feasibility study for NiWest

Alliance Nickel is mere months away from financially greenlighting the NiWest project after meeting an important milestone in November 2024, when it published the project’s definitive feasibility study (DFS).

The document, which represents A$20m ($12.4m) worth of shareholder spend over two years, outlines that the NiWest project could produce on average 20,000 tonnes (t) per annum of nickel and ~1,600t of cobalt over the first 12 years.

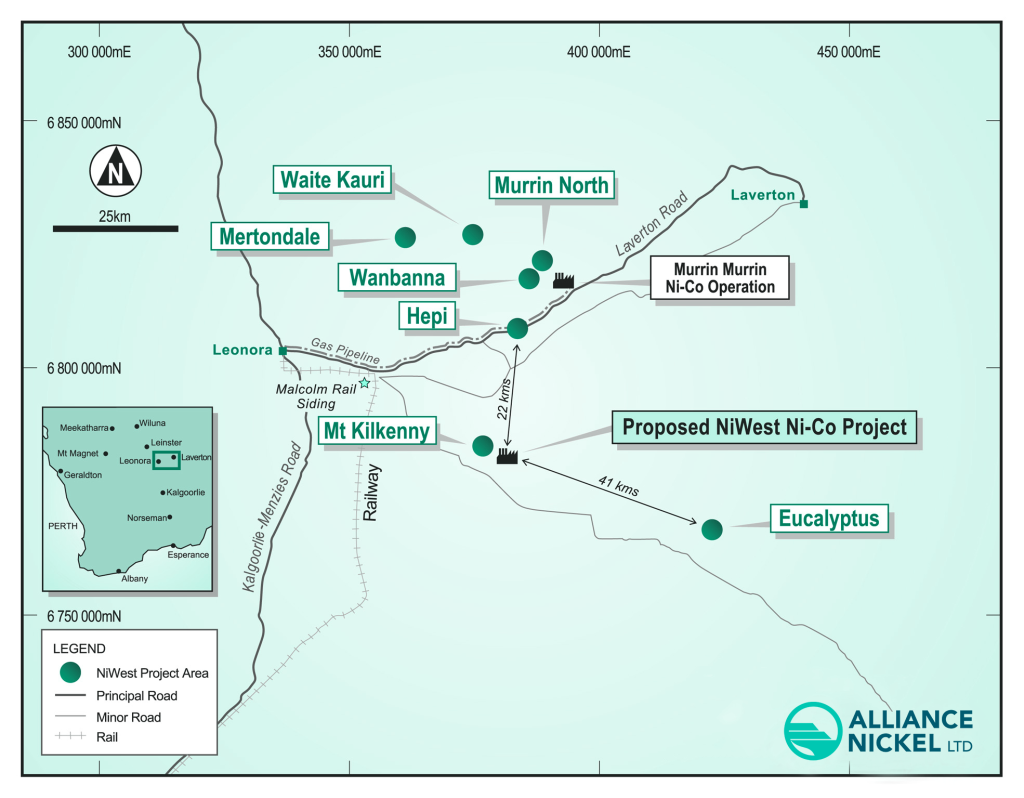

In total, over 27 years, 252.8 million tonnes of dry material could be mined across seven separate areas within a 50km radius of a proposed processing plant at Mt Kilkenny that is close to rail, gas lines and sealed arterial roads.

“This is a bankable DFS,” says company managing director and CEO Paul Kopejtka with conviction. “Even in these challenging times,” he adds.

US Tariffs are shifting - will you react or anticipate?

Don’t let policy changes catch you off guard. Stay proactive with real-time data and expert analysis.

By GlobalData“Yes, we would like the price to be higher, but the question is, if we were producing under this cost environment [$15,500/t at the time of speaking], would we make money? And the answer based on the DFS is yes.”

This is a message Kopejtka has been relaying over the past 18 months, during which time the company has talked to around 13 commercial banks and received “a hugely positive response” to the project, he says.

Alliance Nickel is also engaging with Export Finance Australia, from which it has a letter of support, the Canadian export credit agency (ECA), where sulphur needed for the project will be sourced, Samsung and South Korean ECAs.

Now the DFS is published, the company is “actively” working through negotiations with existing and potential strategic partners. These include carmaker Stellantis, with which it has a deal, focusing on securing offtake “aligned to project level joint venture investment”.

Low-cost processing method

Alliance claims that NiWest can defy the now-notorious nickel downturn that has seen mines shuttered in WA, due to the project’s proposed low-cost processing method enabled by the unique local geography.

NiWest is a nickel laterite project, as opposed to a nickel sulphides one. The proposed processing method integrates heap leaching with direct solvent extraction (DSX) and crystallisation to produce high-purity nickel and cobalt sulphates with a low carbon footprint. It is a process that has been used by Glencore in the nearby Murrin Murrin mine for several years, along with some others globally.

The heap leaching process is generally less capital-intensive compared with other methods like high-pressure acid leaching (HPAL), says Kopejtka.

It involves stacking nickel laterite ore and applying a leaching solution to dissolve the nickel and cobalt content.

Following this, the pregnant leach solution containing dissolved metals undergoes DSX – a step that selectively separates nickel and cobalt from impurities, streamlining the process by eliminating intermediate product formation.

The final stage involves crystallising the purified nickel and cobalt solutions to produce battery-grade nickel and cobalt sulphate crystals.

Kopejtka says other projects using HPAL have capital development costs of around $3bn, whereas NiWest is around half of this, with a reproduction capex of $1.65bn.

The low-cost process puts the cost base for the NiWest project in the first cost quartile – below even projects in rival Indonesia, he says. It has an all-in sustaining cost of $4.84/lb of nickel.

The NiWest project’s low-carbon credentials

The NiWest project can market itself as a low carbon because the energy used in the processing is generated from burning sulphur to make the acid that generates steam, which can be used to power the mine and the refinery.

“There is no cost to that power for us, as opposed to other projects, which may have to import power from the grid, which in Indonesian nickel, for example, is generally from coal-fired power stations,” says Kopejtka.

The mining itself will be open-pit with a low strip ratio using a conventional load and haul mining fleet and limited blasting.

The NiWest project has faced challenges, however, due to water scarcity in the region that, coupled with the water-intensive nature of nickel laterite projects, has added a previously unforeseen A$350m to its cost.

“The water that was meant to be where our mine is turned out to be much less than anticipated,” says Kopejtka. “So we had to go further away [around 200km] until we could find sufficient quantities”.

“We have got about A$300m tied up just for the water infrastructure, but that is the cost of doing business in a dry, arid country like Australia.”

Making premium deals for nickel

Boosting the project’s bottom line is the premium Kopejtka says the company can get for its more environmentally friendly product.

Alliance expects to secure a 10% premium over the London Metal Exchange nickel price for its nickel sulphate. This premium, the company says, reflects the high purity and suitability of NiWest’s nickel sulphate for battery manufacturing.

There is a great deal of debate about whether carmakers will really pay a premium for a more environmentally-friendly product. Some believe it will come, if at all, in the form of capital investments rather than end pricing.

Western OEMs and all battery manufacturers will pay that premium for low-carbon, IRA (Inflation Reduction Act]-compliant nickel

Kopejtka, however, is adamant it is achievable. “The reason I can say that is because we have a contract with Stellantis, and therefore I can tell you that the Western OEMs and all battery manufacturers will pay that premium for low-carbon IRA-compliant nickel,” he says.

Traceability is important to prove a product is IRA compliant and thus eligible for tax credits. For example, the IRA excludes minerals produced by companies with more than 25% ownership from a foreign entity of concern, including China, which controls much of Indonesia’s nickel production.

This will require environmental, social and governance audits for carbon footprint and origin, which the company has already discussed with Stellantis. Kopejtka says Alliance is open to conducting other wider frameworks such as the Initiative for Responsible Mining Assurance or something similar.

Getting the NiWest project across the line amid uncertainty

There is concern the IRA will be gutted, which would be a blow to the project. However, Alliance Nickel’s position is that the new Trump administration, despite its rhetoric on the matter, cannot just “walk away” from the energy transition.

This is also the analysis of some industry experts. Rystad Energy, for example, has said repealing clean vehicle consumer tax credits is “the next development to monitor”, but adds that doing this might take longer and will require congressional approval – “Meanwhile, the EV [electric vehicle] market share in the US hit a record high for new sales in December 2024.”

Kopejtka acknowledges there will now be a level of uncertainty. However, he is confident the NiWest project can get over the line, with the financial investment decision expected to be made around August 2025. If NiWest goes ahead, the project could create around 600 jobs in WA during construction and 300 over its operational life.