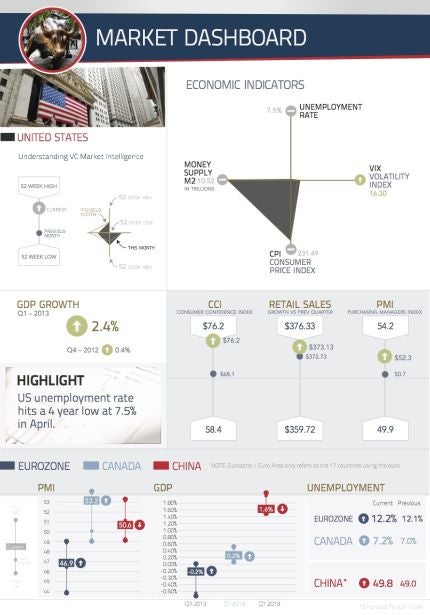

US markets continue the rise seen over previous months, hitting all time highs. At the same time however, Canadian markets dipped low, struggling after a broad based sell off in commodities.

Discover B2B Marketing That Performs

Combine business intelligence and editorial excellence to reach engaged professionals across 36 leading media platforms.

Good news for investors

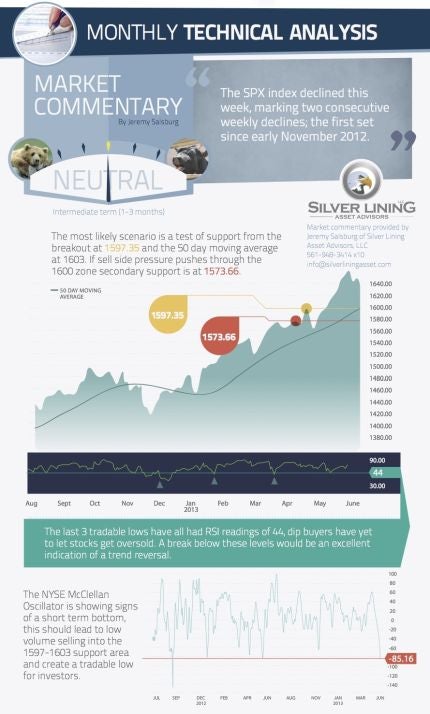

Consecutive drops in the SPX were witnessed for the first time since November 2012. The NYSE McLellan Oscillator showed signs of a short term bottom and low volume selling became good news for investors.

Worrying times for silver?

Silver has been considered a precious metal for thousands of years; demand at the moment however is low. High costs plus challenging economic environments in some of the biggest consumers have created a low-spell in silver’s illustrious history.

US Tariffs are shifting - will you react or anticipate?

Don’t let policy changes catch you off guard. Stay proactive with real-time data and expert analysis.

By GlobalDataReduced industrial production means fewer options

Poor macroeconomic conditions around the world have created a fall in industrial production, and lower production has resulted in less need for silver. Not many options exist over the short term. Companies can either wait for improvement, increase reserves or hedge by shorting future contracts.

US unemployment rates

A lower than expected US unemployment rate is still having a positive impact, riding the wave from May 2013.

Weak commodity prices

Commodity prices were weak across the board in May. Gold stood at $1,413.50, while whole silver reached $23.01.

Related content

Infographic – mining market intelligence May 2013

While weak economic data led to a large-scale sell-off of commodities in April, May has seen US markets reach record highs.

Gold – is the bubble about to burst on a once rock solid commodity?

After a ten year bullish period, gold prices have plummeted, dropping around $600 dollars from its peak price.

.gif)