March 2013 was a particularly strong month for US markets, with each one reaching a 52 week high. Seasonal correlation comparisons for April, although not steadfast, do suggest a decline. Courtesy of Visual Capitalist, this month’s market analysis infographic draws particular insight from the rise and fall of copper. While historically copper has been a good growth indicator, a recent divergence from the SPX is raising eyebrows. Click on each image to see it full size.

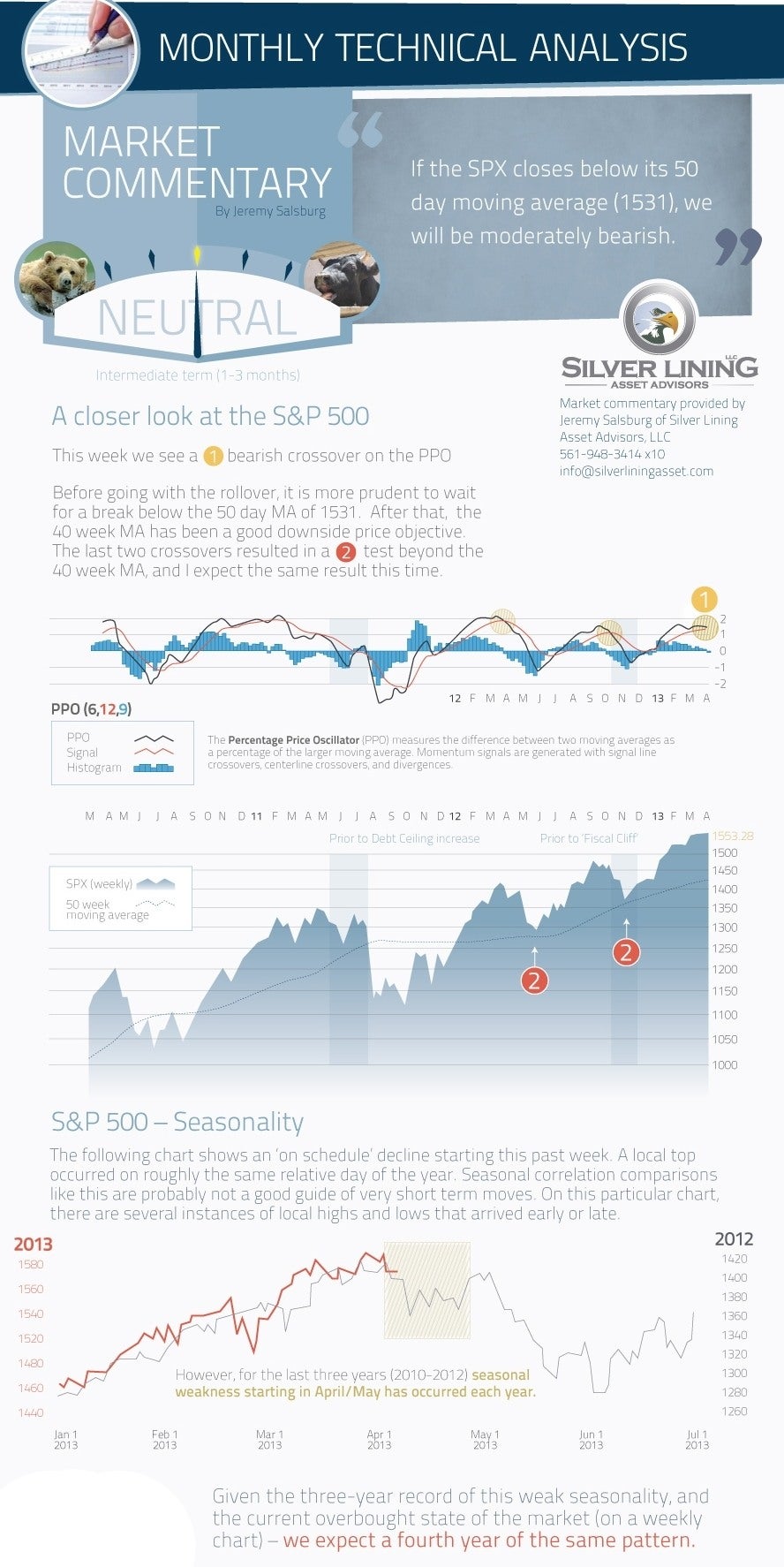

Monthly technical analysis – a closer look at the S&P 500

Jeremy Salsburg of Silver Lining Asset Advisors has commented on the S&P500 stating that, "If the SPX closes below its 50 day moving average (1531), we will be moderately bearish".

(click to see full size)

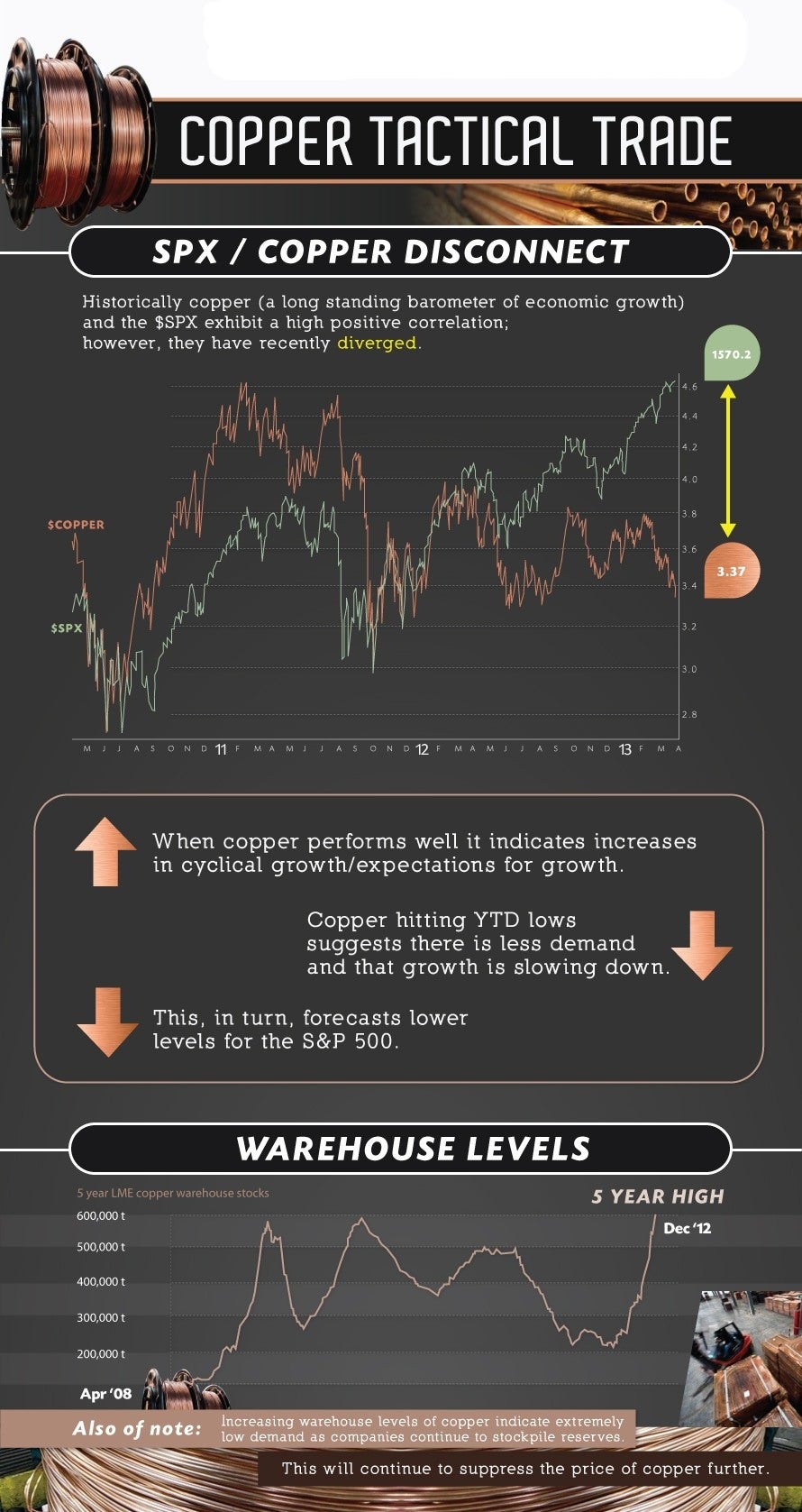

Copper tactical trade – eyes on the SPX / copper disconnect

Historically copper (a long standing barometer of economic growth) and the $SPX exhibit a high positive correlation; however, they have recently diverged. When copper performs well it indicates increases in cyclical growth or expectations for growth. Copper hitting YTD lows suggests there is less demand and that growth is slowing down, which in turn forecasts lower levels for the S&P 500.

Additionally, increasing warehouse levels of copper indicate extremely low demand as companies continue to stockpile reserves, which will continue to suppress the price of copper further.

(click to see full size)

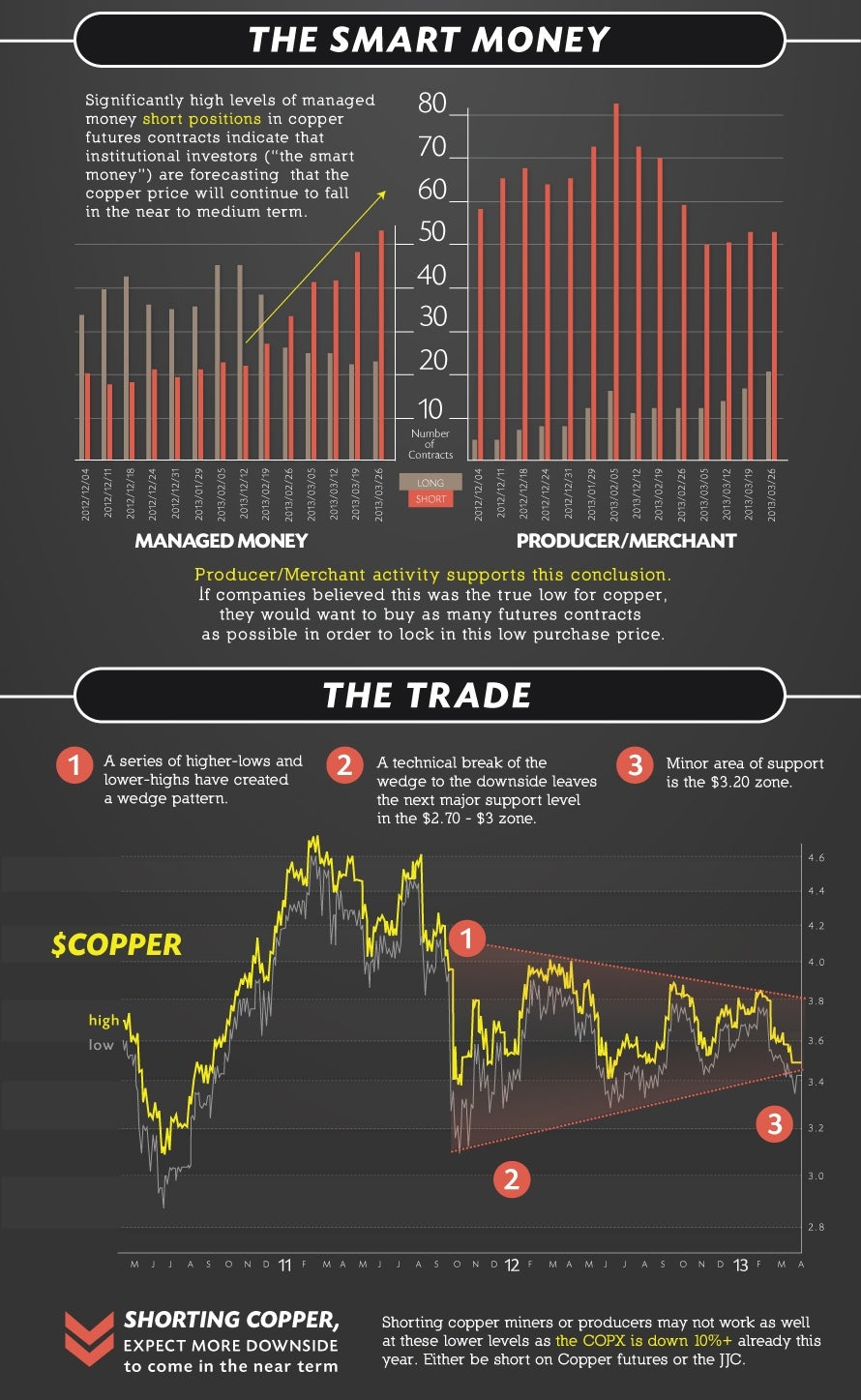

The smart money – investors predict a fall in copper prices this April

Significantly high levels of managed money short positions in copper futures contracts indicate that institutional investors are forecasting that the copper price will continue to fall in the near to medium term. Producer / merchant activity supports this conclusion. If companies believed this was the true low for copper they would want to buy as many futures as possible in order to lock in this low purchase price.

(click to see full size)

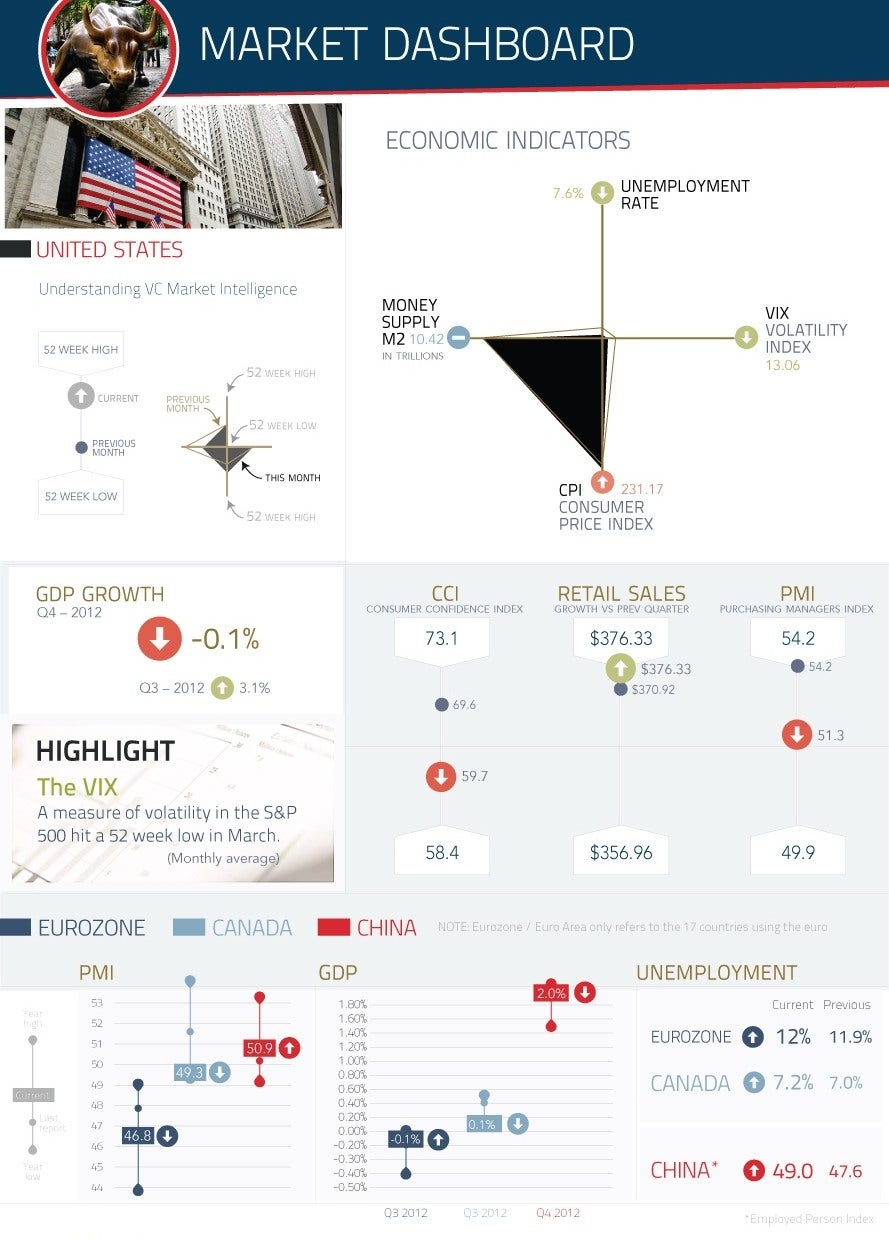

Market dashboard – a close look at your economic indicators

(click to see full size)

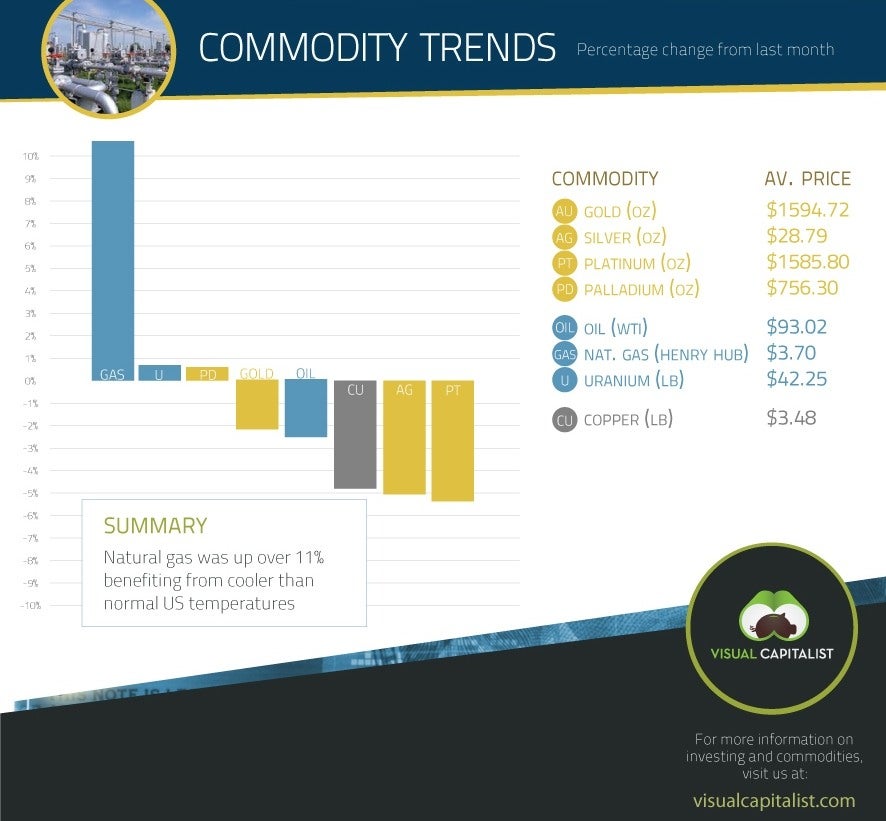

Commodity trends – the commodities percentage change over the month before

(click to see full size)

Related content

Infographic – counting the cost of comminution

As high grade ores stocks dwindle, the need to divest more energy in the pursuit of profits is wreaking havoc on company bottom lines.

Mining lookout: trends to watch in 2013

Low commodity prices and high operating costs dented mining profits last year, but is business set to improve in 2013?

.gif)