Managing Water Consumption in Mining: Strategies Amid Global Shortages

In 2010, the UN declared access to clean water a human right. Three years later, 500 water scientists from the Cooperative Remote Sensing Science and Technology Centre warned that the majority of people on Earth will be forced to live with severe pressure on fresh water supply within the space of two generations, due to over-use, climate change and pollution.

Considering this sobering prediction, which could lead to death and human disaster, it’s no surprise that organisations, NGOs and governments are putting increased pressure on industries, such as mining, which uses water heavily, to be more sustainable.

Not that encouragement should be needed, as for miners, no water means no business.

Mining uses water primarily for mineral processing, dust suppression, slurry transport and employees’ needs. In most mining operations, water is sought from groundwater, streams, rivers and lakes, or through commercial water service suppliers. But often, mine sites are located in areas where water is already scarce and, understandably, local communities and authorities often oppose mines using water from these sources.

But it isn’t just the procurement of water that’s a problem; water extraction is also an issue. In many cases, especially with underground mining, water needs to be pumped away from a mine site, which can reduce the levels of ground water, deplete surface water or cause pollution to local rivers.

Water awareness and investor pressure on industry

There is evidence of a growing awareness of the need for water sustainability in the industry. The Carbon Development Project (CDP) survey, issued on behalf of 530 investors representing $57 trillion in assets, published in July 2013, revealed that 64% of respondents from the mining industry said they have experienced detrimental water related business impacts in the past five years.

According to the report, flooding, water quality and water shortages are the predominant cause of impacts, which resulted in an increase of operating costs for more than half of those reporting detrimental impacts.

Just a quick search of the news highlights many incidences of mining operations around the world being affected by water in some way. At the time of writing, moneynews.com reports that the world’s biggest underground coal mine in Shaanxi province in northern China, a country whose coal industries and power stations use as much as 17% of its water, is under pressure from depleting water supplies.

Examples of financial losses due to water related events, according to the CDP report, include Gold Fields in South Africa, which forked out $4.3m for repairs and losses of production in 2011. MAL Zrt based in Hungary, which was fined €472m for a spillage of toxic sludge from its aluminium operations in 2010, Hungary’s worst chemical incident.

There’s also the reputational cost from environmental impacts caused by a mine’s impact on local water. For example, mining company Aurul, a joint-venture of the Australian company Esmeralda Exploration and the Romanian Government, was responsible for the Baia Mare cyanide spill in the Somes River in Romania in 2000. The spill eventually reached the Danube River, killing large numbers of fish in Hungary and Yugoslavia.

Investors are taking note, says Cate Lamb, who is head of CDP’s water programme: “We are seeing more and more investor action on this issue as time goes on and this whole topic will become more relevant as awareness of it grows,” she says.

A report by Natural Value Initiative said there is an increase in investor action linked to ecosystem impacts. According to the report, Barrick’s Gold, Freeport McMoran and Rio Tinto have all seen investors withdraw because of this issue.

“Water isn’t carbon, so even if you are only consuming a small amount, if that water is coming from a highly stressed basin or if you are discharging water into a sensitive environment you are polluting, you are going to be exposed to specific risks,” says Lamb.

Becoming water stewards, not polluters

“The first step for any organisation, particularly in this sector, is to really understand their impact on water resources and how the water resources themselves could really impact upon businesses,” Lamb explains.

Many mining companies are doing this well, but they haven’t always got a perfect solution.

A report released last year by the International Council on Mining & Metals (ICMM), which presents case studies of water management from mining companies, highlights some progressive projects.

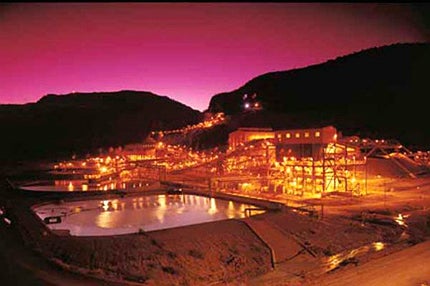

Rio Tinto’s Argyle Diamond mine in north-west Australia – the world’s largest single producer of diamonds – is located in arid conditions reaching 40 degrees heat. Water for the project has to be sourced from two dams and Lake Argyle, meaning it could have potential impacts on ground water.

In 2005 the mine used more than 3,500 megalitres of water from the lake to run operations. By 2009 they had reduced this to 300 megalitres – a 95% drop. Rio Tinto did this by capturing and recycling water used by the processing plant, the biggest user of water, and capturing seepage from tailings, which also get recycled. Dewatering of the underground mine and from the surface pit operations are also collected and stored in two dams for drinking and operational use.

Minera Esperanza’s copper and gold mining operation, located 180km from the city of Antofagasta in Chile, is one of the driest places in the world. The mine needs approximately 20m cubic metres of water a year to run. To meet these demands the mine’s processing plant was designed to use untreated seawater. A supply pipe network was constructed to transport seawater 145km from the Pacific coast to the mine site.

The seawater intake is located at the company’s port facilities, after filtering the sea water is then pumped via a pipeline that climbs 2,300 metres and passes through four intermediate pumping stations to reach a concentrator plant. Eight percent of the water is desalinated for human use and cooling and concentrate washing.

Although it is a good alternative to using valuable local water resources, Lamb says this isn’t quite the right sustainable balance.

“They have dramatically increased their carbon footprint so they need to figure out a way of striking the ultimate sustainable balance for specific projects and I don’t think we are quite there yet,” she says.

Lamb also adds that desalination, which is becoming a popular water solution for miners – BHP announced recently it was spending nearly $2m on a desalination plant in Chile – isn’t necessarily the best answer.

“If you’re looking at it purely from a water resource perspective then, yes, of course, it reduces reliance on a potentially vulnerable water resource. However, from a holistic perspective it does have its challenges. It is very energy intensive,” Lamb says.

Future water use in mining – change and collaboration

The ICMM’s case study report, featuring eight other examples of water management in mining, highlights the industry’s acknowledgement that there is a problem with water resources, that mines need to become more sustainable and essentially become ‘water stewards’, not only for the greater good but because it does, and will continue to, directly and negatively affect business.

However, as Lamb says: “There are still a number of organisations within the sector that are not taking action or that are failing to move beyond their legal compliance.”

This is noted in the 37% that failed to disclose their water practices to the CDP water survey. Full disclosure has worked well in other areas of the mining industry – to stamp out corruption and encourage fair deals with developing countries – therefore it could also work well to encourage better water stewardship.

What we may see, says Lamb, is water becoming a “competitive” issue, with companies using a “cross pollination of technologies” from different industries, or even competitors working together to find water solutions.

All worthy strategies that should be driven by investors, shareholders and regulators, as well as good guidance, in order to usher the mining industry more quickly into a new era of water sustainability.

Related content

Mining data: advanced capture methods help miners do more with less

Across all aspects of the business, from start to finish, the mining industry is awash with data – geological, hydrological, environmental and operational – and all this needs to be processed and analysed in a timely and effective way.

Maximising underground efficiency with energy conscious mining machines

Achieving maximum efficiency is the new Holy Grail in mining; but how and with what technology, does the industry, which has traditionally not been considered energy conscious, plan to evolve into an energy efficient sector?

.gif)