Mine planning software has become an essential tool for the mining industry. Despite already high levels of penetration, the software – used for designing, evaluating and scheduling mine operations – remains an area of investment focus for operators.

Of 162 mines surveyed by GlobalData between March and May 2024, 47% said they expected to invest in, or invest further in, mine planning software in the next two years. Just a third of respondents said they had already “fully implemented” the software.

Utilising a suite of mine planning software tools offers a range of benefits, helping to optimise operations, improve decision-making and address specific challenges.

GlobalData, Mining Technology’s parent company, is tracking software providers at almost 900 operating mines globally, with the top two suppliers used at over 50% of sites.

Mine planning software providers include Autodesk, Bentley Systems, Dassault Systemes, Datamine, Deswik Mining (now owned by Sandvik), Hexagon AB, Maptek, Micromine and RPMGlobal, among others.

Development of mine planning software

Mine planning software is not new, but it is continuously evolving. Over the years, software solutions that emerged in the 1970s and 80s have become more sophisticated with advances in computing power.

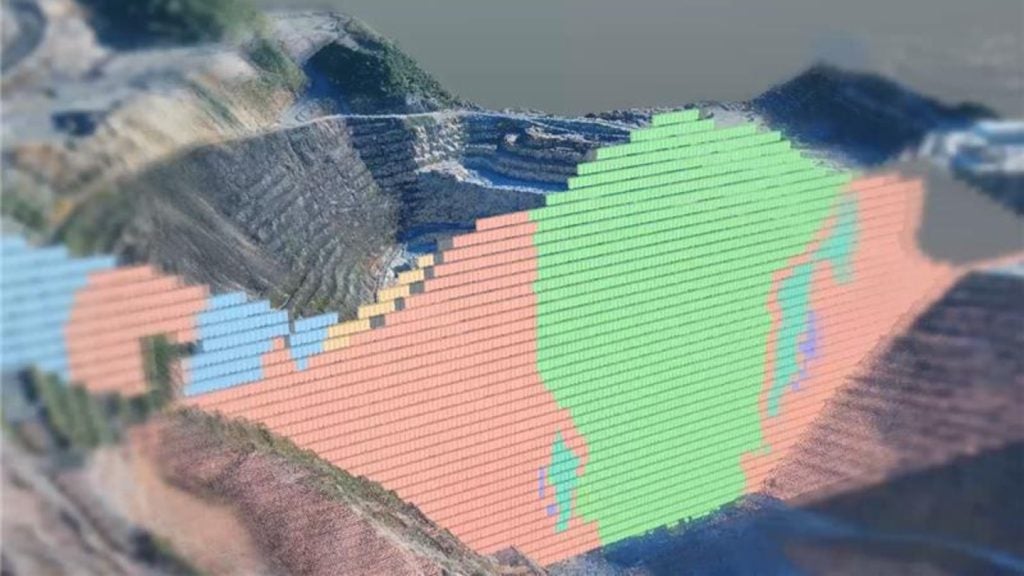

“What started as text-based inputs and outputs evolved into simple 2D visualisers through to full 3D twinning of the mine,” says Gavin Clarkson, business development manager, USCA, at Hexagon Mining.

“Increases in computing power allowed complex scheduling algorithms to crunch millions of combined inputs and return the best possible mining sequence, an impossible task in early planning software.

“These results could then be fully visualised and animated in real time, allowing users to audit results and easily report information to stakeholders.”

Plus, as the technology becomes more accessible, the proliferation of different mine planning solutions has grown “immensely”, says Eduardo Coloma, CEO of Maptek.

While general mine planning software still exists, tools that can address specific issues are becoming more common. However, this brings with it potential challenges such as integration and interoperability.

“You are going to be solving a particular problem with a very specific solution, which is really good for that purpose,” Coloma tells Mining Technology.

“However, the outcome of that tool is going to be useful for all parts of the business. If you do not have good integration… it is not going to be very beneficial in the holistic view.”

Regionally the market is also changing. Mines in Africa, the Americas and Asia are increasingly looking to adopt software solutions to support mine planning, despite low labour costs in some of those regions. According to GlobalData research, Africa had the highest share of respondents (38%) expecting to invest in mine management software by 2026.

The benefits – akin to the broader advantages of moving from paper-based processes to digital solutions – include improved repeatability, reliability of calculations and reduction of errors in data transposition, supported by data capture devices or telemetry.

What are miners looking for in software today?

“Mines adopt software looking to maximise the value of their projects over the lifetime of the asset,” says Clarkson.

“Mines also look to software for simplifying workflows that can also be easily audited.”

Furthermore, mine planning software can help companies become more agile. Being able to respond to address market volatility, supply chain issues and commodity price fluctuations has become increasingly important since the Covid-19 pandemic, according to Justin Meade, head of product management at Deswik.

There is also a greater focus on optimisation at various planning horizons, from long-term deposit planning to the short-term, such as weekly operations.

Dan Evans, chief information officer at Rio Tinto, previously told Mining Technology that AI used in technologies such as smart mine planning is helping optimise mining processes by considering constraints and bottlenecks throughout the value chain.

As mining operations become more complex – with declining ore grades, increasingly challenging environments and narrower profit margins – even small improvements could have a significant impact on a project’s viability.

“With narrower margins, any iterative improvements on efficiency and accuracy can make or break a project, and a thorough plan with modern planning software combining as many inputs as possible is what makes that difference,” says Clarkson.

Another focus area is on environmental, social and governance (ESG) and closure planning, developers say. Although ESG has fallen down the priority list for companies in the face of macroeconomic and geopolitical threats, GlobalData believes it will remain a critical theme impacting businesses over the next decade.

Future development of mine planning software

Mine planning software is expected to evolve on many fronts. Stochastic planning (a type of probabilistic planning) capability is set to be a focus area for future development. Plus, there will be continued integration of AI, Internet of Things (IoT), digital twins and advanced analytics capabilities into software.

Software interfaces are expected to change too – leveraging the latest tech but also adapting to meet the needs of the changing industry demographic.

Stochastic planning

“Simulation, twinning and stochastic planning are both the current and future trends in the mining industry,” says Clarkson.

In most standard mine planning procedures, the inputs for the long-term plan are assumed to be known and constant. In reality, that is not the case, with factors such as geological uncertainty, market unpredictability and operational variabilities “unavoidable”.

“Stochastic mine planning is a relatively new approach that is generating significant interest in the industry,” Clarkson adds. It integrates these uncertainties into the planning process to create a plan that balances net present value and risk in a way not previously accounted for.”

He adds: “On the day-to-day operations, mines want to be able to track ore and waste movement in extreme detail, whether to improve environmental impact or increase ore recovery.”

Meade points to how integrated mine design and planning could be used to model the differences between diesel fleets and electric or hydrogen vehicles. They each have different mechanical and performance characteristics – size of vehicles, turning circles, ramp tolerances, power curves and loading characteristics – which can in turn affect both the physical design of the operation as well as the sequence of ore packages you can get to and thus the economics of the mine.

“It is not just at the start of the mine,” that mine planning software is useful, Meade says. “What happens if the laws around emissions change part-way through your life of mine? How do you then change the whole shape of your mine and the operational future of it?”

“That is where people are heading,” says Meade. However, to achieve this, the software needs to work in a connected way, to be able to run a mine model repeatedly with different inputs, and to be able to do it continually in response to the changing world around us.

“Right now, people are looking at solving all of those problems.”

Digital technologies

Further integration of digital technologies such as AI, IoT and advanced analytics capabilities will support real-time operational insights.

Clarkson tells Mining Technology that: “Real-time tracking and monitoring of materials from extraction to port are becoming ubiquitous, providing valuable insights and enabling data-driven decisions.”

Additionally, as hardware evolves alongside mine planning software, planners will be able to access higher fidelity information, giving them a better view of their assets, Meade says. More information is available now – both in the detail of the information, as well as the timeliness of it.

Meanwhile, Coloma points to continued growth of cloud-based software solutions, which offer increased usability, improve accessibility and enhance collaboration between teams.

ESG focus

Mine planning software can support strategies to minimise environmental impacts and fulfil reporting requirements.

However, according to Coloma, many of the algorithms the industry is using today do not incorporate the variables needed to evaluate the environmental impact of operations. This is an area he sees as a priority for future development.

Software can also assist in modelling closure obligations and optimising rehabilitation costs, which is of growing importance for environmental and social governance, as well as more effectively controlling the cash flow of an operation, according to Meade.

“Software groups… are really helping mining groups understand what their closure liability is, so that they can plan for that effectively.”

There are already active use cases. In Brazil, Alcoa is using Hexagon’s MinePlan software to optimise its vegetation and environmental rehabilitation activities in the Amazon region.

Mine planning software is also supporting community engagement through virtual reality modelling of mine sites.

User interface

Developers say mine planning software as well as business approaches must change to support the new mining sector demographics. Solutions need to be able to meet the needs of both experienced professions and new graduates, and emerging regions.

The mining sector is facing a “generational gap”, with many of its subject matter experts, including those in mine planning, set to retire in the next 10–15 years, says Coloma.

“Tools that are difficult to use are not going to make it,” he says.

Coloma believes there will be continued demand for intuitive user interfaces and that agentic AI could have a role to play in future.

“With the growing adoption of large language models, the interface has to change,” he says.

“The thinking is now more around what kind of questions do you want to ask from the data. That is going to be very important, because it is going to change how you teach people in university.”

Meade also says that future software interfaces may incorporate natural language processing, allowing users to interact with the software more intuitively. As the number of mining professionals entering the market diminishes it will remain important that software, as well as training tools, are available in multiple languages to serve a more mobile workforce.

Additionally, collaboration and interoperability will remain priorities.

“The members of this segment of the market are going to need to collaborate more and the collaboration is going to enable new use cases,” says Coloma.