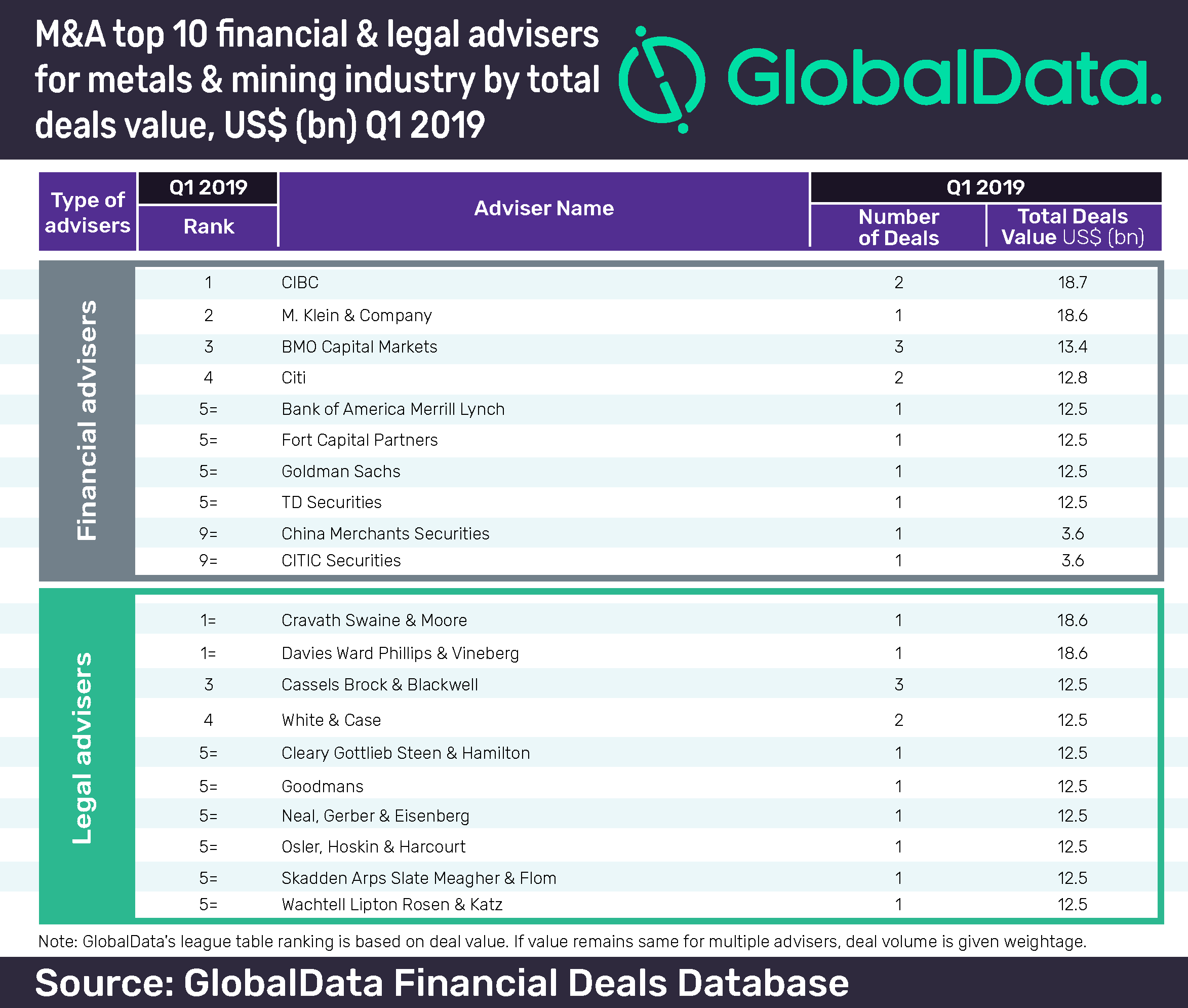

CIBC was the leading financial adviser globally for mergers and acquisitions (M&A) in Q1 2019 in the metals & mining sector, according to GlobalData.

The Canada-based financial services group led the table with two deals worth $18.7bn, gaining a marginal edge over M. Klein & Company, which advised on one deal worth $18.6bn.

BMO Capital Markets secured third position with three deals valued at $13.4bn.

GlobalData has published a top 10 league table of financial advisers ranked according to the value of announced M&A deals globally. If value remains the same for multiple advisers, deal volume is given weightage.

The top ranked company in the metals & mining sector, CIBC was absent from GlobalData’s Q1 2019 ranking of top 20 financial advisers for global mergers and acquisitions. The metals & mining league table’s second-ranked M. Klein & Company stood seventh in the global rankings.

The metals & mining sector saw an increase in deal value in Q1 2019 when compared with the corresponding quarter of the previous year. The overall deal value grew by 6.3% from $21.2bn in Q1 2018 to $22.5bn in Q1 2019. Deal volumes decreased by 8.7% from 358 in Q1 2018 to 327 deals in Q1 2019.

Cravath Swaine & Moore, and Davies Ward Phillips & Vineberg shared the first spot in the table of the top 10 legal advisers by value with just one deal, but worth $18.6bn. Cassels Brock & Blackwell secured the third position with three deals worth $12.5bn. CravathSwaine& Moore secured 12th position in the global league table of top 20 legal advisers for Q1 2019.

GlobalData’s league tables are based on the real-time tracking of thousands of company websites, advisory firm websites and other reliable sources available on the secondary domain. A dedicated team of analysts monitors all these sources to gather in-depth details for each deal, including adviser names.

To ensure further robustness to the data, the company also seeks submissions from leading advisers, through adviser submission forms on GlobalData’s website