The mining industry continues to be a hotbed of patent innovation. Activity is driven by improved computing power and connected sensors to control and monitor the mining environment. By adding internet connectivity and sensors to vehicles, machinery, and people, mining companies can increase efficiency, improve productivity and safety, and reduce costs on the mine site. Examples of this include autonomous drilling, driverless haul trucks, and predictive maintenance. In addition, it is imperative to provide workers with clean, non-toxic air and sufficient oxygen in underground mines, and Internet of Things (IoT) sensors can monitor potential dangers, such as convergence or toxicity, in real-time. In the last three years alone, there have been over 3,000 patents filed and granted in the mining industry, according to GlobalData’s report on Innovation in mining: tunnel safety monitoring. Buy the report here.

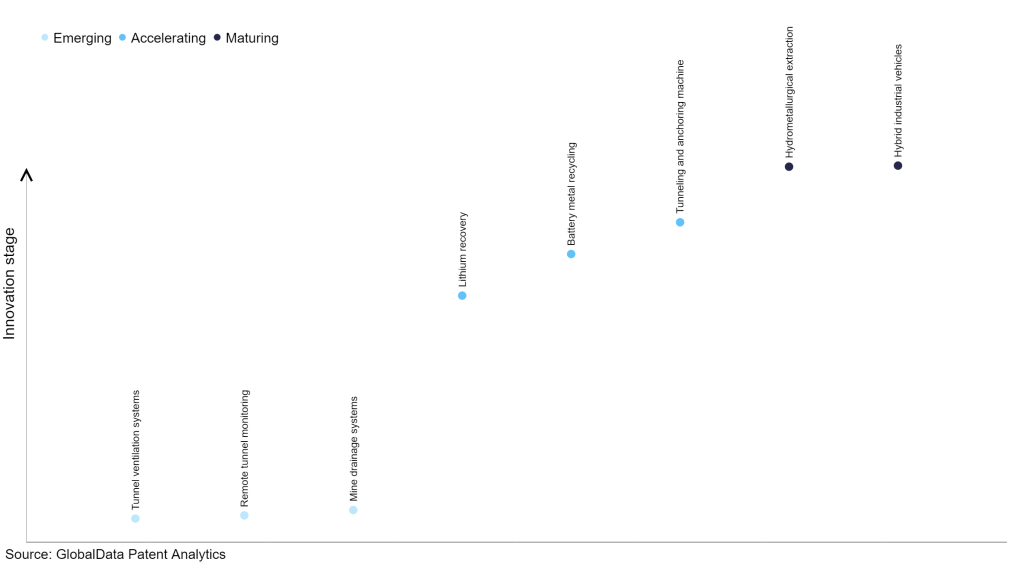

However, not all innovations are equal and nor do they follow a constant upward trend. Instead, their evolution takes the form of an S-shaped curve that reflects their typical lifecycle from early emergence to accelerating adoption, before finally stabilizing and reaching maturity.

Identifying where a particular innovation is on this journey, especially those that are in the emerging and accelerating stages, is essential for understanding their current level of adoption and the likely future trajectory and impact they will have.

45+ innovations will shape the mining industry

According to GlobalData’s Technology Foresights, which plots the S-curve for the mining industry using innovation intensity models built on over 81,000 patents, there are 45+ innovation areas that will shape the future of the industry.

Within the emerging innovation stage, tunnel ventilation systems, remote tunnel monitoring, and mine drainage systems are disruptive technologies that are in the early stages of application and should be tracked closely. Lithium recovery, battery metal recycling and tunneling, and anchoring machine are some of the accelerating innovation areas, where adoption has been steadily increasing. Among maturing innovation areas are hydrometallurgical extraction and hybrid industrial vehicles, which are now well established in the industry.

Innovation S-curve for the mining industry

Tunnel safety monitoring is a key innovation area in mining

Tunnel safety monitoring helps to rescue people inside a tunnel and to maintain air quality and control spread of smoke in case of fire or a disaster. As mines become deeper, more remote, and technically more difficult, the ability to source tunnel safety devices becomes more important than ever. Global corporations are witnessing a technological revolution in the underground mining sector. Automation enables the safe and remote operation of equipment, while smart technology enables real-time performance monitoring to drive cost and productivity improvements. Devices such as drones, wearables, proximity detection sensors on moving machinery and vehicles, and scanners to identify different ore grades and feed this information through the mining value chain can all yield small but cumulative gains in productivity.

GlobalData’s analysis also uncovers the companies at the forefront of each innovation area and assesses the potential reach and impact of their patenting activity across different applications and geographies. According to GlobalData, there are 435+ companies, spanning technology vendors, established mining companies, and up-and-coming start-ups engaged in the development and application of tunnel safety monitoring.

Key players in tunnel safety monitoring – a disruptive innovation in the mining industry

‘Application diversity’ measures the number of applications identified for each patent. It broadly splits companies into either ‘niche’ or ‘diversified’ innovators.

‘Geographic reach’ refers to the number of countries each patent is registered in. It reflects the breadth of geographic application intended, ranging from ‘global’ to ‘local’.

Patent volumes related to tunnel safety monitoring

| Company | Total patents (2021 - 2023) | Premium intelligence on the world's largest companies |

| China Railway Group | 177 | Unlock Company Profile |

| State-owned Assets Supervision and Administration Commission of the State Council | 53 | Unlock Company Profile |

| China Energy Investment | 29 | Unlock Company Profile |

| China Communications Construction Group | 26 | Unlock Company Profile |

| Tian Di Science & Technology | 23 | Unlock Company Profile |

| China State Construction Engineering | 20 | Unlock Company Profile |

| China General Nuclear Power | 20 | Unlock Company Profile |

| Uni-President Enterprises | 19 | Unlock Company Profile |

| Yankuang Group | 19 | Unlock Company Profile |

| Huainan Mining Group | 19 | Unlock Company Profile |

| Jinneng Holding Group | 15 | Unlock Company Profile |

| Sandvik | 13 | Unlock Company Profile |

| Tian Di Science & Technology | 13 | Unlock Company Profile |

| China National Petroleum | 12 | Unlock Company Profile |

| Ministry of Defence (UK) | 12 | Unlock Company Profile |

| The 2nd Engineering of China Railway 12th Bureau Group | 11 | Unlock Company Profile |

| Caterpillar | 11 | Unlock Company Profile |

| Power Construction Corporation of China | 11 | Unlock Company Profile |

| Beijing LongRuan Technologies | 9 | Unlock Company Profile |

| China Railway 11Th Bureau Group No4 Engineering | 9 | Unlock Company Profile |

| Shandong Hi-Speed Group | 8 | Unlock Company Profile |

| Orica | 8 | Unlock Company Profile |

| Shanghai Construction Group | 8 | Unlock Company Profile |

| Shanxi Tiandi Coal Mining Machinery | 8 | Unlock Company Profile |

| Epiroc | 8 | Unlock Company Profile |

| Shanghai Tunnel Engineering | 8 | Unlock Company Profile |

| Shanxi Coking Coal Group | 8 | Unlock Company Profile |

| China Railway First Group | 8 | Unlock Company Profile |

| China Railway Tunnel Survey & Design Institue | 7 | Unlock Company Profile |

| Huaibei Mining | 7 | Unlock Company Profile |

| China Railway Group | 7 | Unlock Company Profile |

| China Coal Handan Design Engineering | 6 | Unlock Company Profile |

| State Grid Corporation of China | 6 | Unlock Company Profile |

| China Railway 14 Bureau Group | 5 | Unlock Company Profile |

| China Railway Tunnel Stock | 5 | Unlock Company Profile |

| China National Coal Group | 5 | Unlock Company Profile |

| China Petrochemical | 5 | Unlock Company Profile |

| Pingdingshan Antaihua Mining Safety Equipment Manufacturing | 5 | Unlock Company Profile |

| Powerchina Roadbridge Group | 4 | Unlock Company Profile |

| China Coal Technology | 4 | Unlock Company Profile |

| Shandong Gold Group | 4 | Unlock Company Profile |

| Beijing Municipal Construction Group | 4 | Unlock Company Profile |

| Komatsu | 4 | Unlock Company Profile |

| China Railway Engineering Group | 4 | Unlock Company Profile |

| First Engineering Of China Railway 16Th Construction Bureau Group | 4 | Unlock Company Profile |

| Shandong Dongshan Xinyi Coal Mine | 4 | Unlock Company Profile |

| Jingying Shuzhi Technology | 4 | Unlock Company Profile |

| Jiaozuo Coal Industrial Group | 4 | Unlock Company Profile |

| Huaneng Group Technology Innovation Center | 4 | Unlock Company Profile |

| Schlumberger | 4 | Unlock Company Profile |

Source: GlobalData Patent Analytics

Sandvik, Epiroc, Caterpillar and Orica are some of the key patent filers in tunnel safety devices. Sandvik’s OptiMine Mining Data Platform (MDP) service allows for real-time monitoring of machines, workers, equipment, and material underground in order to improve mine safety and productivity. Furthermore, the company offers the OptiMine Evacuation Assistant, which provides a visualization of an evacuation, searches for the nearest safe place underground and indicates the location of personnel who are guided to the nearest rescue chamber, based on the location and capacity of those chambers.

Epiroc's Mobilaris Mining Intelligence platform improves safety by better and faster managing emergencies from a centralized location. The mobile-safety solution project is a collaboration between LKAB and Epiroc, and incorporates both existing Epiroc products and new development.

In terms of application diversity, Pingdingshan Antaihua Mining Safety Equipment Manufacturing leads the pack, while Jiaozuo Coal Industrial Group and Shanxi Coking Coal Group stood in the second and third positions, respectively. By means of geographic reach, Shanghai Construction Group held the top position, followed by China General Nuclear Power and Jinneng Group.

To further understand the key themes and technologies disrupting the mining industry, access GlobalData’s latest thematic research report on Mining.

Data Insights

From

The gold standard of business intelligence.

Blending expert knowledge with cutting-edge technology, GlobalData’s unrivalled proprietary data will enable you to decode what’s happening in your market. You can make better informed decisions and gain a future-proof advantage over your competitors.