The mining industry continues to be a hotbed of patent innovation. Activity is driven by the need for safety, productivity, and sustainability, which are all supported by robotic deployment. The two main uses of robotics in mining are for drilling and haulage. Drilling rigs can be automated to various extents, while haulage vehicles can be replaced by autonomous trucks or autonomous railways. Minor uses include underground rock cutters and inspection drones. Productivity is improved primarily because robotic technology is more precise, reliable, and enduring than human labor. The main contribution of robotics to the sustainability of a mine is the reduction of energy expenditure. In the last three years alone, there have been over 3,000 patents filed and granted in the mining industry, according to GlobalData’s report on Innovation in mining: robotic mining. Buy the report here.

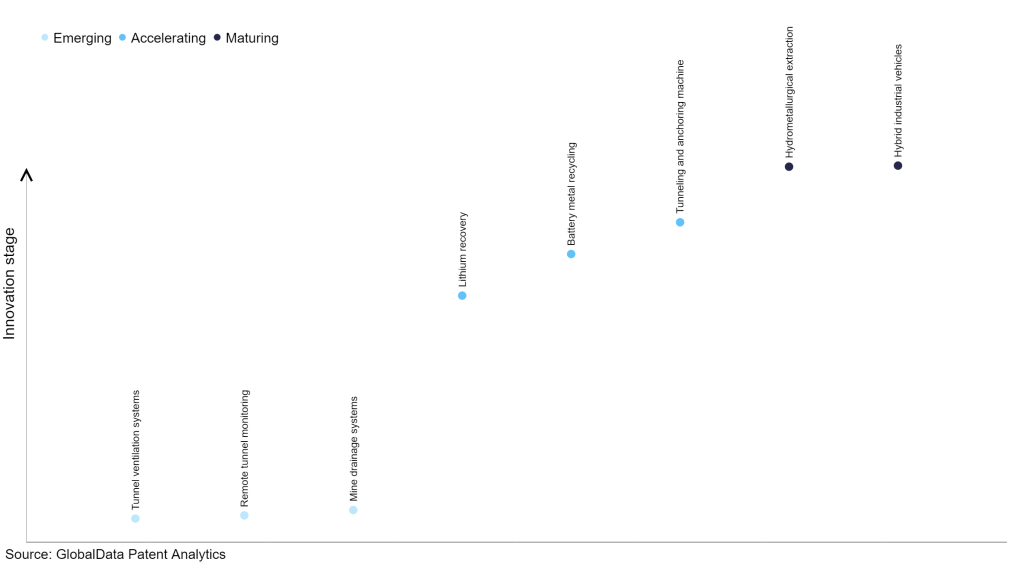

However, not all innovations are equal and nor do they follow a constant upward trend. Instead, their evolution takes the form of an S-shaped curve that reflects their typical lifecycle from early emergence to accelerating adoption, before finally stabilizing and reaching maturity.

Identifying where a particular innovation is on this journey, especially those that are in the emerging and accelerating stages, is essential for understanding their current level of adoption and the likely future trajectory and impact they will have.

45+ innovations will shape the mining industry

According to GlobalData’s Technology Foresights, which plots the S-curve for the mining industry using innovation intensity models built on over 81,000 patents, there are 45+ innovation areas that will shape the future of the industry.

Within the emerging innovation stage, tunnel ventilation systems, remote tunnel monitoring and mine drainage systems are disruptive technologies that are in the early stages of application and should be tracked closely. Lithium recovery, battery metal recycling and tunneling and anchoring machine are some of the accelerating innovation areas, where adoption has been steadily increasing. Among maturing innovation areas are hydrometallurgical extraction and hybrid industrial vehicles, which are now well established in the industry.

Innovation S-curve for the mining industry

Robotic mining is a key innovation area in mining

Robotic mining refers to the use of autonomous or remote-controlled robots to extract minerals or resources from mines. These robots are equipped with sensors, cameras, and tools to navigate the mine, locate and extract resources, and transport them to a designated location. The two main uses of robotics in mining are for drilling and haulage. Drilling rigs can be automated to various extents, while haulage vehicles can be replaced by autonomous trucks or autonomous railways. Minor uses include underground rock cutters and inspection drones. The three common goals of mining companies - safety, productivity, and sustainability - are all supported by robotic deployment. Safety is improved by the removal of humans from hazardous areas. Drilling rigs can be operated and supervised remotely rather than on-site, haulage can be done without human drivers, underground tasks can be done without human presence, and the inspection of high walls or underwater regions can be done by drones, land rovers, and underwater robots.

Productivity is improved primarily because robotic technology is more precise, reliable, and enduring than human labor. Drills can follow specified boring patterns and calculate the optimal amount of explosive to fill, haulage trucks can drive without stopping for breaks or staff changes, and underground mining can be performed without waiting for the smoke from detonations to clear.

GlobalData’s analysis also uncovers the companies at the forefront of each innovation area and assesses the potential reach and impact of their patenting activity across different applications and geographies. According to GlobalData, there are 15 companies, spanning technology vendors, established mining companies, and up-and-coming start-ups engaged in the development and application of robotic mining.

Key players in robotic mining – a disruptive innovation in the mining industry

‘Application diversity’ measures the number of applications identified for each patent. It broadly splits companies into either ‘niche’ or ‘diversified’ innovators.

‘Geographic reach’ refers to the number of countries each patent is registered in. It reflects the breadth of geographic application intended, ranging from ‘global’ to ‘local’.

Patent volumes related to robotic mining

| Company | Total patents (2021 - 2023) | Premium intelligence on the world's largest companies |

| Komatsu | 163 | Unlock Company Profile |

| Sandvik | 93 | Unlock Company Profile |

| Tian Di Science & Technology | 79 | Unlock Company Profile |

| Sanyhe International | 34 | Unlock Company Profile |

| Caterpillar | 25 | Unlock Company Profile |

| China Energy Investment | 13 | Unlock Company Profile |

| Shanxi Tiandi Coal Mining Machinery | 12 | Unlock Company Profile |

| Tiandi Shanghai Mining Equipment Technology | 12 | Unlock Company Profile |

| Deere | 10 | Unlock Company Profile |

| Shanghai Chuangli Group | 7 | Unlock Company Profile |

| Grenevia | 7 | Unlock Company Profile |

| China Coal Technology | 5 | Unlock Company Profile |

| Jinneng Holding Group | 4 | Unlock Company Profile |

| Pingdingshan Antaihua Mining Safety Equipment Manufacturing | 4 | Unlock Company Profile |

| China Railway Group | 4 | Unlock Company Profile |

| Zoomlion Heavy Industry Science and Technology | 3 | Unlock Company Profile |

| Shandong Energy Group | 3 | Unlock Company Profile |

| Sany Heavy Equipment Investments | 3 | Unlock Company Profile |

| Wanbei Coal Electricity Group | 2 | Unlock Company Profile |

| China National Coal Group | 2 | Unlock Company Profile |

| Shanghai Zoomlion Heavy Industry Piling Machinery | 2 | Unlock Company Profile |

| Beijing Energy | 2 | Unlock Company Profile |

| Zhou Bin | 2 | Unlock Company Profile |

| Zhongjin Gold | 2 | Unlock Company Profile |

| Huaneng Power International | 2 | Unlock Company Profile |

| Digital Realty Trust | 2 | Unlock Company Profile |

| AnHui Jinrisheng Mining | 2 | Unlock Company Profile |

| Primetech | 2 | Unlock Company Profile |

| XCMG Construction Machinery | 2 | Unlock Company Profile |

| PowerChina Northwest Engineering | 2 | Unlock Company Profile |

| Tongling Nonferrous Metals Group Tongguan Mine Construction | 1 | Unlock Company Profile |

| Triumph Heavy Industry | 1 | Unlock Company Profile |

| Anhui Mining Electromechanical Equipment | 1 | Unlock Company Profile |

| Anhui Kechuang New Energy Technology | 1 | Unlock Company Profile |

| Inst Techniki Gorniczej Komag | 1 | Unlock Company Profile |

| Wuhu Hailian Mechanical Equipment | 1 | Unlock Company Profile |

| Yang Qinghua | 1 | Unlock Company Profile |

| LIUNA | 1 | Unlock Company Profile |

| Henan Inst Engineering | 1 | Unlock Company Profile |

| Zijin Mining Group | 1 | Unlock Company Profile |

| China Communications Construction Group | 1 | Unlock Company Profile |

| Anhui Hengyuan Coal-Electricity Group | 1 | Unlock Company Profile |

| China Railway Tunnel Equipment Manufacturing | 1 | Unlock Company Profile |

| Fu Yu | 1 | Unlock Company Profile |

| Chongqing Gas Group | 1 | Unlock Company Profile |

| Hubei Xingfa Chemicals Group | 1 | Unlock Company Profile |

| State Grid Xin Yuan | 1 | Unlock Company Profile |

| Zhengzhou Coal Mining Machinery Group | 1 | Unlock Company Profile |

| Liu Yang | 1 | Unlock Company Profile |

| Jiamusi Coal Mining Machinery | 1 | Unlock Company Profile |

Source: GlobalData Patent Analytics

Komatsu and Sandvik are among the leading patent filers in robotic mining. Komatsu's autonomous mining systems include remote oversight and operations, automated haulage, high-precision cutting, proximity detection, collision avoidance, M2M communication, and auto-bolting.

Komatsu’s digitalization solutions use the power of data and technology to improve safety in underground coal mines and enhance productivity and performance. Komatsu introduced the AFC Faceboss RS20s control system in August 2022 to improve operational synergy and safety in longwall coal operations. The control system, which is based on the existing RS20s platform for powered roof supports, leverages a diverse pool of engineering resources and technological know-how to improve armored face conveyor performance and expand the possibilities of underground coal mining. Komatsu and Toyota Motor announced a joint project in May 2023 to develop an autonomous light vehicle (ALV) that will run on Komatsu's Autonomous Haulage System (AHS) to achieve further safety and productivity improvements in mines by running autonomous haul trucks. Both companies are currently testing a concept ALV on their proving grounds, with the goal of having a proof of concept at a customer site by January 2024.

Sandvik's smart mining approach and data solutions increase productivity, efficiency, and overall safety. In October 2023, the company introduced AutoMine® Core, a comprehensive automation platform for mass mining applications, to help customers transition from manual to fully-autonomous production. The new system is intended to assist customers in transitioning from manual mining techniques to fully-automated manufacturing processes. It provides users with a variety of compatibility options for Sandvik's own fleet as well as fleets from third-party original equipment manufacturers.

Some other key patent filers in this space include Kobe Steel, Rio Tinto, and Newmont.

In terms of application diversity, Kobe Steel leads the pack, while Husqvarna and AB Electrolux stood in the second and third positions, respectively. By means of geographic reach, Newmont held the top position, followed by Rio Tinto and Husqvarna.

To further understand the key themes and technologies disrupting the mining industry, access GlobalData’s latest thematic research report on Mining.

Data Insights

From

The gold standard of business intelligence.

Blending expert knowledge with cutting-edge technology, GlobalData’s unrivalled proprietary data will enable you to decode what’s happening in your market. You can make better informed decisions and gain a future-proof advantage over your competitors.