The mining industry continues to be a hotbed of innovation, with activity driven by the need for improved productivity, safety, cost control and sustainability, with the growing importance of recycling in order for sufficient metals and materials to be available to support the global energy transition. In the last three years alone, there have been over 48,000 patents filed and granted in the mining industry, according to GlobalData’s report on Environment Sustainability in Mining: Alkaline Metal Recycling. Buy the report here.

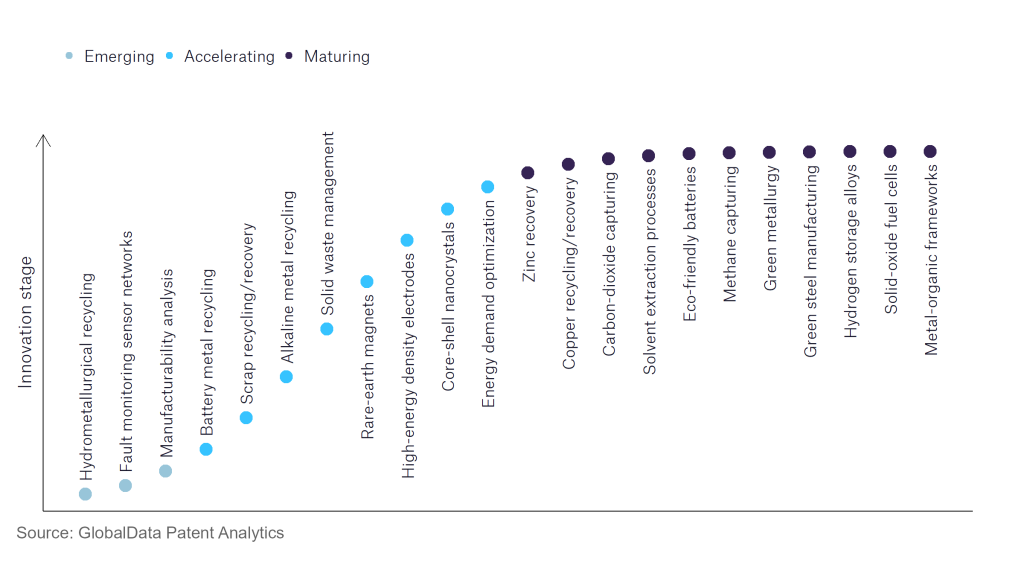

However, not all innovations are equal and nor do they follow a constant upward trend. Instead, their evolution takes the form of an S-shaped curve that reflects their typical lifecycle from early emergence to accelerating adoption, before finally stabilising and reaching maturity.

Identifying where a particular innovation is on this journey, especially those that are in the emerging and accelerating stages, is essential for understanding their current level of adoption and the likely future trajectory and impact they will have.

150+ innovations will shape the mining industry

According to GlobalData’s Technology Foresights, which plots the S-curve for the mining industry using innovation intensity models built on over 350,000 patents, there are 150+ innovation areas that will shape the future of the industry.

Within the emerging innovation stage, high-energy density electrodes, manufacturability analysis, and solid waste management are disruptive technologies that are in the early stages of application and should be tracked closely. Green steel manufacturing, scrap recycling/recovery, and core-shell nanocrystals are some of the accelerating innovation areas, where adoption has been steadily increasing. Among maturing innovation areas are green metallurgy, and solvent extraction processes, which are now well established in the industry.

Innovation S-curve for environmental sustainability in the mining industry

Alkaline metal recycling is a key innovation area in environmental sustainability

Recycling of alkaline metals such as lithium involves electrolysis of their fused chloride forms. This is due to high reactive nature of alkali metals. Recycling batteries allows for the reuse of metals, potentially addressing major criticism and obstacles faced by automakers due to the high carbon footprint associated with mined materials. Belgium, South Korea, China, and Canada recycle the most batteries, with the metals contained in them typically recovered through smelting.

GlobalData’s analysis also uncovers the companies at the forefront of each innovation area and assesses the potential reach and impact of their patenting activity across different applications and geographies. According to GlobalData, there are 14 companies, spanning technology vendors, established mining companies, and up-and-coming start-ups engaged in the development and application of alkaline metal recycling.

Key players in alkaline metal recycling – a disruptive innovation in the mining industry

‘Application diversity’ measures the number of different applications identified for each relevant patent and broadly splits companies into either ‘niche’ or ‘diversified’ innovators.

‘Geographic reach’ refers to the number of different countries each relevant patent is registered in and reflects the breadth of geographic application intended, ranging from ‘global’ to ‘local’.

Patent volumes related to alkaline metal recycling

| Company | Total patents (2021 - 2023) | Premium intelligence on the world's largest companies |

| ENEOS Holdings | 171 | Unlock Company Profile |

| Nemaska Lithium | 92 | Unlock Company Profile |

| Orbite Technologies | 50 | Unlock Company Profile |

| Lithium Australia | 42 | Unlock Company Profile |

| Metso Outotec | 41 | Unlock Company Profile |

| Lixivia | 27 | Unlock Company Profile |

| Reed Industrial Minerals | 24 | Unlock Company Profile |

| Vale | 21 | Unlock Company Profile |

| Nippon Steel | 17 | Unlock Company Profile |

| POSCO Holdings | 16 | Unlock Company Profile |

| Graymont | 12 | Unlock Company Profile |

| MMC Norilsk Nickel | 11 | Unlock Company Profile |

| Jinchuan Group | 10 | Unlock Company Profile |

| Nippon Steel Nisshin | 5 | Unlock Company Profile |

Source: GlobalData Patent Analytics

Leaders in alkaline metal recycling include ENEOS Corporation and Lithium Australia. ENEOS Corporation has pioneered the recovery of high-purity metal salts from automotive lithium-ion batteries. In 2020, the company began operating bench-scale equipment installed in its Hitachi Works Technology Development Center for technological and system development for closed-loop recycling, in which resources are recovered from used automotive lithium-ion batteries and reused as raw materials for new automotive lithium-ion batteries. Furthermore, in 2021, the company started trials for nickel sulphate recovery and introduced a new process at its Tsuruga Plant based on this bench-scale equipment.

Lithium Australia, through wholly-owned Envirostream Australia, provides sustainable solutions for the disposal of end-of-life batteries as well as the recovery of critical energy metals that are used to manufacture new lithium-ion batteries.

To further understand the key themes and technologies disrupting the mining industry, access GlobalData’s latest thematic research report on Mining.

Data Insights

From

The gold standard of business intelligence.

Blending expert knowledge with cutting-edge technology, GlobalData’s unrivalled proprietary data will enable you to decode what’s happening in your market. You can make better informed decisions and gain a future-proof advantage over your competitors.