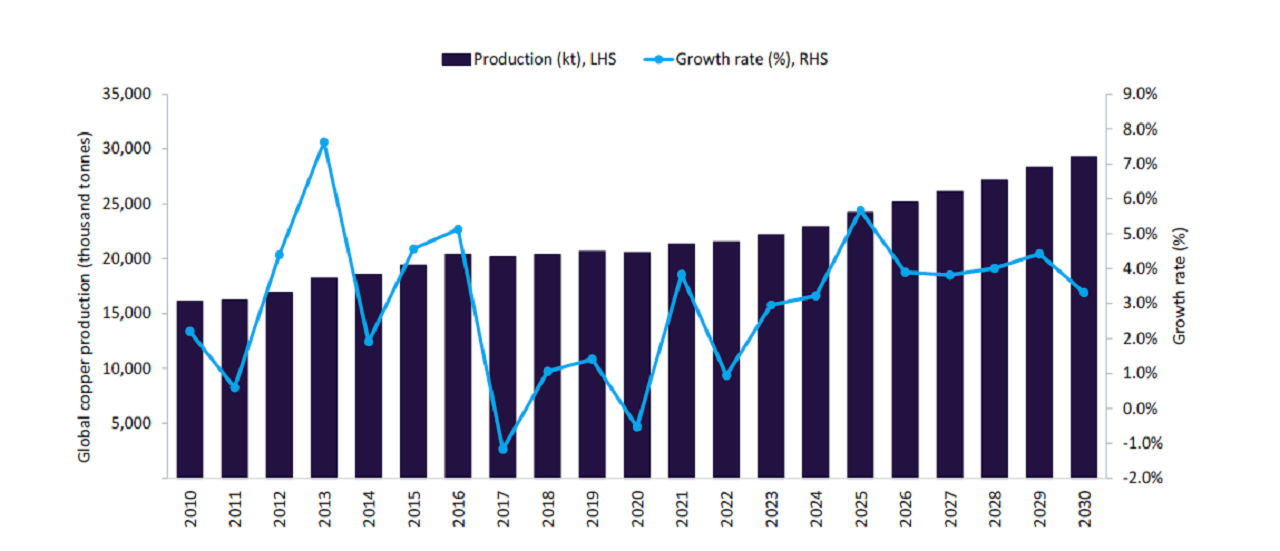

The global copper market is poised for significant growth in 2024, with production expected to reach a new high of 22.9 million tonnes, a 3.2% increase from the previous year. This growth is being driven by expansions at key mining operations in several countries, including Chile, the Democratic Republic of Congo (DRC), Russia, Zambia, and China.

Chile, a leading copper producer, is set to see a substantial increase in output, primarily due to the expansion of Teck Resources’ Quebrada Blanca mine. This mine is projected to produce an estimated 252.5 kilotonnes of copper in 2024, a remarkable 303% increase compared to 2023 (62.7 kilotonnes). This expansion underscores Chile’s continued dominance in the global copper market.

The DRC, another major copper producer, is also anticipated to experience growth. Its copper production is forecast to reach over 2.9 million tonnes in 2024, a 3.3% increase from the previous year. This growth is primarily attributed to the ongoing expansion of the Tenke Fungurume Mine (TFM) and Kamoa-Kakula, two of the world’s largest copper projects.

Russia, while ranking seventh in global copper production, is expected to see a significant increase in output. The country’s production is projected to rise to 965.4 kilotonnes in 2024, a 7.4% increase compared to 2023. This growth is primarily driven by the planned start of the Ak-Sug mine and the ongoing ramp-up of the Udokan project. The Udokan project, which began operations in 2023, is expected to reach its full capacity of 135 kilotonnes by the end of 2026.

China, the world’s largest copper consumer, is expected to contribute to the global supply increase through consistent strong output from its domestic mines. Zambia, another key producer, is also anticipated to benefit from ongoing expansions at its

Sentinel, Konkola, and Lubambe mines. Likewise, Indonesia and the US are also projected to increase their mined copper output by 5% and 4%, respectively, in 2024. These increases will further contribute to the global supply growth.

Looking ahead, leading data and analytics company GlobalData forecasts a compound annual growth rate (CAGR) of 4.2% for global copper production, reaching 29.3 million tonnes by 2030. This positive outlook reflects the growing demand for copper in various industries, including electric vehicles, renewable energy, and infrastructure development.

Global copper production to grow by 3.2% in 2024, supported by key expansions

Leading copper producer Chile is set to see a substantial increase in output.