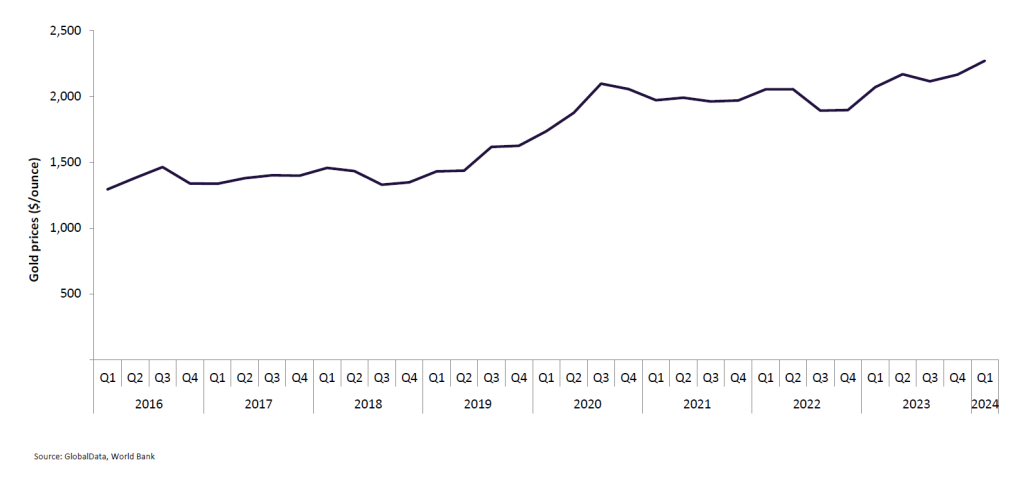

The future for gold is looking bright. The yellow metal achieved a record price of $2,450 per troy ounce in May, having rallied more than 40% since November 2022. While the effects will not be seen in 2024, higher prices are enticing Australian gold miners to raise production plans to 2030.

“A confluence of tailwinds has propelled gold prices higher this year in defiance of rising real interest rates and sustained US dollar strength,” explains Konstantinos Venetis, macroeconomist at GlobalData TS Lombard.

What is prompting record gold prices, and will they continue?

The list of factors causing the higher gold price is extensive. It includes an increase in central bank purchases, Chinese retail demand, geopolitical turbulence and expectations of cuts to interest rates as inflation tails off across the globe.

More importantly, will high gold prices continue into the coming years?

“A rise in safe-haven demand for gold amid the ongoing Israel–Hamas war and Red Sea shipping crisis are set to see prices remain elevated,” Vivek Aggarwal, senior commodities analyst at research company the Smart Cube told Mining Technology earlier this year.

According to the World Gold Council’s latest survey, 57% of respondents from central banks in advanced economies believe that gold’s share of global reserves will rise in the next five years, up from 38% in 2023. None of those surveyed expect gold reserves held by central banks to decline over the next 12 months, whereas 81% expect holdings to increase.

Several central bank officials said that they are looking to diversify their holdings away from the dollar due to the so-called US weaponisation of the currency against Russia. Furthermore, gold is considered a store of long-term value, which cannot be altered by banks or governments, making it politically dexterous.

Globally, central banks added more than 1,000 tonnes (t) of gold to their reserves in both 2022 and 2023. In 2023, the People’s Bank of China was the largest buyer, acquiring 225t of gold throughout the year, prompting John Read, chief market strategist at the World Gold Council, to remark that “Chinese speculators have really grabbed gold by the throat”.

Australia’s role as a gold producer

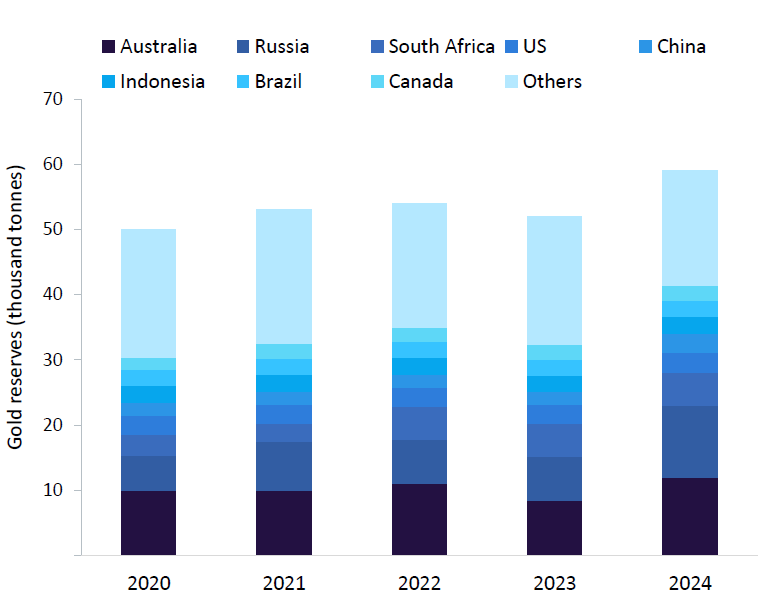

Australia holds 20.3% of the world’s gold reserves and is the third-largest gold producer behind Russia and China. In 2023, Australia produced 10.6 million ounces (moz), equivalent to 8.2% of global gold production that year.

Currently, jewellery makes up 47% of global gold demand. The pandemic negatively impacted this demand stream, but since economies have recovered, uptake has returned.

Crucially, the economic resurgence in China led to a 24% year-on-year increase in gold-based jewellery at the nation’s Spring Festival or Chinese New Year. As such, China is one of the largest importers of Australian refined and unrefined gold, accounting for around 41% of Australia’s total gold exports, according to GlobalData.

How are Australian gold miners reacting to rising prices?

It appears that strong demand (from both central banks and the world’s jewellers) and the consequent high gold prices are set to continue for the coming years. As the world’s third-largest gold producer, how has Australia reacted to the ferocious market?

Perhaps surprisingly, analysts predict Australia’s gold mine production will fall for the fourth consecutive year in 2024 to 10.3moz, a 2.6% decrease from 2023.

This is primarily due to a planned reduction in head grades at the country’s major mines including Newmont’s Cadia, Boddington, Tanami and Telfer mines, and Agrico Eagle’s Fosterville. Production from these five projects is set to fall from 1.79moz in 2023 to 1.7moz in 2024.

Operations in WA, where 60% of Australia’s gold is located, were also set back by heavy rainfall in March. However, production is expected to start increasing in 2025 with a modest increase of 0.7%, according to GlobalData. From 2025 to 2030, it will then continue to grow at a compound annual growth rate (CAGR) of 2%.

Australia’s gold mine expansions and new projects

Growth in Australia’s gold production will result from mine expansions and the commencement of several projects including Yandal, Trident, Hemi and McPhillamys, explains Siripurapu Gayathri, senior analyst at GlobalData Mining Intelligence.

Overall, there are 11 gold projects in development with a high chance of becoming operational by 2030.

The Yandal project, owned and operated by Northern Star, is expected to start producing up to 102,500oz a year from 2025.

De Grey Mining’s Hemi Gold Project in WA is targeting first gold production in the latter half of 2026. The open-pit mine has an estimated production capacity of 553,000oz per year, which would make it one of Australia’s top gold-producing mines.

Currently in the regulatory approvals and permitting stage, the Mcphillamys project in New South Wales could produce 200,000oz of gold per year from 2028. It has a medium chance of starting operations by 2030, according to GlobalData.

Miners are also reacting positively to the strong prices. Kelly Carter, chair of WA’s independent Gold Industry Group, told ABC News that “there is obviously significant investment in exploration at the moment”.

“Every producer at the moment will be looking at how they can best capitalise on the higher prices. This not only allows for the extension of mine life of existing mines in the state… and brownfields exploration, but I think more excitingly, it really does support that investment in greenfield exploration, which is obviously a significant part of the future of mining,” she added.

Speaking to Mining Technology, Sven Lunsche, VP of corporate affairs at Gold Fields, a South African miner with extensive operations in Australia, says that “of all the external factors impacting the performance of our company, the most critical is the gold price”.

“The performance of bullion has been beneficial to Gold Fields over the past few years – rising steadily since 2015, but accelerating markedly since 2019, and particularly over the past few months,” he adds, referencing the company’s most recent Integrated Annual Report.

The impact of M&A on the Australian gold industry

Significant M&A activity is also helping to bolster production in Australia’s gold mining industry.

According to Gayathri, M&A activity can boost growth and efficiency in Australia’s gold mining industry by consolidating resources and operations, resulting in more efficient production processes. Over time, this results in economies of scale, as long run costs of production fall, causing margins to improve. Recent examples of such M&A activity include Newmont’s acquisition of Newcrest for $16.8bn (A$25bn) in November 2023, creating a consolidated behemoth that is set to be the world’s largest gold mining company.

Around the time the deal was being concluded, Newmont claimed the combined group will have a portfolio comprising more than half the world’s tier-one assets with long-life operations, and ample exploration opportunity. It expects the consolidation to generate $500m in annual pre-tax synergies within the first two years, and that the project will continue to provide returns for decades. Illustrated by the case of Newmont, M&A activity is likely to lead to further increases in gold production in Australia up to 2030.

Other significant mergers include Red 5’s acquisition of Silver Lake Resources in February and De Grey Mining’s deal with Kalamazoo Resources in the same month. In April, Canadian-based Karora Resources expressed its interest in the Australian market by indicating that it could merge with Westgold Resources in the near future.

Although the impact will not be clear in 2024, Australian gold miners look set to capitalise on higher gold prices in the coming years. The combination of potent factors causing the price rally do not occur often, and miners are unlikely to miss out on such a golden opportunity.