The ageing population of many developed countries presents both opportunities and a challenge. The challenge comes from the extra burden on public spending that senior citizens require, on healthcare, on public pensions. The opportunity, however, comes through tapping into a demographic – loosely those aged 50 and over – that has savings to spend and free time to travel. Increasingly, investors are coming to realise just how lucrative the ‘silver economy’ can be.

“There is an ageing population, and in that ageing population people are living longer and [they are] healthier,” says Leon Diamond, executive officer at UK first lien residential mortgage lender LiveMore Capital. Previously, this segment of the population use to hoard their money in their house, or to give it to their children, but now they are spending much more on their lifestyles, he adds.

European Commission research shows that the silver economy is expected to contribute more than €5.7trn ($6.4trn) to Europe’s economy by 2025, while Euromonitor International previously forecasted that the global spending power of those aged 60 and above would reach $15trn by 2020.

This comes as the number of people in the world aged 65 years or over is set to increase by 120% over the next 30 years, according to data from the UN, from 703 million people in 2019 to 1.55 billion people in 2050. This growth will be led by the northern Africa and western Asia region (226%), followed by sub-Saharan Africa (218%). At the opposite end of the scale are Europe and North America (both 48%) and Australia and New Zealand (84%).

Based purely on numbers, the regions with the largest populations aged 65 or over will be eastern and south-eastern Asia, followed by central and southern Asia, then Europe and North America, according to the UN.

So, with their numbers rising so quickly, investors and investment promotion agencies (IPAs) are ensuring that they don't miss out on the opportunities presented by the silver economy across sectors such as health, banking, housing, leisure, tourism and telecommunications.

How well do you really know your competitors?

Access the most comprehensive Company Profiles on the market, powered by GlobalData. Save hours of research. Gain competitive edge.

Thank you!

Your download email will arrive shortly

Not ready to buy yet? Download a free sample

We are confident about the unique quality of our Company Profiles. However, we want you to make the most beneficial decision for your business, so we offer a free sample that you can download by submitting the below form

By GlobalDataAgeing opportunities in the finance industry

Mortgages for older people have emerged as a business opportunity for investors looking to back projects that deliver both healthy returns and societal impact. Diamond says that the gap for such products has been prevalent in the UK market for some time, with many older borrowers facing difficulties upon reaching the end of their mortgage term and requiring refinancing.

LiveMore Capital is looking to fill this gap by offering specialised mortgages and other financial products to customers aged between 50 and 92. Diamond says that mortgage lending and macro-investing is an interesting opportunity in the market, because it combines strong customer outcome with a strong institutional demand.

“On the institutional side, the average [fixed-rate] mortgage duration [before renewal] is about 3.8 years in the UK, while our average duration sits at about 11 years, which means we create long-term, fixed-paying assets that are considered low risk by the ratings agencies," he adds. "In turn, that is exactly what insurance companies and pension companies need on the fixed duration side, because of the low-interest environment. They need longer-duration assets and no shorter-duration ones on the fixed side.”

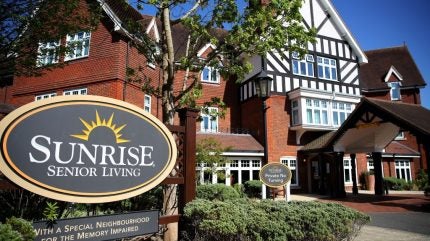

What's more, “supporting and realising the potential of a global ageing population presents a major role for the private sector”, according to UK bank Barclays. The organisation sees opportunities in 'silver villages' and age-friendly housing, social care and robots, longevity tech, lifelong learning, and age-friendly lifestyle and wellness services.

How IPAs can surf the silver wave

The silver economy is not just a business opportunity for institutional investors and the private sector, however. It has also risen on the radar of countries and their IPAs, with many looking to increase their investment attractiveness by presenting themselves as silver economy hubs.

As part of the Greek government's efforts to tap into Europe’s growing silver economy, Enterprise Greece and the Greek Health Tourism Council have signed a memorandum of understanding to jointly promote Greece as a destination for the EU’s €47bn-a-year medical tourism sector. The country is also looking to establish itself as a retirement destination for seniors.

“Developing the silver economy has significant potential to create jobs and attract foreign investment to Greece," states the website of Enterprise Greece. "The recently passed tax incentive for retirees to relocate to Greece is expected to bring €5bn annually into the economy and create 60,000 jobs."

Tapping into the silver market and engaging the over-65s as consumers offers big opportunities for locations to attract investment and create jobs across a large number of sectors, but it is also presents an opportunity for multinational corporations and investors to back profitable projects that embrace environmental, social, and governance criteria that will promote sustainable development and help to meet the targets of the UN’s Sustainable Development Goals.