Mining companies are particularly focused on addressing scope 1 and scope 2 greenhouse gas (GHG) emissions, with many having short-term targets to meet by 2030, as well as the objective of achieving net zero by 2050, or earlier.

While results have been mixed in the last few years, after analysing the performance of 101 mining companies for the last reported year, GlobalData, a leading analytics company, observed an overall 1.55% decrease in scope 1 and scope 2 emissions over the 2021-22 period.

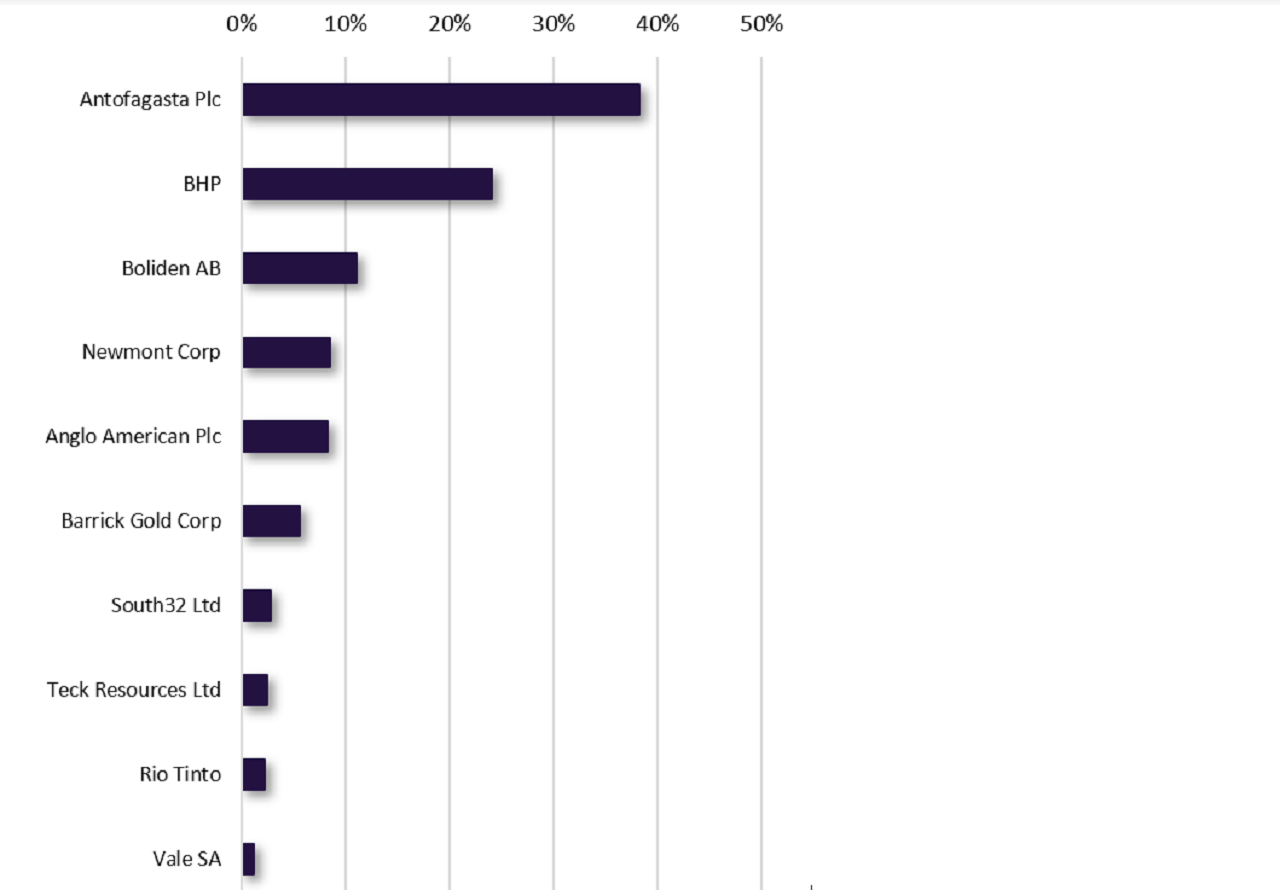

Amongst the best performers in 2022 were Antofagasta, which successfully reduced its operational emissions by 0.75 tonnes of carbon dioxide equivalent (tCO₂e) (a 38.2% GHG emissions reduction), primarily due to the shift of all its mining operations using power from 100% renewable energy in April 2022.

In doing so, the company achieved its 2025 emissions targets three years early.

BHP also reduced its total scope 1 and 2 emissions by 3.9tCO₂e (a 24.1% reduction), due primarily to reduced scope 2 emissions by switching 46% of its purchased power to renewables.

Another example is Anglo American, which increased its renewable share of electricity from 46% in 2021 to 52% in 2022, thereby helping to deliver an emissions cut of 1.2tCO₂e (an 8.3% reduction).

Furthermore, looking further back over the 2018-2022 period, for the 85 companies for whom data was available, there has been an overall 14.3% decrease in scope 1 and 2 emissions over the five years.

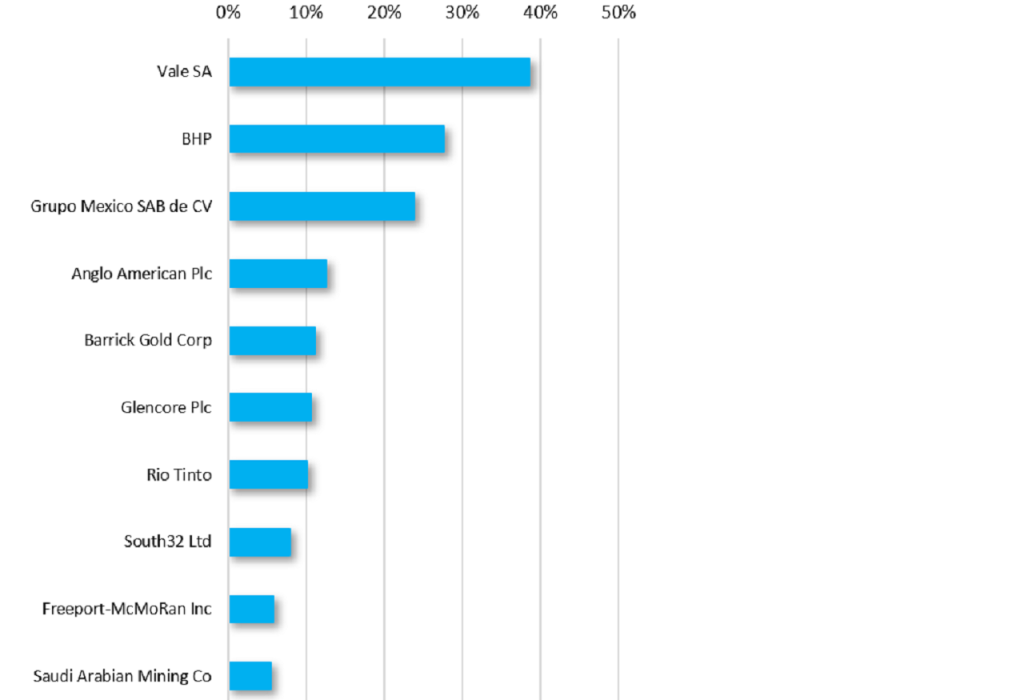

Out of the 85, 42% of miners managed to reduce their emissions, with the most significant cuts by Vale, Barrick Gold, and Rio Tinto, which achieved 38.6%, 11.1%, and 10.1% emissions reductions over the period, respectively.

Vale cut its emissions by 5.6tCO₂e over the 2018-2022 period mainly by increasingly sourcing its electricity from renewable sources, with this share rising to 98.6%.

For example, in Brazil, 99.95% of the electricity consumed in mining processes is renewable and supplied under concession contracts and power purchase agreements (PPAs).

Barrick Gold’s operational emissions reduction by 0.84mtCO₂e has been enabled by its investments in solar power in the US and Mali, and hydropower stations in DRC to reduce its energy supply from carbon-intensive sources.

Rio Tinto cut its emissions by 3.4tCO₂e mainly through switching to renewable power at Kennecott and Escondida over the period, although it also reduced the planned production from the Kitimat and Boyne aluminium smelters in 2022.

To date, achieving emissions reductions has primarily been through shifting power sources, mainly by consuming a higher proportion of renewable energy, but also through the increased use of natural gas in order to transition away from higher-emission fossil fuels such as coal, diesel, and heavy fuel oil.

This shift is facilitated through PPAs and, when grid power is unavailable where they operate, directly through on-site power plants.

It should be noted that, where companies have reported an increase in their scope 1 and 2 emissions, it may be coming about from an increase in output or through merger and acquisition activity.

For example, Harmony Gold’s acquisition of Mponeng Mine operations and related assets in 2021 was a contributing factor to its scope 1 and 2 emissions rising by 1.3tCO₂e between 2020 and 2021, but in terms of GHG emission intensity, this fell from 0.158tCO₂e tonnes/tonnes treated to 0.107tCO₂e treated between financial year 2020 and 2021.

Similarly, Zijin Mining’s emissions intensity fell from 1.79tCO₂e/RMB10,000 in 2021 to 1.55tCO₂e/RMB10,000 in 2022, although its scope 1 and 2 emissions rose from 7.26tCO₂e to 7,78tCO₂e between 2021 and 2022.