The mining industry continues to be a hotbed of patent innovation. Activity is driven by the need for greater productivity as well as safety. Accordingly, miners are using tunnelling machines in place of traditional drilling and blasting methods. Deployment of these potentially reduces disturbances to the geographic conditions thereby increasing safety. In the last three years alone, there have been over 3,000 patents filed and granted in the mining industry, according to GlobalData’s report on Innovation in mining: tunnel boring machines. Buy the report here.

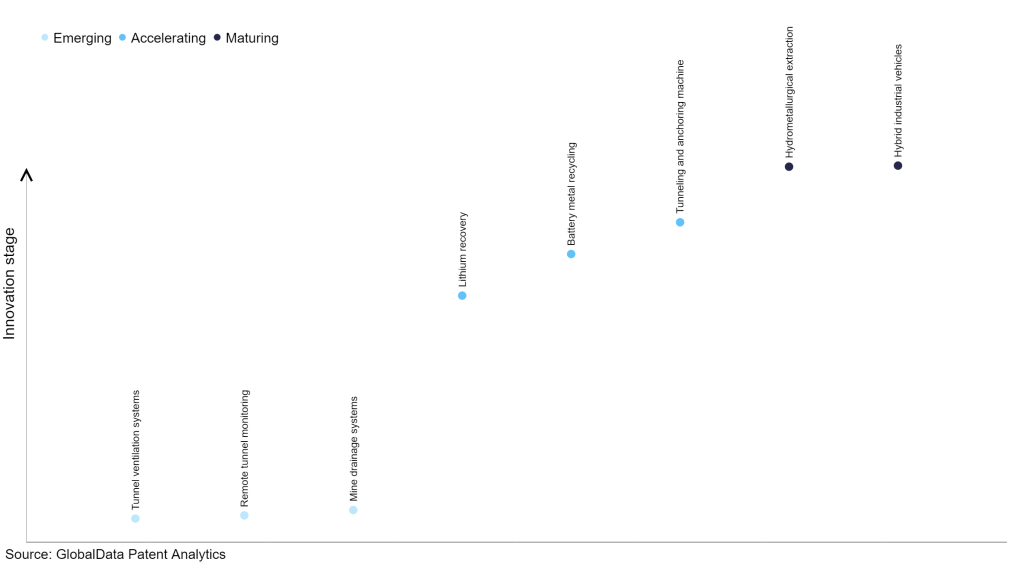

However, not all innovations are equal and nor do they follow a constant upward trend. Instead, their evolution takes the form of an S-shaped curve that reflects their typical lifecycle from early emergence to accelerating adoption, before finally stabilizing and reaching maturity.

Identifying where a particular innovation is on this journey, especially those that are in the emerging and accelerating stages, is essential for understanding their current level of adoption and the likely future trajectory and impact they will have.

45+ innovations will shape the mining industry

According to GlobalData’s Technology Foresights, which plots the S-curve for the mining industry using innovation intensity models built on over 81,000 patents, there are 45+ innovation areas that will shape the future of the industry.

Within the emerging innovation stage, tunnel ventilation systems, remote tunnel monitoring, and mine drainage systems are disruptive technologies that are in the early stages of application and should be tracked closely. Lithium recovery, battery metal recycling and tunneling, and anchoring machine are some of the accelerating innovation areas, where adoption has been steadily increasing. Among maturing innovation areas are hydrometallurgical extraction and hybrid industrial vehicles, which are now well established in the industry.

Innovation S-curve for the mining industry

Tunnel boring machines is a key innovation area in mining

Tunnel boring machines (TBMs) are used instead of drilling and blasting through rock and conventional mechanical excavation in soft ground. TBMs used in mining projects differ from those used in typical civil engineering applications. TBMs have been used for a variety of purposes as part of new and expanding mining projects, including new access, ore and waste conveyance, drainage, exploration, and water diversion.

Some of the benefits of using TBMs include higher and more sustainable progress rates in generally good quality hard rock conditions. Lower ventilation is required, allowing for the construction of smaller tunnels and improved health conditions for workers who are not exposed to blast smoke and fumes. They also produce a smooth tunnel wall, which lowers the final lining cost. TBMs significantly reduce the total excavation time of long tunnels when compared to conventional excavation methods.

GlobalData’s analysis also uncovers the companies at the forefront of each innovation area and assesses the potential reach and impact of their patenting activity across different applications and geographies. According to GlobalData, there are 140+ companies, spanning technology vendors, established mining companies, and up-and-coming start-ups engaged in the development and application of tunnel boring machines.

Key players in tunnel boring machines – a disruptive innovation in the mining industry

‘Application diversity’ measures the number of applications identified for each patent. It broadly splits companies into either ‘niche’ or ‘diversified’ innovators.

‘Geographic reach’ refers to the number of countries each patent is registered in. It reflects the breadth of geographic application intended, ranging from ‘global’ to ‘local’.

Patent volumes related to tunnel boring machines

| Company | Total patents (2021 - 2023) | Premium intelligence on the world's largest companies |

| Komatsu | 226 | Unlock Company Profile |

| Sandvik | 198 | Unlock Company Profile |

| China Railway Group | 39 | Unlock Company Profile |

| Atlas Copco | 31 | Unlock Company Profile |

| Caterpillar | 30 | Unlock Company Profile |

| Herrenknecht | 23 | Unlock Company Profile |

| Epiroc | 18 | Unlock Company Profile |

| State-owned Assets Supervision and Administration Commission of the State Council | 17 | Unlock Company Profile |

| Sinoma International Engineering | 9 | Unlock Company Profile |

| Bouygues | 8 | Unlock Company Profile |

| Sanyhe International | 7 | Unlock Company Profile |

| Shanxi Tiandi Coal Mining Machinery | 7 | Unlock Company Profile |

| China Railway First Group | 6 | Unlock Company Profile |

| Taisei | 6 | Unlock Company Profile |

| HyperSciences | 5 | Unlock Company Profile |

| Shijiazhuang Zhongmei Coal Mine Equipment Manufacture | 5 | Unlock Company Profile |

| Shanghai Tunnel Engineering | 4 | Unlock Company Profile |

| China State Construction Engineering | 4 | Unlock Company Profile |

| Xiangyang Zhongliang Engineering Machinery | 4 | Unlock Company Profile |

| China Communications Construction Group | 4 | Unlock Company Profile |

| Hongrun | 3 | Unlock Company Profile |

| Obayashi | 3 | Unlock Company Profile |

| Shanghai Construction Group | 3 | Unlock Company Profile |

| XCMG Construction Machinery | 3 | Unlock Company Profile |

| ChampionX | 3 | Unlock Company Profile |

| China Railway First Bureau Group Macau Branch | 3 | Unlock Company Profile |

| Kajima | 3 | Unlock Company Profile |

| Inner Mongolia Shanghaimiao Mining Industry | 2 | Unlock Company Profile |

| Shandong Hi-Speed Group | 2 | Unlock Company Profile |

| Tian Di Science & Technology | 2 | Unlock Company Profile |

| Zoomlion Heavy Industry Science and Technology | 2 | Unlock Company Profile |

| Zhejiang Communications Construction Group | 2 | Unlock Company Profile |

| Lubelska Polt | 1 | Unlock Company Profile |

| Shanghai Chuangli Group | 1 | Unlock Company Profile |

| Poly Changda Engineering | 1 | Unlock Company Profile |

| The 5th Construction of China 15th | 1 | Unlock Company Profile |

| China Railway 16th Bureau Group Road & Bridge Engineering | 1 | Unlock Company Profile |

| China Railway Engineering Group | 1 | Unlock Company Profile |

| China Railway 14Th Bureau Group Shield Engineering | 1 | Unlock Company Profile |

| China Railway 24Th Bureau Group Anhui Engineering | 1 | Unlock Company Profile |

| Corum Group | 1 | Unlock Company Profile |

| 4Th Engineering Ctce Group | 1 | Unlock Company Profile |

| China Railway 14 Bureau Group | 1 | Unlock Company Profile |

| Sinohydro Bureau 10 | 1 | Unlock Company Profile |

| Sany Heavy Equipment Investments | 1 | Unlock Company Profile |

| China Railway 18th Bureau Group Tunnel Engineering | 1 | Unlock Company Profile |

| Yunnan Highway and Bridge | 1 | Unlock Company Profile |

| China Railway Construction | 1 | Unlock Company Profile |

| Jinan Rail Transit Group | 1 | Unlock Company Profile |

| Zhengzhou Rail Transit | 1 | Unlock Company Profile |

Source: GlobalData Patent Analytics

Komatsu and Sandvik are among the leading patent filers in in tunnel machines. Amongst the innovations, Komatsu has partnered with Codelco to test a new tunnel excavation method using Komatsu's newly developed mining TBM. The mining TBM is equipped with new technologies that allow it to adapt to small curves, reverse direction, and pass-through intersections in hard rock tunnel excavation. This new technology increases equipment flexibility and allows tunnels to be excavated in accordance with the more unique designs of each mine. The trial, which will begin in 2024 at Codelco's Chuquicamata mine in Chile, aims to accelerate the potential implementation of the new technology.

Similarly, Sandvik's tunnelling jumbos provide high productivity and dependability using face drilling, mechanized longhole drilling and bolting. The company’s tunnelling machines include DT1232i, DT923i (fully automated), DT1231, DT1131 (three-boom, electro-hydraulic), and DT912D (self-contained, air-mist flushing, diesel-hydraulic high reach single boom).

Some other key patent filers in tunnel boring machines include China Railway Group, Herrenknecht and Atlas Copco.

In terms of application diversity, Hongrun leads the pack, while Alleima and Zhejiang Communications Construction Group stood in the second and third positions, respectively. By means of geographic reach, XCMG Construction Machinery held the top position, followed by China Railway Construction and China Railway First Group.

To further understand the key themes and technologies disrupting the mining industry, access GlobalData’s latest thematic research report on Mining.

Data Insights

From

The gold standard of business intelligence.

Blending expert knowledge with cutting-edge technology, GlobalData’s unrivalled proprietary data will enable you to decode what’s happening in your market. You can make better informed decisions and gain a future-proof advantage over your competitors.