African countries must allow the mining of minerals to happen if they are to experience significant economic growth, but they have to find a way of minimising the damage to the natural environment and to ensure that profits help local communities.

Africa is a massive region, covering three times as much ground as Europe, across 54 countries, and with a total population of 1.4 billion, which is expected to reach 2.5 billion by the end of 2050. However, it is also the world’s poorest region; in 2021, sub-Saharan Africa had an annual income of $1,600 per head compared with $8,300 in Latin America and the Caribbean and $13,000 in East Asia and the Pacific. In 2022, the UK had a bigger economy than the whole of Africa combined; $3.48tn versus $2.96tn.

In 2021, it is estimated that 490 million Africans lived under the poverty line of $1.90 purchasing power parity equivalent per day, 37 million people more than what was projected without the Covid-19 pandemic.

Africa requires economic growth and lots of it if its to lift its people out of poverty. Economists estimate that a low-income country must grow at more than 6% a year over many years to start to see significant poverty reduction. The International Monetary Fund estimates that the sub-Saharan economy expanded by only 3.6% in 2022 and forecasts that it will grow by only 3.7% in 2023. That is just not good enough.

Following China’s example

The mining industry provides an obvious source of wealth for Africa, and recent developments in China could prove to be something of a blueprint for African countries. Since China began to open up and reform its economy in 1978, GDP growth has averaged over 9% a year and more than 800 million people been lifted out of poverty, exactly the kind of change that Africa needs.

Africa has some of the world’s biggest deposits of minerals, which are not only valuable in their own right, but could prove essential to the energy transition. Nickel, cobalt, graphite, lithium, and rare earth elements are all in high supply; for instance, Africa accounts for around 80% of the world’s total supply of platinum, 50% of manganese and two-thirds of cobalt. The continent also holds 40% of the world’s gold reserves and up to 90% of its chromium.

Countries like South Africa, Madagascar, Malawi, Kenya, Namibia, Mozambique, Tanzania, Zambia and Burundi enjoy significant quantities of important rare earths, including neodymium, praseodymium and dysprosium. Ghana is the continent’s largest producer of gold, followed by South Africa and Mali. The Democratic Republic of the Congo (DRC) is Africa’s largest industrial diamond producer, followed by Botswana and South Africa.

Yet there is a disparity in the continent’s mining industries. Africa is endowed with about 30% of the planet’s mineral reserves, but in 2019, it only produced around 5.5% of the world’s minerals and its global share was valued at $406bn that year, according to the World Mining Congress.

African countries must exploit their mineral wealth. The DRC, for example, has a total mineral wealth estimated in the tens of trillions of dollars but the average Congolese person only earns $700 a year. Guinea — a small West African country with only 13.5 million inhabitants — enjoys massive and high-quality bauxite reserves: some 7.4bn metric tons, 23% of the world’s total. Its supply is vital to global aluminium production and for the energy transition to go ahead but the average Guinean only earns $1,440 a year.

By 2040, at least 30 times as much lithium, nickel and other key minerals may be required by the electric car and battery storage industries to meet global climate targets, according to the International Energy Agency (IEA). Similarly, the rise of low-carbon power generation to meet climate goals means a tripling of mineral demand from this sector by 2040. In May 2021, the IEA declared that the world is undergoing a massive industrial conversion that marks a “shift from a fuel-intensive to a material-intensive energy system”.

Minimising environmental impacts

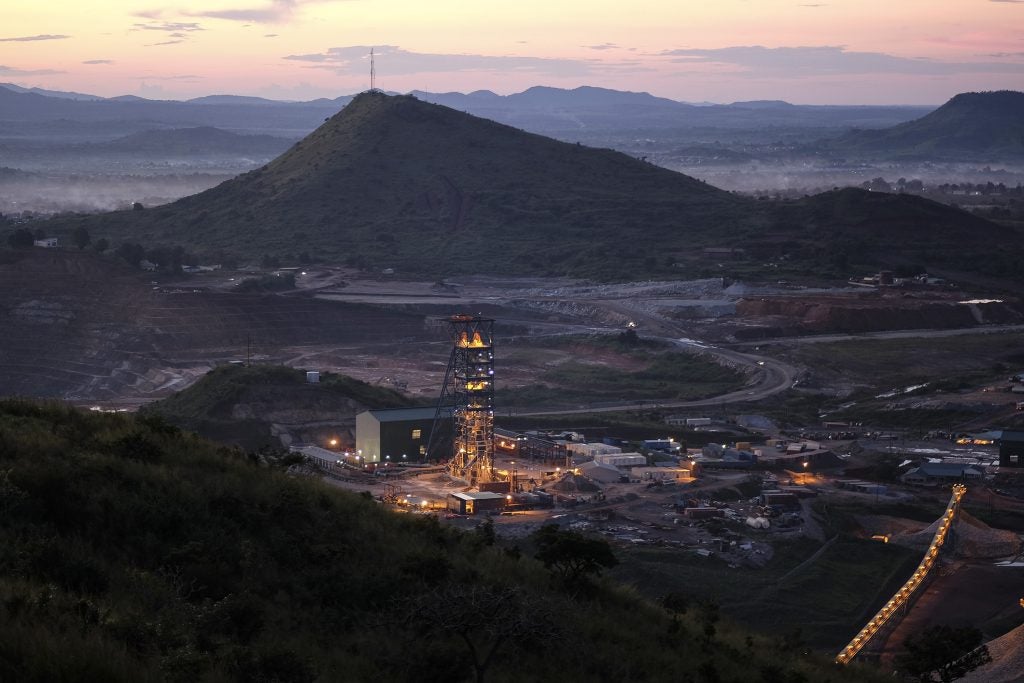

The potential for mineral transformation creates an enormous economic opportunity for Africa. However, increased mining in the region throws up two major issues that do need addressing — natural habitat loss and inequality. In the end, both these problems are a question of governance.

Further mining will inevitably result in greater deforestation. It is not only the new mining sites that will destroy forests but also all the associated roads and new settlements. The region is already seeing massive destruction of its natural habitat. In 2020, the continent had 636.64m hectares of forest, 16% of the world’s total. But it witnessed the greatest annual rate of net forest loss of any region in the world — at 3.94m ha — between 2010 and 2020.

There is also a big question mark around whether the local communities really gain much economically from all the new mining activity. This is not a challenge unique to Africa; in many cases, it is the elites in wealthy capital cities that enjoy most of the financial rewards from mining.

In Africa specifically, foreign miners headquartered in Europe, North America and China eager to expand their portfolios adds another dimension to this issue, and another type of actor who could take revenue away from local workers.

The need for better governance in Africa

If African countries had better governance, increased mining would not be such a controversial issue. Africa requires ‘responsible mining’, defined as mining that involves and respects all stakeholders, minimises and takes account of its environmental impact and prioritises a fair division of economic and financial benefits. But the crux of the problem is that for responsible mining to really work, a country needs good governance in the first place and most African countries just do not have it.

Transparency International’s Corruption Perceptions Index ranks 180 countries by their perceived levels of public sector corruption on a scale of zero (highly corrupt) to 100 (very clean). In 2021, the sub-Saharan Africa average was 33 — the lowest in the world — and 44 African countries ranked below 50.

Improving governance in Africa is not an easy thing to do. Many African countries are fragile democracies at best, and in a number of cases they are outright dictatorships. Whenever possible Western governments need to bear pressure on African governments to take steps to become better, more sophisticated democracies, or at least implement aspects of governance such as labour rights and environmental protection.

That in itself is not a straightforward task for many Western governments to do without being accused of colonial-style interference, and reflects a paradox at the heart of much of African mining: more effective mining could deliver great economic benefits and a sense of autonomy for local groups, but should this mining come from foreign companies and over-reaching Western powers, there is a risk of it all being for nought.

Africa stands at an economic threshold. The energy transition – through increased mining – could improve the region’s wealth immeasurably. It is an economic opportunity that must be seized. However, it falls on the continent’s next generation to ensure that their governments are more accountable and that a lot more mining can be balanced at least to some extent with conservation of the natural environment. They must also ensure that the economic benefits of more mining are more evenly spread.