Canadian mining company Great Panther Silver has signed a scheme implementation deed to acquire all of the issued ordinary shares of Australia-based gold producer Beadell Resources through a scheme of arrangement.

The transaction is set to result in the formation of a new growth-oriented precious metals producer, with a diverse asset portfolio, including three producing mines, an advanced stage project, and significant exploration potential.

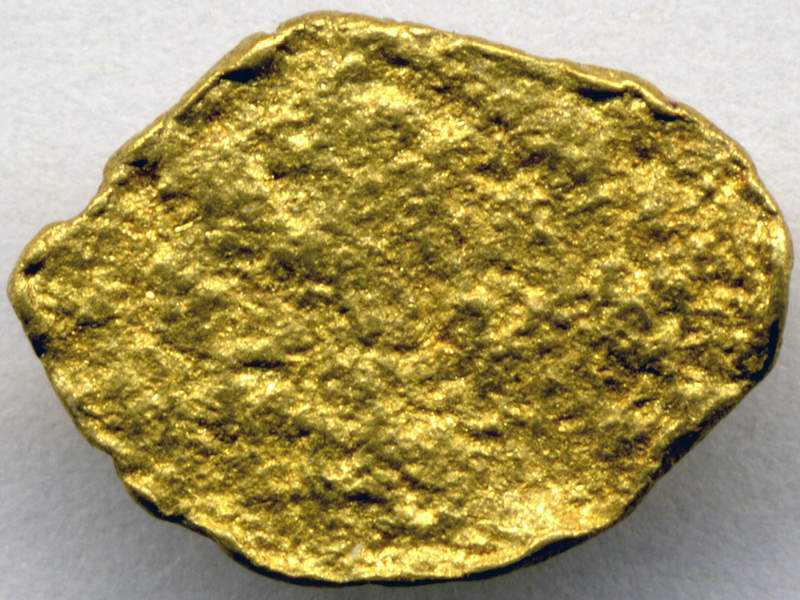

Beadell holds a 100% interest in the Tucano gold mine located in Amapá State, northern Brazil, within a 2,500km² highly prospective land package.

The mine offers resource growth opportunities with multiple in-mine lease discoveries.

Pursuant to the scheme, Great Panther will issue 0.0619 common shares to Beadell shareholders for each ordinary share held by them. This will lead to the issuance of around 103.6 million Great Panther shares.

Based on the exchange ratio, which implies a consideration of A$0.0863 per share, Beadell has an equity value of A$144m ($105m).

Once the transaction is closed, existing Beadell and Great Panther shareholders will respectively hold approximately 38% and 62% of the combined company.

Great Panther Silver president and CEO James Bannantine said: “Great Panther brings the capital to deliver on Tucano’s substantial near and long-term resource growth potential and to continue mine optimisation initiatives.

“The combination of assets, capital and management provides a unique opportunity to unlock a significant re-rating potential for the benefit of both existing shareholders and Beadell’s shareholders who will gain a meaningful interest in Great Panther.”

The combined entity will have a diversified portfolio, which includes three mining operations in Mexico and Brazil, as well as the Coricancha project in Peru.

Beadell Resources CEO and managing director Dr Nicole Adshead-Bell said: “By undertaking this transaction, Beadell shareholders will benefit from Great Panther’s strong balance sheet, steady cash flow, experienced management team and improved market liquidity via Great Panther’s TSX and NYSE American listings.

“The combined company will pool resources to expedite the execution of Tucano’s ongoing operational turnaround.”

In addition, the combined company is expected to have attributable proven and probable reserves of around 1.5 million ounces of gold and a cash balance of $74m to support complementary assets.

The transaction is subject to customary conditions, including regulatory, shareholder, third-party and other creditor approval and consent.