The Savannah project is a nickel-copper-cobalt (Ni-Cu-Co) mine located in Western Australia’s East Kimberley region. The site is fully owned by the Australian development and exploration firm Panoramic Resources.

The mine was first commissioned in late 2004 and produced 1.22Mt of concentrate containing 94,600t of nickel, 53,000t of copper and 5,000t of cobalt over a 12-year period, before being kept on care and maintenance in May 2016.

The company commenced a scoping study in July 2016 to evaluate the viability of recommencing production at the project using the remaining ore reserve (Savannah above 900F) and by developing the Savannah North deposit.

The results of the study were announced in January 2016, and indicated a positive economic outcome.

The decision to restart operations at the Savannah mine was made in July 2018, following the delivery of an updated feasibility study in October 2017.The first shipment of the concentrate is expected to take place in March 2019.

The mine is estimated to produce 10,800t of nickel, 6,100t of copper and 800t of cobalt per annum. It is anticipated to have a mine life of approximately 8.3 years.

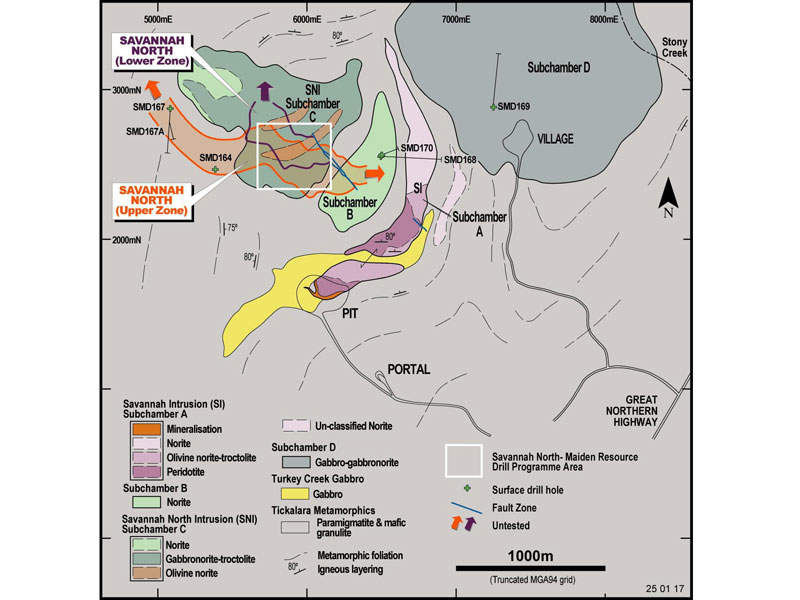

Geology and mineralisation at Savannah North

The Savannah North deposit is located towards the north of Savannah mine and contains Ni-Cu-Co sulphide resources.

The mineralisation at the deposit is similar to the main mine and is characterised by pyrrhotite-dominant sulphides with sub-ordinate pentlandite and chalcopyrite.

It features broad zones of Ni-Cu-Co-rich massive sulphide mineralisation occurring beneath its surface.

The deposit is mainly composed of two discrete zones of mineralisation, namely the upper and the lower zones.

While the upper zone is dominated by massive sulphide mineralisation, which is in contact with the underlying Tickalara Metamorphics, the lower zone contains high-grade, off-contact massive sulphide mineralisation.

Ni-Cu-Co reserves at Savannah mine

As of October 2017, the total mineral resources at Savannah mine are estimated to be 13.2Mt, grading 1.65% Ni, 0.75% Cu and 0.11% Co, and containing 218,300t of nickel, 99,100t of copper and 14,900t of cobalt.

The total ore reserve at the mine is estimated to be 7.65Mt grading 1.42% Ni, 0.68% Cu and 0.10% Co, containing 108,700t of nickel, 51,700t of copper, and 7,300t of cobalt.

Savannah North’s maiden ore reserve is estimated to be roughly 6.65Mt grading 1.42% Ni, 0.61% Cu and 0.10% Co, containing 94,500t of nickel, 40,900t of copper and 6,700t of cobalt.

Savannah above 900F’s ore reserve has been approximated to be 1.56Mt grading 1.16% Ni, 0.74% Cu and 0.06% Co, containing 18,000t of nickel, 11,500t of copper and 900t of cobalt.

Mining and processing at the nickel-copper-cobalt mine

A conventional long-hole open stopping (LHOS) method is being implemented to mine the Savannah North deposit, at mining rates between 0.7Mt and 0.9Mt of ore a year.

The ore is processed in the existing processing plant at the Savannah mine, which is readily equipped with conventional crushing, grinding, flotation and concentrate handling equipment.

The plant produces bulk Ni-Cu-Co concentrate targeting a concentrate grade of 8% nickel with an average processing capacity of 1Mt a year.

Processing recoveries at the plant over the total LoM are expected to average 87% Ni, 96% Cu and 90% Co based on the past performance of the plant.

Infrastructure at Panoramic’s sulphide-rich mine

The mine has sufficient infrastructure to facilitate the recommencement of operations.

Some of the existing infrastructure includes the 1Mt/y processing plant, a paste-fill plant, a fully equipped laboratory, electrical and pumping networks, underground decline and a workshop.

The site also contains administration facilities, a 215-person camp and a tailings storage facility.

Key infrastructure upgrades required will include the development of access to the North deposit from the existing mine through a decline, development of Savannah North FAR and tailing storage facility-1 (TSF1), a tailings dam lift and a new tailing storage facility.

Financing for the mine recommencement project

The recommencement of the mine is estimated to require a pre-production capital of approximately A$20m ($14.8m), including A$8.4m ($6.2m) for capitalised operating costs, A$7.3m ($5.4m) for plant and equipment refurbishment, and A$2m ($1.4m) for initial store inventory.

Offtake agreements

Panoramic will continue to sell the bulk Ni-Cu-Co produced through the recommencement operation to the existing offtake partner Sino / Jinchuan until the original agreement expires in March 2020.

The owner has contacted a number of potential offtake parties for the concentrate purchase after 2020, including Sino / Jinchuan, and received indicative terms for bulk concentrate sales from a number of interested parties.

Panoramic entered a new four-year concentrate sales agreement with Jinchuan and Sino Nickel in June 2018, to replace the current agreement due to expire on 31 March 2020.

Transport and handling

The concentrate produced at the plant will be transported to Wyndham Port by trucks and then shipped to Jinchuan’s smelter / refinery in China’s Gansu province.

Contractors involved

Some of the consultants involved in Savannah’s feasibility study include Beck Engineering, Cube Consulting, Ozvent Consulting and Coffey Mining.