The Waterberg mine is located in the Bushveld Igneous complex, approximately 85km north of Mokopane town in Limpopo Province, South Africa.

The project is jointly owned by Platinum Group (37.5%), Japan Oil, Gas and Metals National Corporation (JOGMEC, 21.95%), Impala Platinum Holdings (Implats) (15%) and Mnombo Wethu Consultants (26%), while Platinum Group is the operator.

An independent pre-feasibility study (PFS) of the project was completed in October 2016, while the preliminary economic assessment was released in February 2014. The mining right application for the Waterberg project was filed in September 2018.

Construction on the project is expected to be completed in approximately 3.5 years, subject to project approval, with first production expected in 2022.

With an estimated annual production of 744,000oz of 4E (platinum, palladium, rhodium and gold) and 23Mlb of nickel and copper, the mine is expected to become one of the world’s biggest platinum group metal (PGM) mines. The estimated life of the mine is 18 years.

The estimated capital required until achievement of full production is $1.06bn, which includes $67m in contingencies. The project is anticipated to create 3,361 new highly trained jobs in the region.

Waterberg mine geology and mineralisation

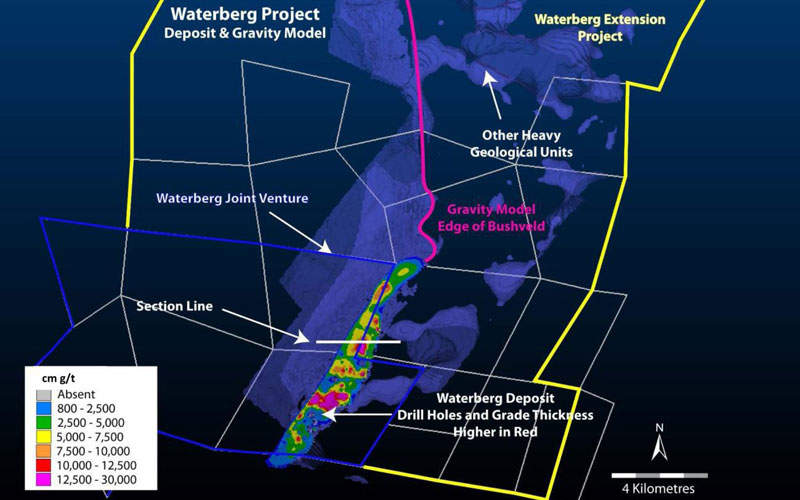

The Waterberg mine is situated close to the Northern Limb of the Bushveld complex in the Kaapvaal Craton, which is famous for mafic/ultramafic layered intrusions. Regarded as the biggest known source for PGM metals, the complex hosts several layers of rich PGM metals, chromium and vanadium.

Geology at the project site mainly comprises Bushveld main zone gabbros, gabbronorites, norites, pyroxenites and anorthositic rock types.

Mineralisation is hosted in the critical zone of the Bushveld complex and is characterised by fine-scale cyclic layers of cumulus chromite hosted in pyroxenites, olivine-rich rocks and anorthosites.

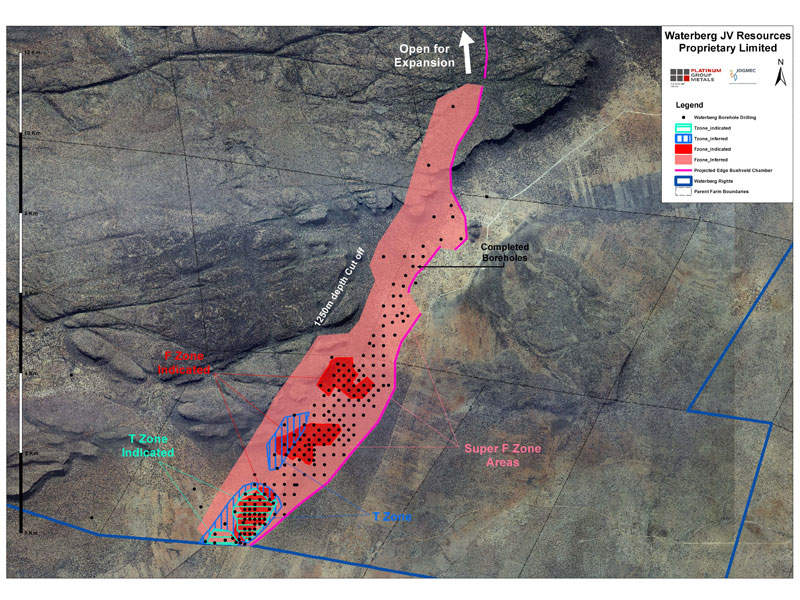

Waterberg project reserves

As of October 2016, the Waterberg mine project is estimated to hold 102.7 million tonnes (Mt) of probable mineral reserves grading 2.5g/t 4E, containing 12.32 million ounces (Moz) of platinum, palladium, rhodium and gold (4E).

The indicated mineral resources are estimated to be 218.265Mt, while inferred resources are estimated to be 97.212Mt grading 2.5g/t 4E.

Palladium accounts for roughly 60% of the total mineral reserves, with an estimated annual production of 472,000oz.

Mining and processing at the platinum plant

Three mining methods, including blind longitudinal retreat, transverse sub-level open stoping and longitudinal sub-level open stoping, have been shortlisted to conduct mining at the project. The depth and the thickness of the mine will enable the implementation of low-cost mechanised underground mining methods.

Three decline ramp clusters will be constructed to provide access to the mine. The ramps are considered to be more economical when compared to vertical shafts and will be developed over two to three years.

The mining and development fleet will include 400 trackless machines such as drill rigs, loaders, dump trucks and so on. New mechanised trackless mobile equipment will also be used for mining and transferring the ore to the large conveyors that carry the ore to the processing plant.

A conventional floatation treatment without any re-grinding is being planned to process the ore. The processing plant, with a steady state capacity of 7.2 million tonnes per annum (Mtpa), is planned for construction in two phases, with each phase comprising a 3.6Mtpa concentrator module. Phase one concentrator module and associated infrastructure will be constructed during the first three years, while the second module will be completed later.

Each module comprises a three-stage crushing circuit, which feeds crushed material to the primary milling circuit consisting of a closed-circuit ball mill. The milling circuit will be followed by a primary rougher flotation tank.

The plant will process the ore to produce a saleable concentrate, at a 4E grade of no less than 80g/t.

Infrastructure

The Waterberg mine project site can be accessed through an existing 32km unpaved road, which will be surfaced for better access. Water for the mining activities will be supplied through a combination of sewage effluent and groundwater.

Power will be supplied by new 132kV overhead lines from the Eskom Burotho 400/132kV main transmission substation. The proposed electricity supply infrastructure includes two 77km-long 132kV overhead lines from Burotho transmission substation, two 132kV line feeder bays and a 132kV switching substation and step-down substation on the project site.

A conventional/thickened residue disposal facility will also be built at the site.

Contractors involved

The PFS was compiled by South African engineering firm WorleyParsons, while the technical report was prepared by CJM Consulting.

Stantec was contracted to perform underground mining engineering and design as well as reserve estimation for the project in November 2017.

DRA Projects was engaged to lead metallurgical test work and infrastructure design development in November 2017.

The contract to design the bulk electricity supply project was awarded to Eskom.