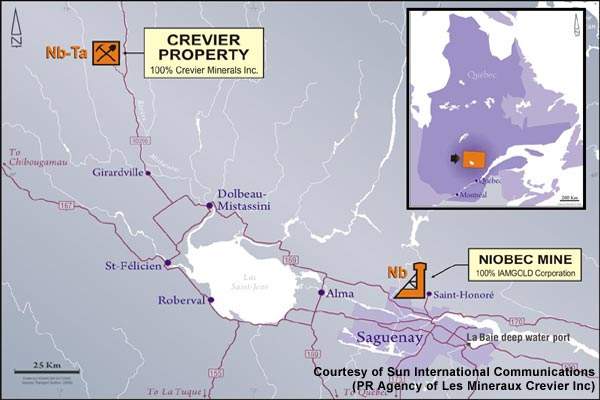

The Anita project is a priority niobium and tantalum mining project located in the Lac-Saint-Jean region of Quebec, Canada. The mine is 100% owned by Les Mineraux Crevier (MCI). Canadian mining company MDN owns 72.5% of MCI and IAMGOLD owns the remaining stake.

The project was announced in April 2009. Since then, MDN has invested $2.4m and has committed an additional $13.5m to fund a development and feasibility study.

Preliminary ore flow sheet designs for the open pit, flotation plant, lixiviation processes and other mining infrastructure were completed by the end of October 2009. Metallurgy testing commenced during this period.

Estimates of the project’s operating costs, capital expenditures, processing operation costs, tailing treatment costs and other overhead costs were also made.

A scoping study for the mine was completed and a feasibility study was started in January 2010. The feasibility study is being conducted with a proposed production of 4,000tpd.

The mine will begin commercial production in 2012-13. Depending on the results of the study, construction of the project is scheduled to begin in 2012. The potential life of the mine as an open pit operation is 18 years.

In June 2011, MDN acquired 98km2 southeast of the mine. MDN is currently searching for a suitable partner for developing the next stages of the mine. It has appointed Price WaterhouseCoopers as the financial advisor for finding a strategic partner for the project.

Background of the niobium and tantalum mining project

The deposit was originally discovered in 1975 by SOQUEM. Between 1975 and 1986, SOQUEM carried out several phases of exploration, during which six drilling programmes were conducted, intersecting 72 holes.

When SOQUEM was privatised, the mine was transferred to Cambior. Operations at the mine were stopped until 2002, after which Cambior carried out drilling campaigns to a depth of 6,000m, totalling 33 holes.

Camboir was sold to IAMGOLD in 2006. In April 2008, IAMGOLD sold the property to MCI.

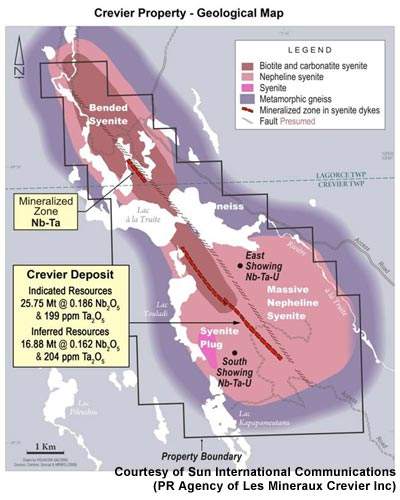

Reserves at Les Mineraux Crevier’s Lac-Saint-Jean-based mine

The mine contains approximately 25.4mt of measured and indicated reserves, grading at 0.196% of niobium oxide and 234ppm of tantalum oxide.

An additional 15.42mt of inferred resources are also estimated. The reserves stated at an assumed cut-off grade of 1,000g/t Nb.

When operational, the mine is expected to produce 1.2 million kilograms of niobium oxide and 115,000kg of tantalum oxide / K-salt a year.

Drilling at the Canadian mine

The mine underwent a diamond drilling programme ending October 2009. Completed to a depth of 5,500m, drilling was undertaken to bring part of the indicated resources from the probable category to the proven category.

The rest of the drilling will explore and establish the intersections with high-grade value to the north of the main ore body. It will also include intercepted drill holes that were intersected when the mine was discovered.

Contractors involved in the Anita project

The contract to perform the project’s scoping study was awarded to Canada-based engineering firm Met-Chem.

Analysis and development of the project will be undertaken by a group of companies including SGS Geostat for resource qualification, Hatch and COREM for metallurgical studies and ore treatment process evaluation, Golder for providing data baselines regarding the environmental impact and Roche for conducting preliminary assessment of the mining infrastructures.

UK-based metal consulting firm Roskill Consulting Group has been awarded the contract for conducting the market study on the niobium and tantalum.

The contract includes estimating demand, pricing and consumption trends of the metals.

It will reveal the market and pricing prospects of the metal when production begins in 2012-13.

Other contracts for definition drilling, assay results, topographical maps production and on-site project coordination have been awarded to Forages Mario Rouillier, ACTLAB, MIR Teledetection and IOS Services Geoscientifiques, respectively.

Agreement with IAMGOLD

MCI entered into a preliminary agreement with IAMGOLD to sell the entire niobium oxide production. IAMGOLD will buy the mine production throughout the life of the mine.