The Arizona 1 uranium project is one of four mines under full or partial development in the Arizona Strip. The Arizona Strip is owned and operated by Denison Mines and is located in the town of Fredonia, on the Arizona–Utah state line and spreads 13,000m².

Energy Fuels was the original owner of the Arizona 1 uranium deposit. In 1992, Energy Fuels was acquired by the Concord Group. After declaring bankruptcy, the Concord Group was acquired by the International Uranium Corporation (IUC) in 1997. In December 2006, IUC and Denison Mines merged forming Denison Mines Corp.

Mining activities at Arizona 1 began in 1990. They were suspended in 1992 at a shaft depth of 1,254ft. The target depth was 1,600ft to reach the ore body at the deposit.

Before 1992, Energy Fuels dug 253 drill holes, amounting to 67,600ft of drill footage. Underground drilling was done in 236 holes amounting to 42,312ft. Surface drilling on 17 holes amounted to 25,289ft.

In April 2007, development work at the deposit was initiated again. Key activities, including the rehabilitation of the shaft, underground development, sinking of an internal raise (to be used as an ore pass) and the sinking of a ventilation shaft, were completed by September 2008.

In November 2009, Denison recommenced mining in Arizona 1 uranium deposit and added it to its production base.

Denison has been alleged to have restarted mining at Arizona 1 without obtaining prior and full permission from the US Environment Protection Agency (EPA). The EPA claims that the mining operations at Arizona 1 are illegal as the mine remained inactive for a long period and new permission was not obtained upon transfer of ownership from Energy Fuels to Denison.

Although the Arizona Department of Environmental Quality (Adeq) issued an air quality permit to Denison in August 2009 to recommence mining, the EPA claims that Adeq is not the authorised agency to approve the construction activities.

A litigation was filed against the company for not complying with all the rules of the US Bureau of Land Management before the start of the operation. The EPA, however, withdrew its finding of violation in April 2011

Geology and reserves

Arizona 1 is made up of a solution collapse of Redwall Limestone. The throat diameter in this formation is in the order of 200ft to 300ft and has a vertical displacement throat average of 175ft. The uranium mineralisation depth is over 650ft at the Hermit Shale formation to a maximum depth of 1,400ft from the surface.

In 1992, the exploration department of Energy Fuels documented the historical estimate of the mineralised material in Arizona 1 pipe. The mineral resources were estimated to be 120,000t at an average grade of 0.545% U3O8, containing 1.3 million pounds of U3O8. The cut-off grade used by Energy Fuels was 0.15% U3O8.

In the first quarter of 2007, the inferred mineral resource of Arizona 1 was estimated to be 70,300t at an average grade of 0.68% U3O8, containing 956,000lb of U3O8.

All mineral resources from the property were classified as inferred due to the difficulties faced in validating historical data on Arizona 1 project’s mineral resources.

In the 2009 mine plan, the mineral resources are estimated to contain 72,121t at an average grade of 0.66% U3O8. The cut off grade used for drilling is 0.20% U3O8.

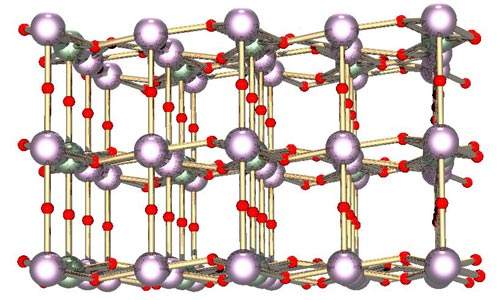

Mineralisation

The mineralisation at Arizona 1 is a vertically located breccia pipe deposit which cuts the surroundings with uranium oxides pitchblende or uraninite ore materials. The common drill hole intersections are at a grade of 1% U3O8. The average intersection of the 12 drill holes was met at 75ft at a grade of 0.62% U3O8. The maximum drill hole intersection at Arizona 1 is 92.5ft at a grade of 1.55% U3O8.

Mining

The underground mining operations are carried out through a combination of long hole and shrinkage stopping methods. The mining rate is 335t/day, operating four days a week

Ore processing

The ore is trucked to the White Mesa mill located 325 miles away from the Arizona 1 mine. It is batch treated in the mill and recovered up to 95%.

Processing of the ore from Arizona 1 at the White Mesa mill began in December 2010.

About 92,800t conventional ore was carried at the mill comprising approximately 369,000lb of U3O8 and 1.73Mlb of V2O5 by December 2010. Denison Mines also had approximately 392,000lb of U3O8 contained in an alternate feed material stored at the processing plant.

Production

Production is estimated to reach 461,000lb by 2011and 240,000lb by 2012.

Costs

In 1993, Energy Fuels published a feasibility report on the project. The details included a two-phase programme of exploration, development and production over a mine life of six years. The anticipated mine life is estimated be four years.

The pre-production costs are estimated to be $5.6m.

In 2009, the development costs were estimated at $2.3m for key developmental activities including complete underground development, erection of an ore pad at the surface and purchase of underground equipment worth $400,000.

The operating costs are expected to be $30.5/lb of U3O8 comprising $13.52/lb for mining and ore haulage, $10.88/lb for milling, $5.36/lb for overheads and sales and $0.74/lb for reclamation.

Denison expects to generate revenues of $50.8m, net cash flows of $22.2m and net present value (at 10% discount rate) of $17.6m at spot and long-term U3O8 prices of $53 and $65, respectively.