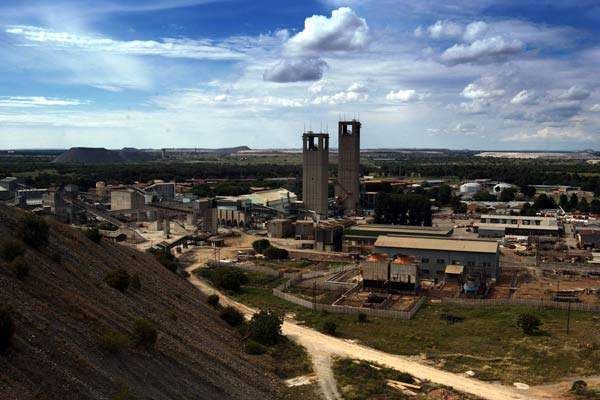

AngloGold Ashanti’s Great Noligwa underground gold mine is situated close to the town of Orkney, on the free state side of the Vaal River in South Africa.

It adjoins Kopanang and Moab Khotsong as part of AngloGold’s extensive Vaal River operations, which comprise four gold plants, one uranium plant and a sulphuric acid plant.

In 2008, the Vaal River operations (including surface operations) produced 34,785kg (1,119,000oz) of gold, equivalent to 22% of group production.

Production at Great Noligwa fell significantly in 2008 because of a transfer of the SV4 section to Moab Khotsong from where it is more easily accessible.

Geology and reserves

The reefs mined at Great Noligwa are the Vaal Reef and the Crystalkop Reef, with the Vaal Reef accounting for over 90% of the gold produced in the mine. The Vaal Reef consists of 85% of the ore reserve tonnage with mining grades between 10g/t and 20g/t.

Mining and processing

The complexity of the ore at Great Noligwa has necessitated a scattered mining strategy comprising a twin-shaft system serving eight main levels at an average depth of 2,400m.

The reef is accessed from the footwall haulage and return airway development, with cross-cuts spaced every 180m to the reef horizon.

Raises are then developed on-reef to the level above and the reef is stoped out on strike with an average stope width of 150cm. Approximately 4,000m of development is completed each quarter.

The orebody is narrow and tabular and averages 35,000m² a month. Panels are on average 26m long.

Great Noligwa has its own dedicated milling and treatment plant which applies conventional crushing, screening, semi-autogenous grinding and carbon-in-leach processes to treat the ore and extract the gold. The plant has a nominal throughput capacity of 230,000tpm.

Production and costs

Production fell by 32% to (330,000oz) in 2008, compared to 483,000oz in 2007. The decline was due to the transfer of the high-grade SV4 section of the Great Noligwa mine to Moab Khotsong.

Safety stoppages and power-saving initiatives also contributed to the decline. The mine saw a decline in tonnes mined by about 34%.

Total cash costs for the year rose by 31% due to production volumes and higher input costs of power, labour and support.

The increase in costs was offset by an increase in uranium by-product credits resulting out of improved production and the cancellation of loss-making uranium contracts. Capital expenditure came to R213m ($26m).

AngloGold Ashanti is expecting a further 30% fall in production in 2009 to 7,000kg (220,000oz) at a total cash cost of between $460/oz and $480/oz. Capital expenditure of R198m ($20m) is planned.

The future

As the operation ages, mining methods are converting from conventional scattered mining to pillar or remnant mining. Until now the Vaal Reef has been the most economically viable reef to mine. However, as this reef is mined out, the less economical Crystalkop Reef is being increasingly exploited as are economically viable pillars within the mine boundaries.