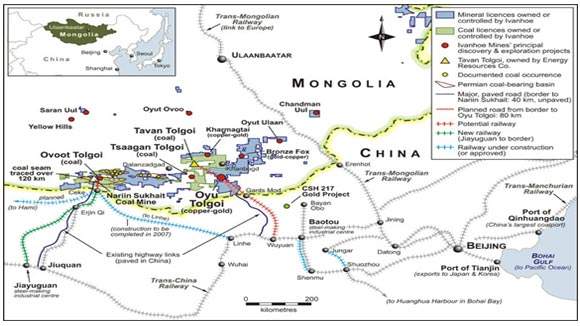

The Oyu Tolgoi gold and copper project, also known as Turquoise Hill, is situated in the south Gobi region of Mongolia, around 80km north of the Chinese-Mongolian border and 550km south of Ulaanbaatar.

It is one of the biggest gold and copper mines in the world and has the potential to produce more than 500,000 tonnes per annum (tpa) following improvements in 2027.

The mine is jointly owned by multinational resources company Turquoise Hill Resources (66%) (previously Ivanhoe Mines) and Erdenes OT, owned by the Government of Mongolia (34%). Rio Tinto, which has a 51% stake in Turquoise Hill Resources, has been operating and managing the development of the Oyo Tolgoi mine since 2010.

An integrated development plan (IDP) suggests that the Oyu Tolgoi Mine will be capable of average annual production in excess of one billion pounds of copper and 330,000oz of gold for at least 35 years. Peak annual production exceeding 1.2 billion pounds of copper and 650,000oz of gold is projected for the first ten years.

On 31 March 2010, Turquoise Hill Resources announced that the necessary conditions to develop and operate the mine were completed.

The development phase of the project began following approval by the Mongolian Government in April 2010. Approximately $758m has been approved by a joint committee between Turquoise Hill Resources and Rio Tinto.

In 2011, a new zone of shallow copper-gold-molybdenum mineralisation was discovered approximately 10km north of the Oyo Tolgoi property, extending the deposit’s strike length beyond 23km.

Investment agreement with Mongolian Government

In 2009, an investment agreement between Turquoise Hill Resources, Rio Tinto and the Mongolian Government was presented in parliament after getting approval from the Cabinet and the National Security Council.

During the same period, Turquoise Hill Resources entered an agreement with GoviEx Gold to introduce proprietary Zeus technology at Oyu Tolgoi in an expanded induced polarisation survey. The survey will test Oyu Tolgoi’s copper and gold mineralised trend.

Oyu Tolgoi owners signed a $4.4bn project finance agreement with global financial institutions and export credit agencies from the US, Canada and Australia, as well as 15 commercial banks in December 2015. The agreement includes an additional $1.6bn supplement debt to complete underground development.

Geology and reserves

The South Gobi area lies near the boundary of the South Mongolian and the South Gobi tectonic units. Mainly Palaeozoic volcanic, sedimentary and intrusive rocks and Mesozoic sedimentary cover underlie the region.

The series of deposits discovered by Turquoise Hill Resources at Oyu Tolgoi and on the adjoining Shivee Tolgoi joint-venture property during the past six years stretch across 6.6km, and have a total proven and probable reserves of 1.45 billion tonnes graded at 0.86% Cu, 0.30g/t Au and 1.97g/t Ag as of December 2015.

Mining at Turquoise Hill

Turquoise Hill is developing a stage one open-pit mine on the near-surface Southern Oyu deposits and a stage two underground block-caving mine at the Hugo Dummett North and South deposits. The initial development programme for the Hugo North underground block cave mine is currently underway with a 1,385m shaft no.1 completed in 2009. In the same year, lateral development continued. Preliminary works for the development of a raise-bore ventilation shaft was also carried out at shaft one. Surface works for constructing shaft two were also undertaken in 2009.

The first phase, the Base Case, consists of a concentrator with a single SAG (semi-autogenous grinding) circuit with an initial throughput rate of 100,000tpd. In March 2010, the key mining equipment was purchased. It included the major components for the 100,000tpd phase one copper-gold concentrator.

Production at Hugo North is expected to commence in 2021, with average production exceeding 550,000t of copper and 450,000oz of gold from 2025 to 2030. The softer, underground mill feed is expected to support a higher throughput rate of 95,000tpa of SAG milling capacity in the concentrator circuit comprising two grinding lines each installed with a SAG mill and two parallel ball mills.

Phase two of the IDP, the Expanded Case, will start with a decision in year three to develop a block-cave mine at the Hugo South Deposit and proceed with the stripping of stages three and four of the open-pit mine.

The Expanded Case envisions the ramping up of production from the underground block-cave mines and the doubling of the capacity of the concentrator, including the addition of a second SAG milling circuit, to increase Oyu Tolgoi’s underground production to at least 140,000tpd by year seven.

Production and costs of Oyo Tolgoi

Oyo Tolgoi owners believe the project has the potential to achieve a mill throughput of 95,000tpd.

Provided that the expansion is undertaken as scheduled, the IDP indicates that Oyu Tolgoi open pits could produce 35 billion pounds of copper and 11 million ounces (Moz) of gold over the projected, initial 35-year life of the mine, based on resources delineated to May 2005. IDP’s sensitivity analysis shows that the project’s rate of return is most sensitive to changes in the copper price, followed by changes in the gold price, changes to the operating costs and, finally, changes in capital costs.

It states that at $1.10 copper and $400 gold, the after-tax IRR increases to 22.08%; the after-tax NPV increases to $3.39bn at an 8% discount rate and $2.39bn at a 10% discount rate.

According to the 2016 Oyo Tolgoi feasibility study, the project’s open-pit and underground mine operations are together expected to produce 23.87 billion pounds of Cu, 10.44Moz Au, 74Moz Ag over a mine life of 40 years.

Molybdenum production is anticipated towards the second half of the project’s expected operational period of 100 years. The first shipment of copper concentrate took place in July 2013 while the mine produced nearly four million tonnes of shipments by July 2018.