The Dugbe gold project is an open-pit mining project that will be developed in Liberia, West Africa. It is one of the largest gold projects in the country.

Spanning 2,559km², the project comprises the Tuzon and Dugbe F gold deposits.

A feasibility study of the project was released in June 2022, which indicated 14 years of mine life with significant upside potential for exploration to enhance the resource estimates.

The project is expected to produce 2.27 million ounces (Moz) of gold over its lifetime while the average annual production in the first five years of operation is estimated to be 200,000oz.

Construction of the project is expected to commence in 2023.

Ownership details of the Dugbe Gold Project

The Dugbe project is 51% owned by UK-based gold ore mining company Hummingbird Resources (Hummingbird).

Pasofino’s subsidiary ARX Resources signed an earn-in agreement with Hummingbird Resources to acquire a 49% interest in the Dugbe project in June 2020. The agreement is subject to the fulfilment of various conditions, including the completion of a feasibility study.

Having completed the feasibility study, Pasofino is required to file it on SEDAR, Canada’s electronic filing system for disclosures by listed companies, to complete the requirements to acquire the 49% interest in the project, excluding the Government of Liberia’s 10% free carried interest.

The earn-in agreement also includes an option for Pasofino to increase its stake to 100%, prior to the issuance of the government’s 10% carried interest. Hummingbird can receive a 51% shareholding in Pasofino in exchange for its 51% ownership of the project.

Location and geology of the Dugbe project

The Dugbe gold project is located in south-eastern Liberia, approximately 240km south-east of the capital city of Monrovia and 76km east of Greenville.

The host rock at the Tuzon and Dugbe F deposits is orthopyroxene gneiss with typically up to 1% sulphide content. It occurs as a stratiform layer sandwiched between a thick sequence of quartz-feldspar biotite gneiss. The deposits are cut by whitish granitic bodies and barren pegmatite intrusions.

Mineralisation and reserves

Gold mineralisation at the deposits is spatially linked to high sulphide concentrations, primarily pyrrhotite and arsenopyrite. It is localised within a single layer and typically found in orthopyroxene-gneiss. Gold occurs in native form, amalgam, electrum, and maldonite.

The centre of the mineralised layer has a greater grade.

The Dugbe gold mine’s proven and probable reserves are estimated at 66 million tonnes (Mt) containing 2.76Moz of gold grading 1.3g/t, as of May 2022.

Mining details of the Dugbe Gold Project

The mine plan includes the use of traditional open-pit mining methods at the Dugbe F and Tuzon deposits. The mining fleet is expected to include 100t dump trucks and 200t excavators for loading and hauling the ore.

The mining operation will involve the conventional truck and shovel method to supply mill feed and waste to the run-of-mine tip and waste stockpile facilities, respectively.

The deposits are planned to be mined simultaneously to maintain a low initial strip ratio. Furthermore, the plan includes a low-grade stockpile to ensure the processing facility is mainly fed with higher-grade ore.

Rock will be mined at a rate of 28 million tonnes per annum (Mtpa) during the first five years, which will increase to an average of 41Mtpa in the following years.

Processing details at the Dugbe Gold Project

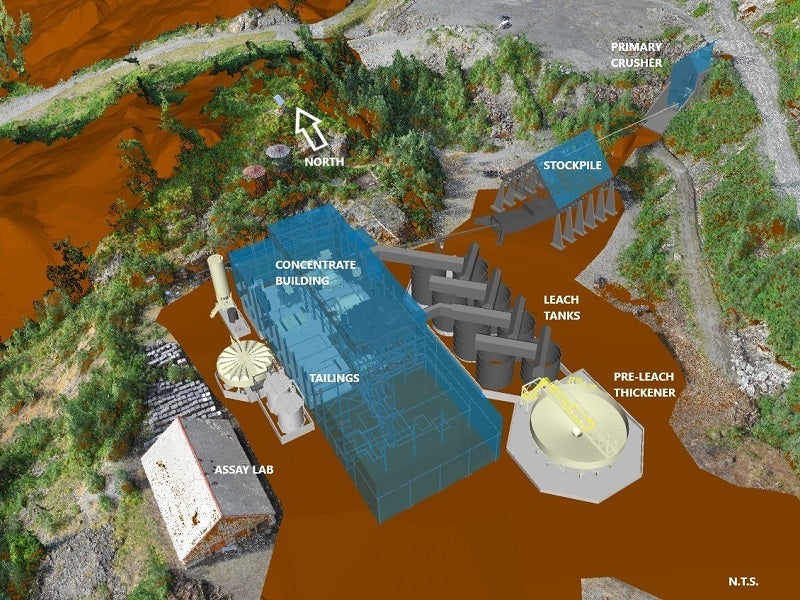

The processing plant is expected to have a throughput of 5Mtpa. It will comprise a standard semi-autogenous grinding (SAG) and ball milling circuit, followed by a gravity concentration and carbon-in-leach (CIL) gold recovery circuit.

The ROM ore will be fed to the primary crusher and the crushed ore will be sent to the stockpile before it undergoes processing in the SAG and ball milling circuit. The material will be sent to a pre-leach thickener, followed by the CIL circuit.

Gold will be recovered using elution, electrowinning and smelting methods.

The plant is expected to have a gold recovery rate between 80% and 85%, with an average of 83% over the life of the mine.

Infrastructure details

The project can be accessed by a 76km-long road from the Port of Greenville. All construction and operational cargo of the mining operation are expected to be transported through the port.

A local power plant will be built to meet the electricity needs of the project. The proposal includes a liquefied natural gas (LNG)-fuelled thermal power production facility in combination with a 16MWp solar photovoltaic (PV) facility. The thermal facility will comprise 16 2Mwe generators.

The Geebo River will serve as the source of raw water during the first year of operation. Beginning in year two, treated water from the tailings storage facility (TSF) will be used for raw water requirements. Two TSFs will be built to handle 65Mt of tailings over the mine life. The infrastructure also includes a detox plant and a water dam to treat and release the excess water from the TSFs.

Contractors involved in the Dugbe gold project

SRK Consulting (SRK), an international mining consultancy, prepared a mineral resource estimate for the Tuzon deposit in March 2014, followed by an updated MRE for the deposit in 2020.

CSA Global prepared an updated MRE for the Dugbe F deposit in 2020. The report was reviewed by SRK.

Engineering group DRA Global was engaged to prepare the preliminary economic assessment (PEA) for the project. The company was supported by SRK Consulting and Epoch Resources.

DRA Global was also responsible to prepare the feasibility study for the project.

Geotech Airborne, an airborne geophysical solutions provider, was appointed to undertake an airborne magnetics and radiometric survey for the project in February 2013. Southern Geoscience Consultants (SGC) conducted a full litho-structural interpretation of the aeromagnetics and radiometrics data received from Geotech Airborne.

Test work as part of studies related to the processing plant was primarily conducted at the Perth facility of ALS Global, a testing, inspection, certification, and verification services company, between 2021 and 2022.

Comparative tests and analyses on samples were undertaken by different organisations and companies such as SGS, Mintek, and Bureau Veritas.

Cestos Investments was contracted to provide initial drilling services for the Liberian gold project in September 2020.