Africa plays a critical role in supporting the shift to carbon neutrality, with the region holding the mineral and metal reserves needed to build batteries. But how can miners reposition themselves to be the supplier of battery-grade minerals to the European market?

“A lot of conversations around the energy transition are taking place across Europe and Africa,” says Darryn Quayle, Vice President Energy Transition, Resources at Worley. “And while the common goal of net zero unites these two regions, their individual needs are different.

“Mainland Europe is nearly fully industrialised. Its focus has shifted from mining locally to the beneficiation of raw materials in other countries for products such as electric vehicle (EV) battery anodes and cathodes. But, as the demand for processing battery minerals rises, the need for cleaner energy and green minerals and metals across Africa is gaining momentum.”

So, in a complex set of African countries, how can battery-grade material be mined sustainably at the pace required?

Finding a stable supply of battery material

There are currently more than 200 battery gigafactories in construction across the world, including 25 announced lithium-ion (Li-Ion) factories in Europe. EVs are a large contributor to this growth.

According to the European Economic and Social Committee’s Strategic Action Plan on Batteries, the demand for EV batteries is expected to surpass 200 GWh per year by 2023 and reach around 400 GWh by 2028.

This will create a demand for minerals for which there is not enough supply.

“For Europe to meet its future demand for energy transition materials it needs a greater security of supply from sources it either owns or can manage through long-term agreements,” says Nick Bell, Global Sector Lead, Resources at Worley. “It also needs products made with low-carbon materials from low-impact mines to meet environment, social and governance (ESG) expectations.”

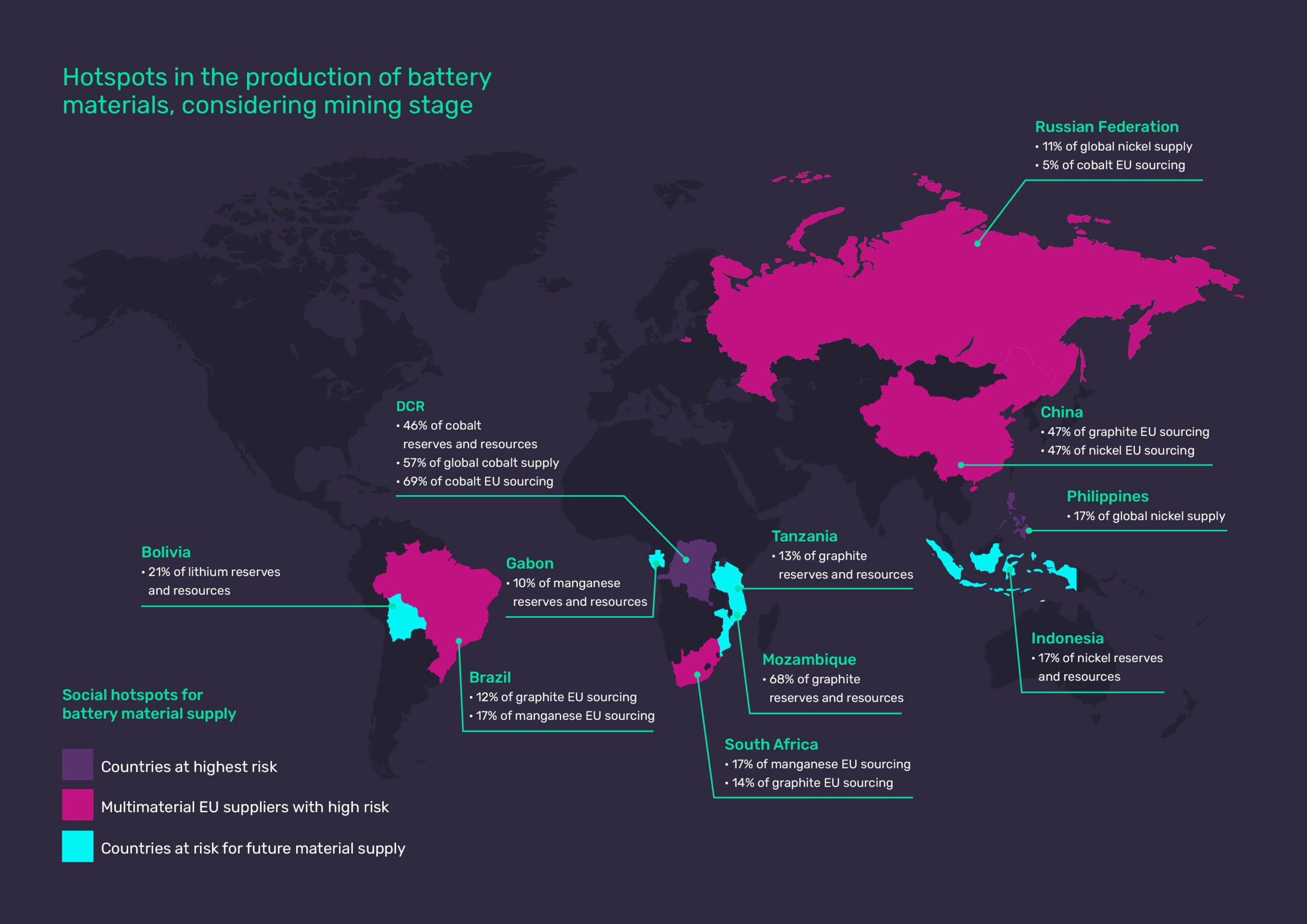

A 2020 report by the European Commission’s Joint Research Centre offers a forensic analysis of the risks and opportunities within the battery supply chain. It highlights Democratic Republic of the Congo (DRC), Mozambique and South Africa as sources of the minerals and metals currently in the European battery supply chain, as well as the risks associated with each country, including the environmental challenges.

All eyes on Africa

With proven reserves and vast, unexplored regions, Africa has the potential to supply battery-grade materials to Europe, while also providing economic growth opportunities for local communities.

But there are still things miners need to do to capitalise on this demand. Miners across Africa will need to meet the requirements of international investors and incorporate low-energy strategies that meet global safety and productivity standards.

“There are several vulnerabilities in the critical minerals supply chain that may hinder adequate supply, leading to greater price volatility if supply proves fragile,” says Bell. “These risks include a high geographical concentration of production and processing led by non-Western governments, long project development lead times if traditional processes are followed, declining resource quality, growing scrutiny of Environmental, Social, and Corporate Governance [ESG] issues, and exposure to climate risk in high water stress areas.”

Considering all these challenges, the one at the forefront is the energy used to power a mine.

How fast can Africa catch up?

African-based miners will need to start with emissions reduction across the mining value chain if they’re to sustainably meet the needs of the European batteries market. This includes reducing the energy intensity of a mine site.

However, creating capital to reinvest in renewable energy infrastructure will take forethought and planning. “The reality is that margins are tight, and miners across Africa will need to create new capital if they’re to confidently invest in low-emission solutions like wind farms or solar power,” says Mervyn Stevens, Vice President for mineral processing, Worley.

“One solution is to go further down the beneficiation stream. Currently, material passes hands several times before it gets to the component level. Compressing the supply chain presents opportunities for African miners. Other than lithium, everything travels well, and can be purified locally into high-value materials and shipped to the European batteries market,” adds Stevens.

For example, South Africa has around 70% of the world’s manganese. With the right investment, the country could become a leading electrolytic manganese producer.

“It’s something that’s gaining traction, with three advanced studies for electrolytic/high-purity manganese facilities currently being undertaken,” explains Stevens. “The same applies to electrolytic cobalt and nickel sulphate. African-focused investment has been slow over the last five years, but it’s progressing quickly as miners look to supply a more beneficiated product that feeds directly into the batteries manufacturing process.

“A higher-value product creates a better margin for the local producer to invest in renewables. And we’re seeing this happen in pockets, with miners adding solar facilities to generate green electricity.”

Complex mining solutions needs a diversified partner

Finding the right partner with end-to-end process experience is important to produce battery grade material for European manufacturers.

“We’ve completed more than 200 projects involving graphite, nickel, manganese, vanadium, lithium and cobalt mining,” says Quayle.

“We’re able to see this through the intermediate processing steps by helping our customers refine and convert raw materials into active material. This includes graphite anode facilities from mining through to anode precursor, and we’ve completed work for several cathode precursor producers of Li-ion NCM material and electrolyte.

“This type of experience has allowed us to deliver both anode and cathode precursor projects with some directly integrated with mining and mineral processing.”

A brighter future for Europe and Africa

As Europe pushes forward with its decarbonisation plans, its relationship with Africa has never been more important as it races to build capacity and secure a sustainable supply chain.

“Meeting the challenges to position for growth will take a step change in how resources are developed and operated,” says Bell. “It’ll require coordination and cooperation between governments at all levels, investors, operators, equipment suppliers, service providers, end-users and communities to accelerate the development of critical minerals, while at the same time managing the needs of all stakeholders.”