The Norseman gold project, jointly owned by Pantoro (50%) and Norseman Gold (50%), is located in the Eastern Goldfields of Western Australia. Pantoro acquired the stake in July 2019 from Central Norseman Gold Consolidated and is the mine’s operator.

The mine will produce 108,000 ounces (oz) a year, on an average, with peak production of 119,000oz expected in the second year of production. Phase one of the project is expected to have an initial life of seven years.

Production from the Norseman gold project was started in 1935. More than 5.5 million ounces (Moz) of gold has been produced since then. The project is considered one of the highest-grade fields within the Yilgarn Craton.

Mining operations at the historic mine, also known as Central Norseman gold mine, were stopped in 2014. Pantoro and Norseman Gold intend to restart operations at the project. The results of the definitive feasibility study (DFS) for phase one of the restart of operations were announced in October 2020.

Drilling and other works have already commenced at the site, with a focused mineral resource definition drilling on six initial mining areas comprising multiple deposits.

Norseman gold project location

The Norseman gold project is located at the southern end of the Norseman-Wiluna greenstone belt in the Eastern Goldfields region. It is situated approximately 200km from Kalgoorlie and Esperance, and 725km from Perth.

Norseman gold project reserves

The proven and probable reserves at the Western Australian gold project are estimated to be nine million tonnes (Mt) graded at 2.1g/t of gold (Au), containing 602,000oz of gold as of October 2020.

Mining at Norseman gold project

The phase one DFS envisions strong returns based on the initial mine life, with potential to extend the mine life by planned targeted drilling in the future.

Operations at the mine will be restarted with production from Scotia and Cobbler open-pit mining centres and the OK underground mine. The mining plan includes the extraction of resources from the initial open pits before the surface mining fleet will proceed to the next open-pit mining centres. Underground mining will be commenced from the base of the completed open-pits based on the feasibility of the location.

The mine schedule was prepared with a focus on minimising sunk mining costs and ensuring the availability of suitable stockpiles for several months of feed throughout the project’s lifetime.

The ores from the mines will be sent to a central one million tonne per annum (Mtpa) processing plant.

The OK and Scotia underground mines will be mined using long hole open stoping mining method, which was selected due to the sub-vertical orebody, modified stope stability analysis, and rock mass characteristics.

The Scotia underground mining is expected to be started after the completion of the north and south stages of open-pit mining. The Scotia open-pit mining centre will utilise conventional open-pit mining methods, employing drill and blast to break the ground, and excavators and trucks to carry the material out of the pit.

The Cobbler open-pit mining centre will act as a central starter pit for targeting the high-grade core of the orebody. A large cutback of the starter pit will facilitate the recovery of the remaining mineralisation. It will also employ the same mining method as that of the Scotia open-pit mining centre.

Processing at Norseman gold project

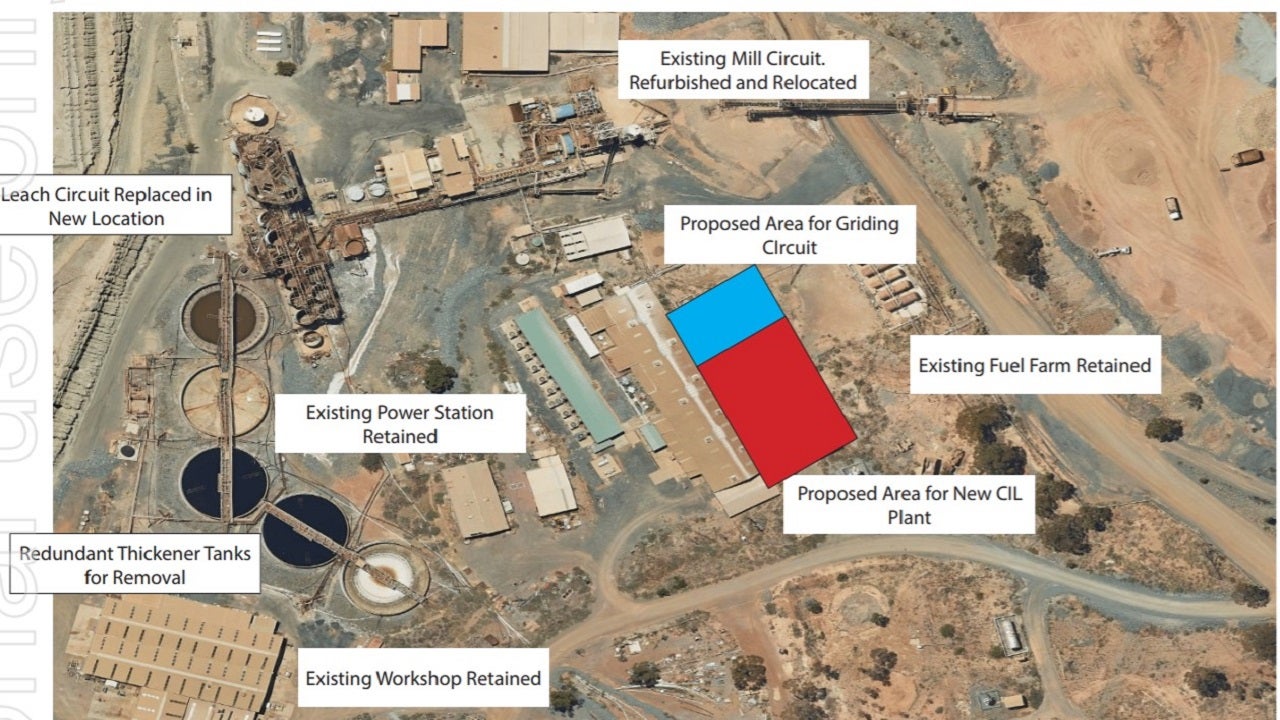

The Norseman gold project will have a 1Mtpa carbon-in-leach (CIL) processing plant, with the provision to be expanded to 1.5Mtpa. It will be located adjacent to the existing Phoenix mill that is planned to be dismantled and removed.

The processing plant is designed to grind 1Mtpa at p80 75µm for the phase one ore blend, as multiple ore sources are expected to be used to feed the plant over the life of mine. The design facilitates the processing of the hardest feed source (Scotia) at a grind size of p80 106µm to provide maximum flexibility to operations.

The existing buildings and infrastructure will be refurbished to minimise capital and operating costs. Though the buildings in the processing area are in a suitable condition, the majority of the existing processing plant will be replaced while the primary crushing structures will be retained and upgraded.

The processing plant will have a crushing circuit with a primary jaw crusher, crushed ore reclaim, crushed ore stockpile, and a multi-deck crushed ore screen working in closed circuit with a secondary, as well as a tertiary, cone crusher. A milling circuit will produce crushed ore stockpile. The processing will then move to gravity concentration, removal of coarse-free gold from the milling circuit and treatment of gravity concentrate by an intensive leach reactor, followed by a dedicated electrowinning circuit.

Other major components of the plant will include a CIL circuit, and an Anglo-American Research Laboratory (AARL) type elution circuit. The gold will be recovered in the form of gold dorés using a gold smelting / barring furnace.

Project infrastructure

A tailings storage facility (TSF), with a design life of five years, is planned to be developed with a capacity of 5Mt to store tailings. Access to the Cobbler mining centre will be provided by developing a new intersection to the highway between Coolgardie and Esperance. An existing intersection to the highway provides access to the Scotia mining centre.

The accommodation facilities will support fly-in fly-out operations and accommodate up to 260 workers. The existing power supply station will be upgraded from 10MW to 15MW.

Contractors involved

BEC Engineering was contracted to provide the cost estimate for re-energising the existing high-voltage (HV) power supply to the bore field and installing a new power line to the OK underground mine. Brilly Group received a contract to provide an estimate for the refurbishment of bores and the water transfer station.

TailCon Projects was selected to assess the project’s TSF requirements. Other project consultants that supported the DFS study included Minecomp, Peter O’bryan & Associates, Entech, ALS Metallurgy, Outotec, Orway Mineral Consultants, MACA Interquip, and Contract Power Group.